Healthcare

- Aesthetic Centres, Clinics, and Medical Centres

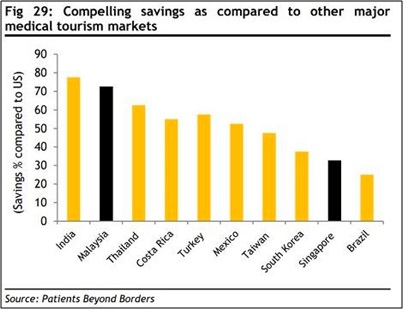

Malaysia is one of Asia’s top health destinations. Affordable healthcare is one of the reasons foreigners prefer to come to Malaysia for medical treatment. According to Patients Beyond Borders, health travellers could save up to 80% on health costs in Malaysia.

The healthcare sector is a big sector because of the limited capacity and expertise of government hospitals. Some of the larger government hospitals are University Malaya Medical Centre, Selayang Hospital, Queen Elizabeth Hospital in Kota Kinabalu and Penang General Hospital.

Due to the demand for better services and higher level of expertise, the healthcare sector has grown to cater to a more demanding market where price is a less determining factor. Many large private hospitals such as KPJ Healthcare and Sunway Medical Centre are owned by local investors, whereas the foreign owners of hospitals include Columbia Asia Group and Parkway Pantai (owner of Gleneagles and Pantai Group). Generally the big private hospitals provide facilities for medical care, for example operating theatres and x-ray facilities, but medical specialists that support these private hospitals are specialists in their own right and operate as independent consultants to hospitals.

There are also a number of smaller medical establishments such as medical centers with less than 100 beds, and specialty medical centers such as gynaecology clinics, oncology clinics, aesthetic clinics, dialysis centres, child specialist clinics, nursing homes, orthopaedic centres and many more.

Complexities of the industry from accountancy and tax angles

Healthcare is somewhat similar to the education sector insofar as accounting and tax issues are concerned. From the accounting angle, revenue recognition for healthcare entities which provide emergency services to patients prior to knowing the amount that will ultimately be paid by a private insurer or the patients themselves could be challenging. This is because the amount ultimately paid may be adjusted due to negotiation and/or dispute.

MFRS 15 requires these variable considerations to be included in the determination of transaction price if it is highly probable, and this will require a high degree of judgment to estimate the amount of consideration to be included as part of the transaction price. MFRS 15 also requires the revenue from contracts to be allocated to each distinct good or service provided on a relative standalone selling price basis. It is sometimes necessary for revenue to be deferred to match the performance obligations. PPE is usually high and needs to be evaluated every year when there is an indication of impairment.

The healthcare sector is eligible for tax incentives especially those for healthcare tourism but are subject to conditions. As such, it may be necessary for companies in this sector to evaluate their business structure for tax efficiency.

How can we help?

In addition to performing a statutory audit, we are able to assist companies in this sector to adopt the correct accounting policies that are appropriate to their circumstances. These policies include those relating to recognition of income, treatment of fees received in advance, deferred taxation due to temporary differences, etc. In particular, we can assist these companies to comply with MFRS 15 Revenue from Contracts with Customers and MFRS 16 Leases to ensure that they have accounted for their revenue, lease assets and lease liabilities correctly.

Healthcare groups with operations in many parts of Malaysia and overseas will find that our network of 13 branches in Malaysia and 250 Crowe firms throughout the world can greatly facilitate group audits.

For more details of our audit services, please click here

From the tax angle, we can assist to plan and apply for tax incentives. This involves understanding the type of tax incentives that a healthcare company is eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. We can also maximize the claim of capital allowances for the capital expenditure incurred which may at times require careful planning. Group relief may also be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses, planning for submission of tax estimates to the tax authorities, resolving grey tax issues, dealing with the tax authorities, etc. Sales Tax does not feature much in the healthcare industry and most healthcare services are generally exempted from Service Tax except for certain services. Our Indirect Tax division is able to advise on Service Tax where necessary.

Healthcare companies, being property-based companies, may encounter Real Property Gains Tax and stamp duty on their property transactions. We have extensive experience in advising on these taxes.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.