- Americas

- Asia Pacific

- Europe

- Middle East and Africa

COVID-19 Impact and Response

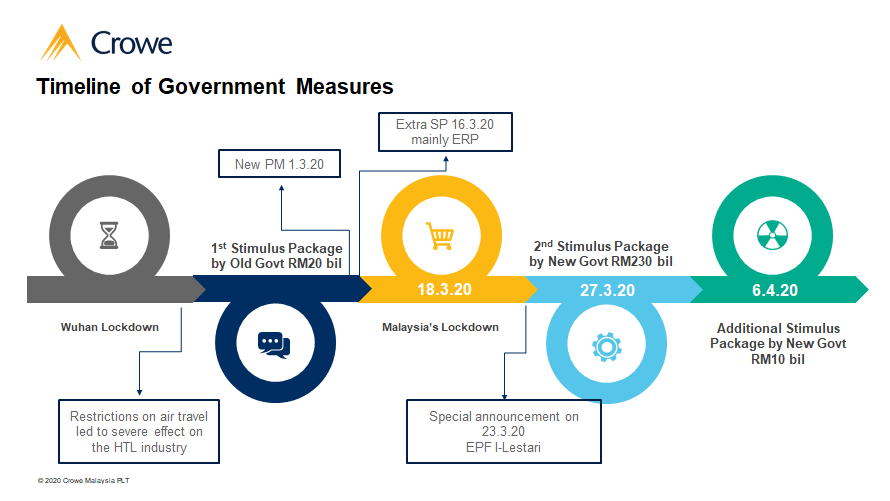

Government Measures and Stimulus Packages

Since the outbreak of COVID-19, the Government has announced various Economic Stimulus Packages to aid the Rakyat and business community.

We are pleased to summarise below all the important resources made available by the government to assist the business sector to alleviate the hardships brought about by the COVID-19 crisis.

The chronology of the measures provided by the Government is as follows:

Economic Stimulus Packages (ESP) Announcements

Initiatives & Measures

PERKESO

Inland Revenue Board

Loans for SMEs

Employees Provident Fund (EPF)

Human Resources Development Fund (HRDF)

PERKESO

Inland Revenue Board

Loans for SMEs

Employees Provident Fund (EPF)

Human Resources Development Fund (HRDF)

Resources & Insights

Budget 2021: Resilient as One, Together We Triumph

Cashflow Survival & Stimulus Package Assessment Tool

Extension of Various Statutory Deadlines

Exclusive Tax Planning Handbook for Businesses

Crowe Global Insights

Accounting and Audit Implications of COVID-19

What do MNEs need to know about Managing Transfer Pricing Risks?

Cash Flow Management from a Transfer Pricing Perspective

Managing Insolvency in Malaysia

Tax Implications on Business Restructuring

Budget 2021: Resilient as One, Together We Triumph

Cashflow Survival & Stimulus Package Assessment Tool

Extension of Various Statutory Deadlines

Exclusive Tax Planning Handbook for Businesses

Crowe Global Insights

Accounting and Audit Implications of COVID-19

What do MNEs need to know about Managing Transfer Pricing Risks?

Cash Flow Management from a Transfer Pricing Perspective

Managing Insolvency in Malaysia

Tax Implications on Business Restructuring

Featured Insights

Events

| Title | Date | Location |

|---|---|---|

|

Mastering Business Etiquette and Grooming for Professional Success

30/05/2024AC Hotel by Marriott Kuala Lumpur | Public Programme

|

30/05/2024 | AC Hotel by Marriott Kuala Lumpur | Public Programme |

COVID-19 Cashflow Survival & Stimulus Assessment Tool

How long can your cash reserves last during this COVID-19 pandemic?

To help you in the most critical phase of this crisis, we have designed a Cashflow Survival & Stimulus Assessment Template. The purpose of this template is to help you analyse how long your business’ cash reserves can last. This will give you a clear view of your business' financial health, thus empowering you to plan ahead of time before your cash reserves run dry.

The template can also help you to understand the Malaysian government’s measures in the Stimulus Packages which can assist you in:

Download Request Successful

Thank you! You may download our Cashflow Survival & Stimulus Assessment Tool by clicking the button here.

We will also add you to our mailing list which will enable you to receive the lates tax updates, industry insights and exclusive event invitations.

Read the instructional guide on how to use the assessment tool here.