Mining in Malaysia has undergone shifting trends across the decades. In the early years of Malaya (pre-establishment of Malaysia) around the early 19th century, tin mining was the core mining resource that was in high demand globally. Substantial investments from the British empire led to the construction of many tin mining facilities, which are still evident up to today, in the form of old tin mine lakes across the Malaysian peninsula.

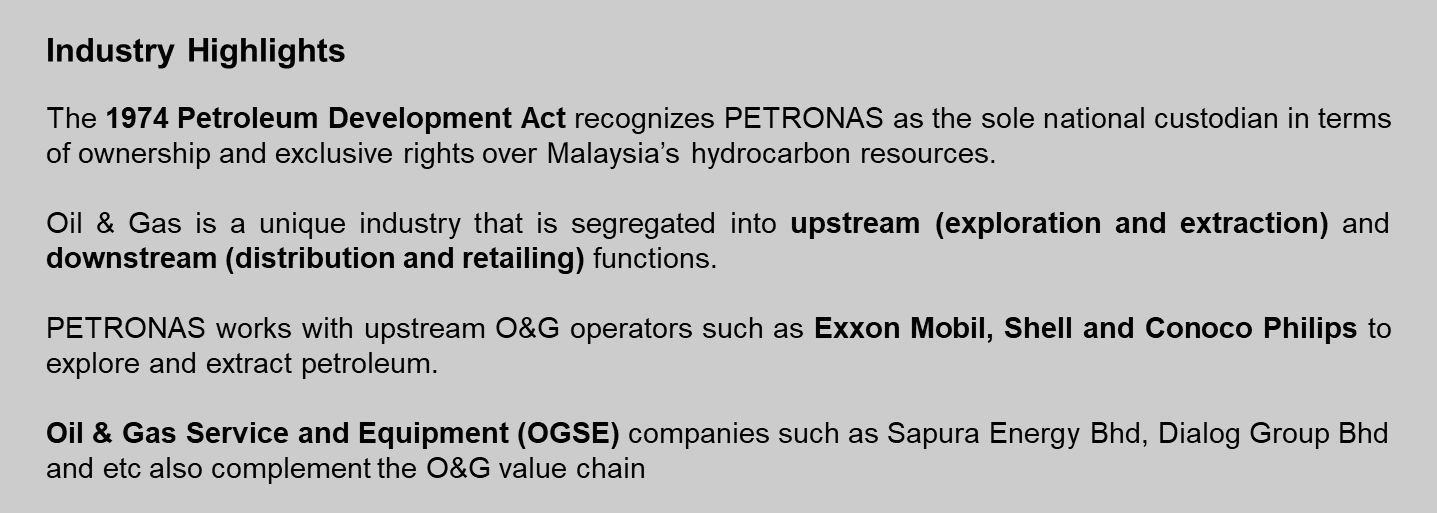

However, with the advancement of oil & gas exploration technologies in the early 1960s, further fueled by the demands of the industrialization era, Malaysia moved on from declining tin prices to the new black gold, in the form of oil and gas. As a collective economic response, Petroliam Nasional Berhad (PETRONAS) was established with the vested power to explore and extract petroleum from the shores of Malaysia.

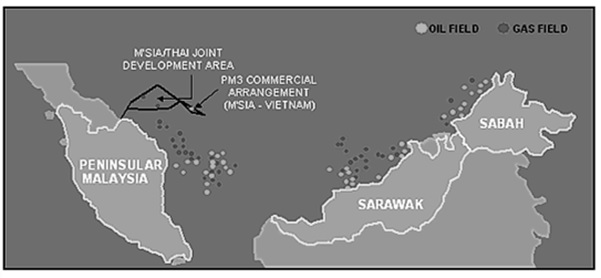

O&G is paramount to the country since it contributes between 20% to 30 % to the country’s Gross Domestic Product (GDP)1. According to the U.S. Energy Information Administration, Malaysia is the world’s 26th largest oil producer. Almost all the oil comes from offshore fields in East Malaysia, Sabah and Sarawak basin and some extracted from the Malaysia-Thailand Joint Development Area (JDA).

Source: Export.gov: Malaysia Oil and Gas

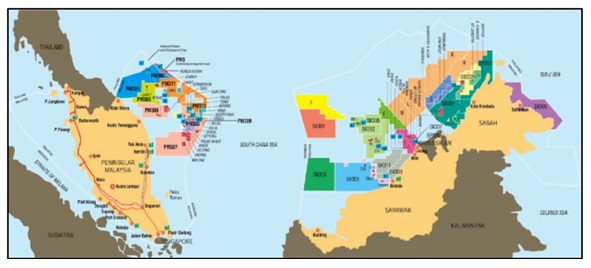

FIGURE: Oil & Gas Field Block Locations in Malaysia

Source: http://www.ccop.or.th/epf/malaysia/malay_status.html, 1 January 2002

Source: MOGSC - Occupational Analysis of Oil & Gas Industry

The O&G industry is supported by these Exploration and Production (E&P) companies:

- Local companies listed on Malaysia Stock Exchange: Dialog Group Berhad, Yinson Holdings Berhad and Serba Dinamik Holdings Berhad

- Major foreign O&G companies - ExxonMobil and Shell Malaysia

- Large foreign oilfield service companies - Schlumberger, Aker Solutions and Baker Hughes

Oil & Gas, Energy & Mining Sectors

Complexities of the industry from accountancy and tax angles

Oil exploration and other extractive mining industries have accountancy issues in deferring costs to a future period when revenues are derived from the ventures. This poses issues in respect of the amount of costs that can be deferred and the amount of impairment that is necessary. Extractive agreements especially those with the government can be complex and the financial terms have to be interpreted independently so that the correct accounting treatments can be accorded under the Malaysian Financial Reporting Standards (MFRS).

Accountancy issues relating to the downstream service-based industries tend to be more straight forward but will need attention especially those relating to impairment of assets at a time of low crude oil prices, revenue recognition for composite contracts which have a mix of performance obligations, and going concern issues.

Tax wise, a special tax regime applies to upstream oil & gas industries under the Petroleum Income Tax Act. In recent years, the proliferation of the shipping industry supporting the oil & gas industry has given rise to unique issues such as transfer pricing when the ships are rented from a Labuan entity to a Malaysian company. As for other oil & gas companies, withholding tax issues usually arise from payments to overseas companies.

How can we help?

In addition to performing a statutory audit, we are able to assist companies in this sector to adopt the correct accounting policies that are appropriate to their circumstances. These policies include those relating to recognition of income, deferment of costs, deferred taxation due to temporary differences, etc.

Groups in this sector with operations in many parts of Malaysia and overseas will find that our network of 13 branches in Malaysia and 250 Crowe firms throughout the world can greatly facilitate group audits.

For more details of our audit services, please click here

From the tax angle, we can assist to plan and apply for tax incentives. This involves understanding the type of tax incentives that a company in this sector is eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. We can also maximize the claim of capital allowances for the capital expenditure incurred which may at times require careful planning. Group relief may also be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses, planning for submission of tax estimates to the tax authorities, advising on withholding tax, resolving grey tax issues, dealing with the tax authorities, resolving transfer pricing issues, etc. Sales Tax, import duties and Service Tax are all important issues in this industry, which our Indirect Tax Division is can advise on.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

Our Growth Consulting division also covers business reengineering to assist companies in this industry sector via scientific methods, to schedule matching supply and optimized cost against market demand and trending prices. As a growth strategist, our Growth Consulting division can also journey with the company to redefine itself and seek areas of growth, either through innovation, diversification, mergers & acquisition and other tactical market strategies.

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.