COVID-19: Cash Flow Management from a Transfer Pricing Perspective

The wheels of the global economy have virtually stopped turning in the past weeks as the world struggles to adapt to the realities of living in the age of the COVID-19 pandemic. Against the backdrop, it is projected that Malaysia will suffer a negative GDP growth of 2.9% for the 2020 fiscal year (MIER, 2020). Despite the enforcement of the Movement Control Order (MCO) from 18 March 2020 to 14 April 2020, infections are expected to rise in the short-term (JP Morgan, 2020), and the month long MCO shall further increase the difficulties to be faced by Malaysian businesses in the months ahead.

Unprecedentedly, Malaysian Government announced two rounds of Economic Stimulus Package (ESP) with ESP1 and ESP2 announced on 27 February 2020 and 27 March 2020 respectively to ease the financial burdens of the Rakyat and to counteract the effect of recession that is expected to set in for the next few months. Amongst others, the ECPs introduce special support packages for SMEs, enhanced access to working capital through credit lines and deferment of tax payments. These measures are in line with the OECD’s Secretary General’s recommendations (OECD Tax Policy Note, 2020).

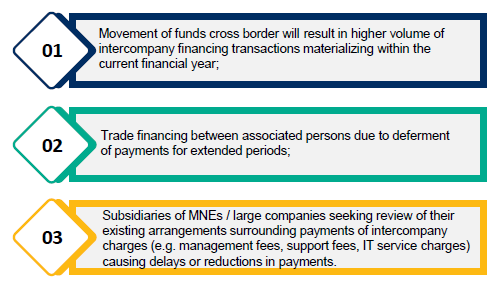

Cashflow is the life-blood of any business. With the current lockdown, businesses across the economic spectrum are facing the biggest business sustainability issue – to ensure sufficient working capital requirements to weather through this economic storm! Obtaining loans from banks is one option, and for companies belonging to a group of companies, there is an additional option - getting financial support from their parent company or other related companies who may be in a much stronger financial position. This may lead to incremental intra-group financing and transfer pricing activities as follows:

- Movement of funds cross border will result in higher volume of intercompany financing transactions materializing within the current financial year;

- Trade financing between associated persons due to deferment of payments for extended periods;

- Subsidiaries of MNEs / large companies seeking review of their existing arrangements surrounding payments of intercompany charges (e.g. management fees, support fees, IT service charges) causing delays or reductions in payments.

As observed above, there is bound to be potential complications within existing transfer pricing framework in these companies. Much of the transfer pricing risks may crystallize in areas concerning intercompany financing, as businesses seek to increase liquidity and overcome short-term cash shortages to ensure business continuity. Overcoming these challenges would require significant planning and on-the-go solutions in order to not only address the current business risks facing the organization but also to make certain that solutions adopted meet the requirements under existing transfer pricing regulations.

As much of the transfer pricing risks may arise in the area of intercompany financing, the taxpayers in Malaysia may consider the following in easing cash flow concerns with respect to transactions with associated persons:

As businesses may decide to defer payments for trade transactions (especially within the same group), taxpayers from both trade debtor and trade creditor perspectives, need to be aware that extended periods of deferment of payments may give rise to transfer pricing complication i.e. whether interest should be imposed by the trade creditor during this extended period. It is important that the issues surrounding such business decisions are well documented, highlighting the necessity to take such decisions and determine upfront the revised terms of settlements. It would also be helpful if these terms have some level of consistency with third party arrangements, thus mitigating the risks of tax authorities questioning these arrangements in the years to come.

Crowe’s View:

Originators of such requests within the Group may have the incentive to utilize these cheaper sources of funds and pass on these savings to their respective associated persons. We note that this solution may be necessary given the current economic climate but proper consideration needs to be given by taxpayers to ensure that intercompany financing is not granted free of interest during this period to prevent tax authorities from questioning the arm’s length nature of the transaction in future years. Also, in deferring interest payments, these should track closely with economic developments within the country (e.g. Bank Negara moratorium on deferment of payments) and avoiding deviation from the market practice. There should not be any unique arrangements that are extremely favourable to associated person that extend beyond the effected period.

Whilst it is natural and necessary for taxpayers to review intercompany payments due to the reduction in utilization of intercompany services, local taxpayers may be at the mercy of larger organizations that may continue to impose charges despite reduced utilization. Malaysian taxpayers should be cautious in readily accepting charges for intercompany services in the event that such benefits are no longer accruing to the Malaysian subsidiaries as their operational requirements may have reduced during and post MCO period. These transactions should be reviewed and may also assist taxpayers in easing their cash flow positions.

On an overall basis, taxpayers within Malaysia and around the world are forced to adapt to the new norms in the current hostile business conditions. From the tax perspective, these harsh business conditions should not be used as a blanket-wide justification for avoiding compliance with existing tax legislation. As the pandemic subsidizes over time, tax authorities will seek to step up their compliance efforts to make up for lost time. In such a scenario, it is worthwhile for taxpayers to be mindful of their commercial arrangements, continuously review their decision making during this difficult time and seek to adopt solutions that are sustainable from a tax perspective as the year progresses.

Click button below to download brochure: