Trading, Distribution and Retail

- Trading

Local trading, imports and exports

There

are many trading companies in Malaysia, but the numbers have diminished due to

the popularity of e-commerce. Nevertheless, the retail industry is still a

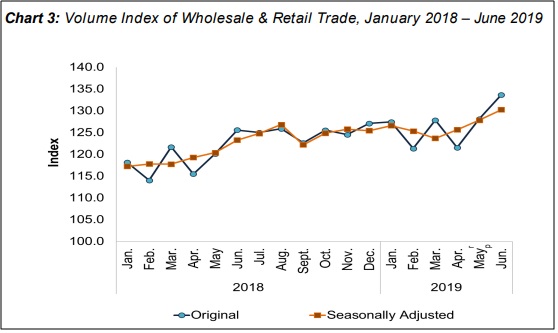

mainstay of the Malaysian economy. The volume index for Wholesale & Retail

Trade posted a growth of 5.9 per cent in June 2019 as compared to the same

month of the previous year. The types of retailing that play a large role in

Malaysia are supermarkets; shopping centres that accommodate specialty stores;

department stores such as Isetan, Parkson and Aeon; and miscellaneous retail

stores.

Source: Performance of Wholesale and Retail Trade June 2019, Department of Statistics, Malaysia

- Distribution

Freight Forwarders, Transport Companies, Logistics, Air-cargo, Shipping, etc.

Distribution encompasses the activity of transferring goods from

the manufacturer to the final customer. For imported goods, distributors need

to import these goods, pack or repack the goods, and use logistics to deliver

these goods to retail stores. The players in this industry are freight

forwarders, logistic companies, cargo airlines, and shipping companies.

Logistics services for distribution include transportation, inventory

warehousing, material handling, security and cold chain facilities.

With the advent of the e-commerce boom, the distribution industry

is poised to gain the most and reap the benefits from the shifting consumer

behavior where online shopping takes a larger precedent in the daily lives of

today’s consumers than the traditional retailing concepts. The increased

demands for distribution and delivery of items, bypassing the show-and-sell

retailing concept, have spurred many new competitors in this space eg freight

forwarders (parallel import & export, direct import to household), End to

End 3PL / 4PL logistics providers and Retail deliveries (Grab Delivery,

Uber Eats, Foodpanda)

Image source: thestaronline: food deliveries for most restaurants under Foodpanda

- Retail

Supermarkets, Shopping Centres, Retail Shops, etc.

In the recent years, retail has been greatly

affected by e-commerce, and as a result, most shopping centres are trying to

find a new niche in the retail sector. Therefore, instead of just selling

goods, they are moving to include lifestyle services such as Food and Beverage

(F&B) and entertainment in their retail outlets.

Image source: globalcoldchainnews: montracon chills for Tesco in Malaysia

Instead of pure e-commerce, some traditional

bricks-and-mortar retail players in Malaysia have succeeded in using e-commerce

to redefine their businesses. Their strategies will include using the

omnichannel or online-to-offline (O2O) approach to provide customers with an

integrated shopping experience. For example, Tesco delivers groceries directly

to customers who buy their goods through e-commerce. Another example is

Kumoten, Malaysia’s largest drop-shipping platform that lets merchants sell on

multiple online marketplaces without the hassle of buying and keeping stock.

https://www.theedgemarkets.com/article/retail-retail-players-resilient-amid-ecommerce-boom

Complexities of the industry from accountancy and tax angles

The retail sector involves significant logistics and maintenance

of inventories to satisfy customers’ requirements. It also requires smart

branding and sales promotions. Inventories need to be managed carefully due to

somewhat long lead times if the goods are imported from overseas whilst

customers’ demand may change over a short period of time due to the state of

the Malaysian economy and customers’ preferences. Importation of goods usually

faces many importation obstacles such as customs procedures and indirect taxes.

The accounting

for inventories will be a challenge due to valuation and impairment issues. In

addition, trade receivables will need to be stated fairly, all of which,

require special expertise in view of MFRS 9 for financial instruments which

require an estimation of an Expected Credit Loss for receivables.

Taxation of

companies in the retail sector usually encounter challenges in the area of

claiming for bad debts written off, claiming write-downs of inventories,

deduction of expenses for sales promotion and claiming of capital allowances

for renovations.

How can we help?

In addition to performing a statutory audit, we are able to assist

companies in this sector to adopt the correct accounting policies that are

appropriate to their circumstances. This is especially so in the

valuation of inventories and accounts receivables. Revenue recognition is also

an important aspect to note if the performance obligations under the sale is

complex.

Companies in

this sector with operations in many parts of Malaysia and overseas will find

that our network of 13 branches in Malaysia and 250 Crowe firms throughout the

world can greatly facilitate group audits.

For more details of our audit services, please click here

Companies in this sector may need tax advice relating to minimizing their indirect tax liabilities such as Import Duties, Sales Tax and Service Tax which is quite prevalent in this sector.

Where a company is eligible, we can assist to plan and apply for tax incentives. This involves understanding the type of tax incentives that the company is eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. We can also maximize the claim of capital allowances for the capital expenditure incurred which may at times require careful planning eg for renovations. Group relief may also be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses such as writedown of inventories and claiming of bad and doubtful debts, planning for submission of tax estimates to the tax authorities, resolving grey tax issues, dealing with the tax authorities, etc.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

From a consulting viewpoint, depending on the Client’s business lifecycle, we could look at risk aversion strategies to reduce the disruptive effects of changing business landscapes. On the flip side, we may also work closely with the Client to understand how innovation can take place, or probably look out for possible acquisition / investment targets to complement the Client’s existing supply line. If the Client is a start-up in this industry, other than strategic planning and operation systemization, we may also journey with the Client to grow and expand the business with the right handles and stakeholders.

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.