Financial Services

- Banking, insurance, insurance broking, asset management, fund management, private equity, unit trusts, money broking, investment holding

At the core of the financial services sector in Malaysia are commercial banks, investment banks and Islamic banks. Within this sector are 26 commercial banks, 11 investment banks and 16 Islamic banks; of which 30 are locally owned while 23 are foreign-owned. Of these banks, the biggest ones in terms of total assets and market capitalization include Maybank, CIMB, Public Bank, RHB and Hong Leong Bank. All of these financial institutions have to be licensed by Bank Negara Malaysia (BNM) and are regularly assessed and monitored by BNM based on their adequacy of risk management procedures. Other financial service companies will include brokerage firms, insurance companies and fund management companies.

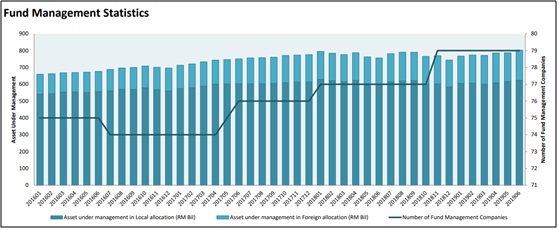

The asset and fund management sector assists firms and individuals in managing their financial portfolio by facilitating investment in financial instruments such as stocks, bonds and sukuk (sharia compliant bonds). Companies with the largest assets under management (AUM) in Malaysia are Public Mutual Berhad, Principal Asset Management Berhad (formerly known as CIMB-Principal Asset Management Berhad) and Affin Hwang Asset Management Berhad.

Source: Securities Commission Malaysia Fund Management Statistics

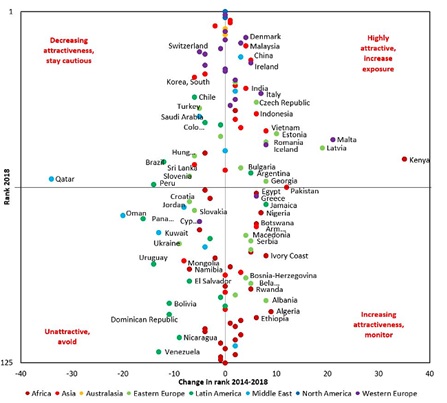

A more specialized form of asset management is private equity firms and venture capitalists. They invest in private companies, whether they are at the startup stage or when the companies are more matured. Malaysia currently ranks 13th out of 125 countries assessed in the Venture Capital & Private Equity Country Attractiveness Index 2018, garnering international recognition which reflects the growth prospects of Malaysia’s private equity and venture capital sector. Malaysia Venture Capital Management Berhad (MAVCAP) is the country's largest VC company with investments in the ICT sector.

Source: VC and Private Equity: Where Next to Invest -- Taking Brexit Into Account

There are also many companies that are engaged in investment holding such as holding of stocks, shares and properties, many of which are family owned companies. Stock brokerage firms in Malaysia include Affin Hwang Investment Bank Berhad, CIMB Investment Bank Berhad, and Maybank Investment Bank Berhad. In the insurance sector, the participants in general insurance are AIG Malaysia Insurance Berhad, Allianz General Insurance Berhad, Zurich Insurance Berhad etc.; whilst in life insurance there are companies such as Sun Life Malaysian Assurance Berhad, Hong Leong Assurance Berhad and Prudential Assurance Malaysia Berhad.

Complexities of the industry from accountancy and tax angles

Banks’ accounting requirements are unique because most of their assets and liabilities are financial in nature. Life and non-life Insurance companies also have their own unique requirements due to their specialized way of revenue recognition and provision for claims liabilities. All other companies in the financial services sector have accounting requirements relevant to their operations in accordance with the accounting standards. Being mostly service companies, the accounting complexities usually revolve around measurement of Expected Credit Loss (ECL) and valuation of financial investments.

MFRS 9 on Financial Instruments has a significant impact on the financial statements of banks and insurance companies. Under this revised standard, accounting for impairment losses has to be made based on the ECL approach instead of the previous incurred loss approach. The measurement of ECL is required to incorporate forward looking information reflecting the potential future economic environment which in turn, requires the development of new methodologies that involve significant judgment.

For insurance companies, the valuation of insurance contract liabilities is complex because the measurement is subject to uncertain future outcomes as to the ultimate full settlement of insurance contract liabilities. These calculations require the use of valuation models and assumptions such as investment return, interest rate, mortality, morbidity, etc.

How can we help?

We are able to perform the audits of banks, insurance companies, stockbroking firms, fund management companies and other financial service entities due to our prior audit experience with this industry. In addition, we can tap on the expertise of our US member firm, Crowe LLP, which has many audit clients in this sector. Their track record is as follows:

For more details of our audit services, please click here

From the tax angle, we can assist to plan and apply for tax incentives for eligible companies that are engaged in promoted financial services activities eg venture capital companies. This involves understanding the type of tax incentives that such companies are eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. Group relief may be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses eg bad and doubtful debts, planning for submission of tax estimates to the tax authorities, resolving grey tax issues, dealing with the tax authorities, etc. Sales Tax does not feature in the financial services industry but our Indirect Tax division is able to advise on Service Tax in this sector.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.