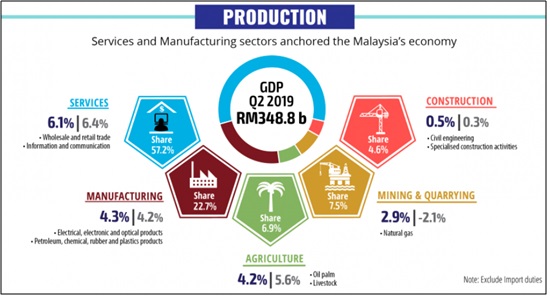

Manufacturing

Source: Euromonitor International from national statistics

Most factories are located in industrial zones which are spread out over the country, but these factories are especially abundant in states like Penang, Johor and Selangor. There is a large range of goods predominantly exported by these factories, from Electrical and Electronics (E&E), to rubber gloves and chemical products. Rubber products are among Malaysia’s top 10 exports. The world’s largest manufacturer of gloves in terms of revenue is Top Glove, followed by Hartalega Holdings, Kossan Rubber Industries and Supermax Corp, all of which are Malaysian companies.

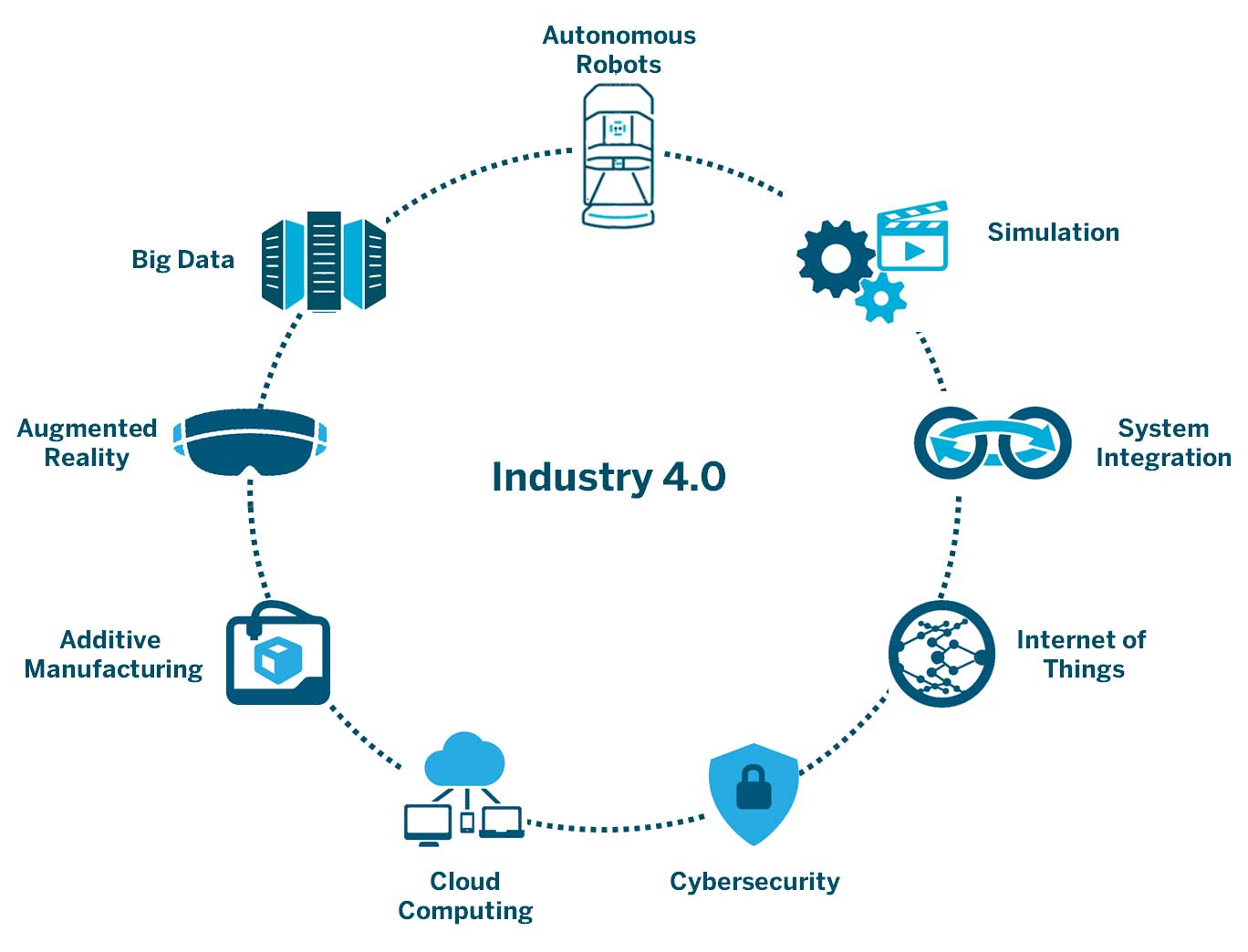

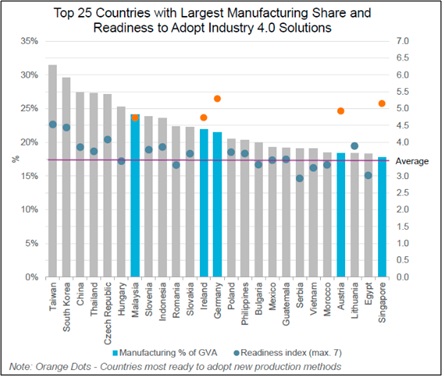

The government is also actively encouraging industry players to move towards Industry 4.0 (IR4.0) with the incorporation of automation and data exchange in manufacturing processes. Malaysia is in a favourable position and is among the top five (5) countries that are most ready to adopt Industry 4.0 solutions.

Source: Towards Data Science: 4.0 Industry Technologies & Supply Chain

Source: Euromonitor International from national statistics

Even though China is a manufacturing powerhouse, Malaysia is able to compete well against China in the international market. This is especially so in areas where Malaysia is a niche player, for example in gloves, semiconductors and food manufacturing.

Complexities of the industry from accountancy and tax angles

Manufacturing has a long lead time from procurement of raw materials to completion of production and finally, to sale of products to customers and obtaining of payment. A typical period is 6 months to a year. To overcome this, banking facilities are of great importance. As a result, banking and finance is a major related issue for the manufacturing industry. From the accounting and audit aspects, the whole chain of assets from Property, Plant & Equipment to inventory, and finally to accounts receivable need to be stated accurately in order to have an accurate set of financial statements. Along the way, there may be valuation, impairment and revenue recognition issues. Bankers are especially careful when lending to this sector due to the issues above and will mostly trust financial statements audited by established audit firms such as Crowe Malaysia.

Taxation is a large area where deep expertise is required because the manufacturing sector enjoys many tax incentives and tax compliance can be complex. Popular tax incentives include the reinvestment allowances and tax incentives under IR 4.0. Companies that are eligible can enjoy Pioneer Status or Investment Tax Allowance, but prior approval has to be obtained from the MIDA. Generous export incentives are also available to those who export overseas.

How can we help?

In addition to performing a statutory audit, we are able to assist companies in this sector to adopt the correct accounting policies that are appropriate to their circumstances whilst satisfying banking expectations. These policies include those relating to recognition of income, valuation of inventories, assessment of impairment of assets, deferred taxation due to temporary differences, etc. We can also assist companies to be listed on the Bursa Malaysia as we are one of the foremost accounting firms involved in the public listing of companies.

Manufacturing groups with operations in many parts of Malaysia and overseas will find that our network of 13 branches in Malaysia and 250 Crowe firms throughout the world can greatly facilitate group audits.

For more details of our audit services, please click here

As a well-known tax adviser to many manufacturing companies, we can assist to plan and apply for tax incentives for eligible companies that are engaged in promoted activities. This involves understanding the type of tax incentives that such companies are eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. Group relief may be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses eg bad and doubtful debts, planning for submission of tax estimates to the tax authorities, resolving grey tax issues, dealing with the tax authorities, etc.

Sales Tax and import duties are major indirect taxes in the manufacturing industry whilst Service Tax may apply for certain services. Our Indirect Tax division is very experienced in advising on all aspects of indirect taxes.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

Our consulting division has extensive experience in the manufacturing sector, covering the area of process optimization engineering / reengineering, solution-based innovation, IR 4.0 adoption, change management, productivity improvement, lean production & management concepts and other operational management techniques that would assist the Client in improving either its top line or bottom line figures. The consulting division has also performed various initial analysis of the client’s operations to assess where improvements and innovations could be made; usually at a minimal cost with the findings and recommended solution(s) being presented to the Client for their own further consumption.

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.