Education

- Educational Institutions, Training, etc.

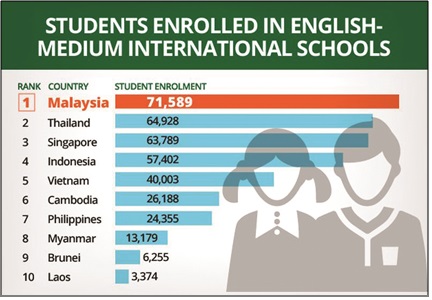

The education sector opened up tremendously when the government allowed local international schools, which were previously restricted to expat children, to be set up for local persons. Now, Malaysia leads Southeast Asia in terms of students enrolled in international schools with English as its teaching language.

Source: Malay Mail: Malaysians Top in Enrolment in Region's International Schools (2017)

- Tertiary Institutions

At the same time, with depreciation of the ringgit, citizens found it too expensive to send children to foreign universities in the United States, United Kingdom and Australia. Moreover, places in public universities such as the University of Malaya (UM), University of Science, Malaysia (USM) and University Putra Malaysia (UPM) were very limited. The government therefore decided to open up alternatives for higher education, by allowing local private universities to franchise foreign courses and offer these courses to Malaysian students. Some of these courses are twinning programs whereby students may be required to go overseas to do part of their degree course in another institution.

One such example is Tunku Abdul Rahman University College which partnered with Coventry University, University of Queensland, University College Dublin and many more. There are also foreign university branch campuses in Malaysia such as University of Nottingham Malaysia Campus, Monash University Malaysia Campus and Curtin University.

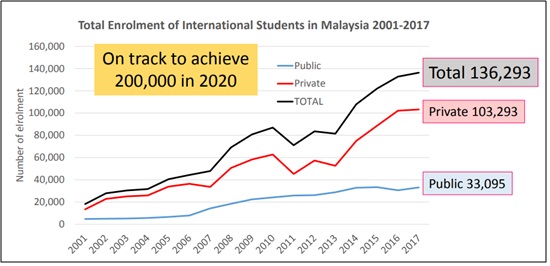

The government also exports education services by inviting international students to study in Malaysia. The total enrolment of international students in Malaysia was 136,293 in 2017.

Source: APAIE 2018 Conference & Exhibition from MyMohes, Unit Data, BPPPD, KPT (2017)

One very important feature of the educational business is that it requires heavy investment in school buildings and land. Due to the need for a strong management team to secure sufficient students, and the substantial investment required, only the well-managed educational institutions are able to flourish. Examples of those who have excelled and grown in this industry are Taylor’s Education Group, Sunway Education Group, UCSI Education Group, and MAHSA University.

Complexities of the industry from accountancy and tax angles

Revenue recognition and accounting for PPE are some of the major issues in this sector. Sometimes, revenue may need to be deferred to match the performance obligations. PPE is usually high and needs to be evaluated every year when there is an indication of impairment.

The education sector is eligible for tax incentives but are subject to conditions which are often not easy to meet. As such, it may be necessary for companies in this sector to undergo restructuring for business and tax efficiency. Service tax may also be a big issue because, although most educational services are exempted from Service Tax, some services are not so exempted.

How can we help?

In addition to performing a statutory audit, we are able to assist companies in this sector to adopt the correct accounting policies that are appropriate to their circumstances. These policies include those relating to recognition of income, treatment of fees received in advance, deferred taxation due to temporary differences, etc. In particular, we can assist these companies to comply with MFRS 16 Leases to ensure that they have accounted for their lease assets and lease liabilities correctly.

Education groups with operations in many parts of Malaysia and overseas will find that our network of 13 branches in Malaysia and 250 Crowe firms throughout the world can greatly facilitate group audits.

For more details of our audit services, please click here

From the tax angle, we can assist to plan and apply for tax incentives. This involves understanding the type of tax incentives that an educational institution is eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. We can also maximize the claim of capital allowances for the capital expenditure incurred which may at times require corporate restructuring and planning. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses, planning for submission of tax estimates to the tax authorities, resolving grey tax issues, dealing with the tax authorities, etc. Our Indirect Tax division is able to advise on the taxability of educational services and help resolve disputes with the Customs authorities.

Companies in the education sector, being property-based companies, may encounter Real Property Gains Tax and stamp duty on their property transactions. We have extensive experience in advising on these taxes.

For more details of our tax services, please click here

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.