PEMERKASA Assistance Package 2021

Key Highlights at a Glance

On 17 March 2021, the Malaysian Government unveiled the Strategic Programme to Empower the People and the Economy (PEMERKASA) stimulus package valued at RM20 billion of which RM11 billion constituted a direct fiscal injection.

The PEMERKASA stimulus package comprises a total of 20 strategic initiatives that aims to boost economic growth, support businesses and provide targeted assistance to the people and sectors that are still affected by the pandemic and/or the movement control order.

It is timely that the Government introduced this PEMERKASA stimulus package to revitalise the country’s economy.

Click here to read the full article

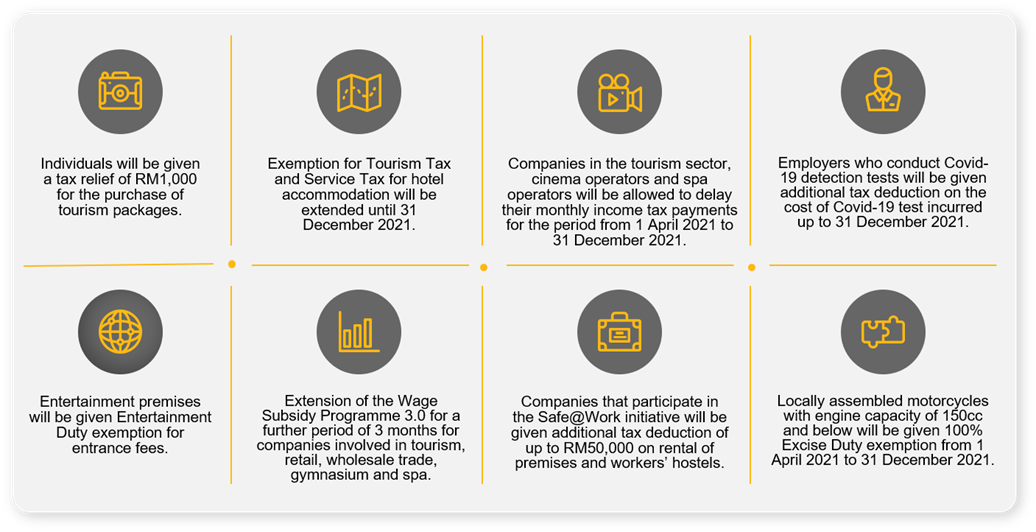

- Individuals will be given a tax relief of RM1,000 for the purchase of tourism packages.

- Exemption for Tourism Tax and Service Tax for hotel accommodation will be extended until 31 December 2021.

- Companies in the tourism sector, cinema operators and spa operators will be allowed to delay their monthly income tax payments for the period from 1 April 2021 to 31 December 2021.

- Employers who conduct Covid-19 detection tests will be given additional tax deduction on the cost of Covid-19 test incurred up to 31 December 2021.

- Entertainment premises will be given Entertainment Duty exemption for entrance fees.

- Extension of the Wage Subsidy Programme 3.0 for a further period of 3 months for companies involved in tourism, retail, wholesale trade, gymnasium and spa.

- Companies that participate in the Safe@Work initiative will be given additional tax deduction of up to RM50,000 on rental of premises and workers’ hostels.

- Companies in the tourism and retail sectors which are unable to operate during the Movement Control Order (MCO) and Conditional MCO period will be given Human Resource Development Fund (HRDF) levy exemption up to June 2021.

- A matching grant of RM30 million will be given to encourage investment in the mechanisation and automation of the palm oil industry.

- Listed companies that post losses in 2021 will receive rebates on their respective annual listing fees for 2021.

- Companies that are applying to list on the Main, ACE and LEAP Markets of Bursa Malaysia will be exempted from payment of listing related fees for 12 months.

- The fundraising limit for companies utilising equity crowdfunding will be increased from RM10 million to RM20 million and equity crowdfunding will be expanded to unlisted Berhad companies.

- An allocation of RM50 million as matching grants will be provided for the development of the aerospace and medical devices industries.

- The tax incentive for tour operators will be extended up to Year of Assessment (YA) 2022.

- The Companies Commission of Malaysia (CCM) has agreed to increase the indebtedness threshold from RM10,000 to RM50,000.

- The allocation for small-scale projects in 2021 will be increased from RM2.5 billion to RM5 billion. Among the projects that will be dedicated to class G1 to G4 contractors are repairs such as infrastructure and public facilities damaged due to floods.

- Micro-enterprises and Small Medium Enterprises (SME) will be given a one-off assistance of RM1,000 under the Geran Khas Prihatin (GKP 3.0).

- An additional financing fund of RM500 million will be provided for micro-credit financing facilities through programmes under BSN, TEKUN, MARA and SME Corporation.

- A special electricity bill discount of 10% for hoteliers, theme parks, convention centres, shopping malls, local airline offices and tour and travel agencies is extended for another 3 months until 30 June 2021.

- An additional of RM2 billion and RM700 million for Targeted Relief and Recovery Facility and Automation and Digitalisation Facility respectively will be allocated by Bank Negara and provided to affected SMEs.

- Homestay entrepreneurs registered with the MOTAC will be given a one-off cash assistance of RM600.

- An additional RM50 million for Smart Automation Grant will be provided under the MIDA to encourage more SMEs and mid-tier companies to leverage on technology to improve their operational efficiency.

- Travel agencies registered with the Ministry Of Tourism, Arts & Culture (MOTAC) will be given a one-off special grant of up to RM3,000.

- A matching grant of up to 20% of machine value will be provided by the SME Bank to SMEs to finance the purchase of machinery and equipment to enhance automation and reduce reliance on foreign workers.

- RM50 million will be allocated to the Ministry of International Trade and Industry for the National Policy on Industry 4.0 (Industry4WRD programme).

- RM3.2 billion will be allocated to the Malaysian Communications and Multimedia Commission (MCMC) for the Universal Service Provision Fund.

- MIDF has allocated a total of RM200 million for automation development, digitalisation and green technology financing schemes. The financing schemes’ interest rates will be reduced from 5% to 3% for 12 months starting 1 April 2021.

- The government will raise the ceiling for the Market Development Grant (MDG) from RM300,000 to RM500,000 per company that participates in international exhibitions.

- The government will launch the Sustainable Sukuk of at least USD 1 billion to help the country become a “sustainable financial hub”.

- Individuals in the B40 group who have lost their source of income will be given a one-off cash assistance of RM500.

- Bantuan Prihatin Rakyat (BPR) recipients who earn RM1,000 and below will be given a single payment of RM500.

- BPR recipients with school children will also be eligible for a one-off subsidy of RM300 for the purchase of gadgets or smartphones.

- Youths aged between 18 to 20 as well as all students of higher learning institutions will receive a one-off credit of RM150 in their e-wallets.

- The B40 group who have to undergo home quarantine due to Covid-19 will receive income replacement of RM50 per day for up to 14 days.

- The CCM will allow those in the B40 group and full-time students of higher learning institutions to register their businesses for free.

- Civil servants who are involved in the immunisation programme will be given a monthly allowance of RM200.

- Up to RM100 million will be allocated to provide assistance for kitchen items for the poor households in major cities across the country.

Measures relating to Businesses

Present

The Government introduced the Wage Subsidy Program to subsidise affected employers in respect of each local employee earning RM4,000 and below per month, according to the following basis:

|

Size of enterprise |

More than 200 employees |

76 to 200 employees |

Less than 76 employees |

|

Subsidy amount

|

RM600 per month for each local employee Note: The maximum number of employees entitled for this subsidy is 200 employees

|

RM800 per month for each local employee |

RM1,200 per month for each local employee

|

Based on the Budget 2021, the Government proposed that the Wage Subsidy Program would subsidise employers of targeted sectors (i.e., tourism and retail sectors), at the rate of RM600 per month for employees earning RM4,000 and below per month. In the PERMAI Assistance Package, the Wage Subsidy Program 3.0 was further enhanced to subsidise affected employers from all sectors in the MCO states (the enhanced WSP) for the month of January 2021. The enhanced WSP subsidised the employers at the rate of RM600 per month for each local employee earning RM4,000 and below per month, for companies with more than 200 employees and up to a maximum of 500 employees.

Proposed

The Government will allocate a sum of RM700 million for the extension of the Wage Subsidy Program 3.0 for another 3 months particularly for those in the tourism, wholesale and retail sectors as well as other types of businesses that were affected by the implementation of the MCO such as gymnasiums and spas.

Effective Date

The current Wage Subsidy 3.0 programme is available for applications made between 1 January 2021 to 30 June 2021.

Commentary

The continuous effort from the Government to subsidise affected employers is a commendable move. The subsidy will alleviate the cash flow issues confronted by affected employers and assist businesses to stay afloat during this pandemic. Further, it will help to safeguard jobs and benefit more employees.

Further clarification is required specifically on the application of the subsidy for the 3 months from February 2021 to April 2021.

Present

Companies in the tourism industry such as travel agencies, hoteliers and airlines were given a deferment for payment of their monthly tax instalments for a period of 9 months from 1 April 2020 to 31 December 2020. This was applicable to monthly tax instalments that fell between 1 April 2020 to 31 December 2020.

Proposed

In light of the continuing pandemic, companies in the tourism industry such as travel agencies, hoteliers, etc. and in selected industries such as cinemas and spas will be given a deferment for payment of their monthly tax instalments for the period from 1 April 2021 to 31 December 2021.

Effective Date

For monthly tax instalment payments falling between 1 April 2021 to 31 December 2021 and the application for deferment must be submitted to the Inland Revenue Board of Malaysia (IRBM).

Commentary

This proposed measure will help to ease the cash flow of the companies in these industries for a period of 9 months.

Present

Currently, businesses are allowed a single tax deduction on expenses incurred for the rental of premises for their employees.

Proposed

An additional tax deduction, limited up to RM50,000, will be given to companies operating in the manufacturing sector and service providers related to the manufacturing sector registered with the Ministry of International Trade and Industry (MITI). Such companies are required to comply with the Safe@Work audit requirement.

Effective Date

Voluntary registration with MITI for the Safe@Work initiative will commence on 1 April 2021.

Commentary

This incentive promotes a conducive environment in the workplaces and dormitories for employees of companies and will translate to a safe working environment.

Present

Businesses are allowed a single tax deduction on expenses incurred on Covid-19 detection tests for employees.

Proposed

An additional tax deduction will be given to all businesses on the expenses incurred on Covid-19 detection tests for employees.

Until 31 December 2021.

This incentive encourages businesses to absorb the cost of Covid-19 screening tests on behalf of their employees which in turn will lessen the financial burden of the employees.

Present

Tourism Tax

Effective from 1 September 2017, accommodation operators who are registered under the Tourism Tax Act 2017 (i.e., registered operators) are required to charge a Tourism Tax to foreign tourists. The Tourism Tax is fixed at RM10 per room per night.

Effective from 1 July 2020 to 30 June 2021, the registered operators are exempted from charging the Tourism Tax to foreign tourists.

Service Tax

Effective from 1 September 2018, accommodation service providers who are registered under the Service Tax 2018 (i.e., registered persons) are required to charge Service Tax on the provision of all taxable services (i.e., accommodation and other related services). The Service Tax is fixed at 6%.

Effective from 1 March 2020 to 30 June 2021, the registered persons are exempted from charging Service Tax on the accommodation and other related services.

Proposed

The above-mentioned Tourism Tax exemption and Service Tax exemption will be extended up to 31 December 2021.

1 July 2021 to 31 December 2021.

The Government is looking forward to boost the tourism industry by extending the Tourism Tax and Service Tax exemptions on the accommodation services which had been adversely affected by the Covid-19 pandemic.

The extension will benefit the consumers as the price charged by the operators of accommodation premises would be reduced by RM10 and 6% respectively. It is hoped that the exemptions would encourage local tourists as well as foreign tourists to visit Malaysia once the Covid-19 pandemic is under control.

Present

Presently, admission fees to places of entertainment are subjected to 25% Entertainment Duty.

Proposed

A 100% Entertainment Duty exemption will be granted on the admission fees to entertainment places (e.g., theme parks, stage performance, sports events and competitions, cinemas, etc). This Entertainment Duty exemption is only applicable to places of entertainment in the Federal Territories of Malaysia (i.e., Kuala Lumpur, Putrajaya and Labuan).

Not specified.

The Covid-19 pandemic and implementation of the MCO had badly affected the tourism industry, especially the entertainment sector. The entertainment sector requires higher reinvestment costs to improve its facilities. In addition, the entertainment premise operators (e.g., theme park operators, etc.) are the key players that boost the tourism industry. The development of the tourism industry can improve living standards through the creation of employment opportunities.

It is hoped that the entertainment premise operators can improve the productivity, quality and competitiveness of the entertainment services following the full exemption on Entertainment Duty.

Present

Presently, assembled motorcycles are subjected to Excise Duty.

Proposed

A 100% Excise Duty exemption will be given on locally assembled motorcycles. This Excise Duty exemption is only applicable for locally assembled motorcycles with engine capacity of 150cc and below.

1 April 2021 to 31 December 2021.

The existing Excise Duty exemption on locally assembled motorcycles is only applicable for Malaysian citizens working abroad who return and work in Malaysia under the Returning Expert Programme.

By expanding the Excise Duty exemption on locally assembled motorcycles, the Government intends to boost the automotive sector which had been adversely affected by the Covid-19 pandemic.

Present

Tour operators were eligible for the following income tax exemptions on statutory income derived from domestic and group inclusive tours up to YA 2020:

- 100% tax exemption on statutory income derived from the business of operating tour packages within Malaysia participated by not less than 1,500 local tourists per year; and

- 100% tax exemption on statutory income derived from the business of operating tour packages to Malaysia participated by not less than 750 inbound tourists per year.

It is proposed that the above tax incentives for tour operators be extended up to YA 2022.

Effective Date

For the YAs 2021 and 2022.

Commentary

The tourism industry is severely affected during the Covid-19 pandemic and this extension provides timely stimulating effects to the tourism industry

Taxes Relating to Individuals

Present

A special personal income tax relief of up to RM1,000 is given to resident individuals for the following domestic travelling expenses:

- Accommodation fees paid to tourist accommodation premises registered with the MOTAC; and

- Entrance fees paid to tourist attractions operators.

The special income tax relief will be expanded to include tour packages purchased from tour agencies registered with the MOTAC.

Effective Date

For expenses incurred up to 31 December 2021.

Commentary

Resident individuals who undertake domestic travelling may enjoy additional tax savings of up to RM300 (RM1,000 relief x the maximum individual tax rate of 30%) in the YA 2021.

Other Economic Stimulus Packages and Insights

COVID-19 Impact and Response