Supporting Large or Listed businesses

Is your company large or listed?

This month's fundamental topic

August 2025

Forensic Accounting

The importance of the expert witness role continues to hold its place in the arena of law. Ultimately, our role as experts is always to assist the Court. In particular, our role is to help the Judge reach a judgement they consider fair and equitable based upon the opinion offered by an expert, or experts, where the Judge may prefer the opinion of one over the opinion of another. It all boils down to evidence, reasoned arguments, and opinion.

The expert role will typically only be required where additional information is needed by the Court. If the matter can be dealt with by reference to the law alone it will likely not be needed, perhaps for civil matters such as a tenancy dispute or a contractual wrangle. Or rather, one of the Parties might apply to the Court to argue expert evidence is needed to allow the Judge to make an appropriate and fair judgement. This will be most relevant in areas such as medicine, accountancy, architecture and similar. The expert’s role can be summarised as follows: it is to clarify and simplify potentially complex issues within their field; and to provide objective opinion that is unswayed by those instructing or paying them.

However, by the very nature of how experts are appointed, with a party approaching them with a scope of work and typically agreeing a daily rate for the work to be carried out, there may be a subliminal leaning to seek a high bar (when acting for the Claimant) or to minimise the quantum of a claim (when acting for the Defendant). It is the strong expert who will advise a party, possibly seeking a high worth claim, that there will be little to no chance of success and to save their money. This may not be the news a client wants to hear, but anything less than presenting a case from an independent perspective will not help the client, or expert’s reputation, in the long term.

One of the processes designed to assist the Court is the joint statement – whereby experts look to narrow the issues they disagree on in a single standalone report – however this can sometimes turn out to be the ground where each party simply expands on the reasons they disagree with the other expert, which is of no assistance to the Court in reaching its judgment.

Many criminal matters may require a jury to decide the fate of a defendant, without any expert input. In other cases, there may be matters such as the Lucy Letby trial where expert medical evidence forms the heart of the case and which continues to draw media speculation for the roles of the experts in determining the guilt of the defendant, raising important topics around over reliance on limited expert findings, and the adequacy of ‘common juries’ in assessing complex industry evidence.

Experts are in a unique position, whereby they can support a client throughout all stages of a case matter, from initial advisory work, where Court proceedings may never even be envisaged, through to giving evidence in Court.

There is also the possibility of providing advice in any alternative dispute resolution process, be that at mediation (where cases sometimes settle) or some of form of expert determination, where the expert will effectively preside as ‘judge’ under joint instructions from both parties with rounds of submissions provided for their review.

Did you know…If an expert gives an opinion without any substantive evidence to support it, they can become the target of criticism from a Judge in their ruling which can seriously harm their reputation. If you would like more information on our expert witness services, please visit Forensic Services, or contact Martin Chapman and Alex Houston. |

Divya Devadoss, Associate Director, Forensic Services

As the corporate landscape becomes ever more complex with more convoluted organisational structures and reporting rules, the risk related to related parties increases.

A related party is a person or organisation that has a close relationship with a reporting entity, including close family members, subsidiaries, affiliates and entities controlled by related individuals. Such individuals or entities could influence or be influenced by the financial or operational decisions of the reporting entity. Related party entities can therefore pose serious audit and fraud risks, especially when used to manipulate financial statements or conceal misconduct.

What are the risks?

In the first instance, identifying all related parties can be difficult. Management may fail to disclose all related parties, making it difficult for auditors to identify and assess the impact. This can be particularly difficult as the definition of related parties can be complex and is not always fully understood by management and related parties are often undisclosed in good faith.

Transactions with related parties are inherently risky because they often lack the independence and transparency of arm's-length dealings.

Key risks include:

- misstatement of financial results: Transactions may be recorded at inflated or deflated values to distort earnings or asset positions

- conflict of interest: Decisions influenced by personal or financial ties can undermine corporate governance

- siphoning of funds: Companies may divert resources to related entities through loans, guarantees or asset transfers with little oversight.

These risks are exacerbated when internal controls are weak or when transactions occur outside the normal course of business. Auditing standards like ISA 550 require auditors to scrutinise related party transactions for legitimacy, business rationale, and proper disclosure.

This can have serious consequences for auditors. In one high-profile case, the Financial Reporting Council (FRC) issued a fine of over £1.3 million in relation to audit failures involving undisclosed related party transactions. A key finding was the lack of professional scepticism applied to management’s assertion that a delivery company, reportedly controlled by a close relative of the CEO, was not a related party. The case underscores the importance of rigorous scrutiny and proper disclosure in related-party dealings.

How can forensic accountants help?

Forensic accountants bring a specialised skill set to uncover and mitigate fraud risks associated with related party entities. Their contributions include.

Identifying hidden relationships

- Use corporate records, tax filings, and organisational charts to uncover undisclosed related parties.

- Apply data analytics to detect patterns of collusion or circular transactions.

Analysing transactions for fraud

- Examine contracts, invoices, and payment records for inconsistencies.

- Assess whether transactions have a legitimate business purpose or are designed to manipulate financial outcomes.

Evaluating internal controls

- Review the company’s policies for approving and disclosing related party transactions.

Recommend improvements to prevent management override and ensure segregation of duties.

Supporting legal and regulatory action

- Prepare forensic reports for litigation or regulatory enquiries.

- Provide expert testimony and assist in asset tracing and recovery.

Enhancing governance and transparency

- Advise boards and audit committees on best practices for oversight.

- Help implement whistleblower programs and fraud reporting mechanisms.

Conclusion

While related party entities are a normal part of business operations, they require rigorous audit procedures and forensic scrutiny to ensure they are not misused. By combining investigative techniques with financial expertise, forensic accountants help organisations maintain integrity, comply with regulations, and protect stakeholder interests. The Crowe Forensic Team handles a substantial number of forensic cases, varying in size and complexity. We are always happy to have an initial, no-obligation discussion on any matters where we can add value and provide expert advice. For more information, please contact Alex Houston or your usual Crowe contact.

Forensic expert witnesses are often involved in determining the profits lost because of the actions of another party. This is typically termed a loss of profit claim or, if the business has been discontinued for a period, a business interruption claim.

This can be viewed from the perspective of the party that has suffered the loss (Claimant), or the party that has allegedly caused the loss (Defendant).

Quantification

Whether defending or assisting in formulating the claim, a primary aim of the expert witness is to gain a sound understanding of the business. For instance, is it a manufacturing or service business, does it serve overseas markets, is it a seasonal business, and so on. The expert witness should also gain an understanding of how the business generates its revenues and profit streams. This will lie at the heart of determining the loss suffered.

The reporting aim is to quantify the position a business would have been in but for the actions of the Defendant, often described as the ‘But For’ Position.

It is important to consider each case on its own merits and what has taken place, for example:

- Has the entire business been impacted by the actions of the Defendant?

- Is it rather the case that only a particular aspect of trade has been disrupted?

- Is the loss of profit within a defined historic period, or is it continuing?

Typically, when instructed by a Claimant, the above information will be collated and, in conjunction with discussions with company management and independent review of the financial evidence, an expert report will be disclosed to the Court to assist in the determination of damages.

When acting for the Defendant, there would typically be a schedule of loss already disclosed within proceedings. This schedule represents the main focus in assisting the Defendant to assess the claim, as a review of this can unveil fundamental flaws in the case being brought against them.

Causation

One common area for all loss of profit cases is the matter of causation, that is, whether there is an identifiable link between a certain event, allegedly caused by the defending party, and the resulting loss of profit. A Claimant will typically point to a tail off in business, with declining revenue and profit streams, arising as a direct cause of the other party’s actions.

It can be the case, however, that any dip in a business’s performance is not necessarily a direct reflection of the actions of the other party, but is instead a result of trading conditions or events that lie outside the responsibility of the Defendant.

Part of the above review might also look more granularly at a business, breaking down its fixed and variable overheads. Certain costs will vary according to the volume of business, but costs such as rent, or rates, generally will not.

Mitigation

With every loss suffered, it is the responsibility of the Claimant to mitigate their loss; that is, to undertake reasonable actions to minimise the loss that it suffers. For example, could trade have continued on a different production line, or certain work been sub-contracted out to allow it to continue in some form and so minimise losses arising.

There can also be situations where a business actually does better as a result of an incident. Take the example of certain shops during Covid experiencing a surge in online sales and profitability as they stopped incurring property costs.

Did you know…In certain cases, a poorly formulated case or providing inappropriate or misleading evidence can see a party ordered to pay the other side’s professional costs of attending trial. |

Independence

Most importantly, it must be borne in mind that, whether acting on behalf of the Claimant or the Defendant on reviewing the loss of profit claim, an expert’s duty is to the Court rather than the party paying or instructing them. They must be seen to be acting impartially, and from an independent perspective, not impacted by the wishes and motivations of the client.

If you would like more information on our expert witness services, please contact Martin Chapman, Alex Houston or your usual Crowe contact.

As an expert witness, you might need to take on various roles in your work - as a party appointed expert; a single joint expert (SJE); a shadow expert; an expert issuing an expert determination; or an expert acting in a purely advisory role.

As a party appointed expert, your instructions come from one of the two parties (or possibly multi parties) that are in dispute, you will either be instructed directly by that party or (more commonly) by the solicitors acting as agent for that party – you may be acting for the party that ‘holds the information’ (e.g. the company’s remaining majority shareholders following a minority exit) or for the party that might not have as much access to information i.e. the exiting minority shareholder) – whichever party appoints you, however, your core responsibility and overriding duty is to the court - you must remain independent and be seen to be independent - the solicitor and barrister are advocates for their client, while the expert is there to give an independent opinion on accounting matters that lie within their expertise.

As an SJE, you are jointly instructed by both parties, this can actually take place in both ‘amicable’ and ‘confrontational’ scenarios, whereby friendly parties wanting to reach a settlement may agree to equally bear the costs of one expert; and similarly, where the parties are not on amicable terms, they may actually agree that their opinions are so polarised that it makes more sense to jointly appoint just the one independent expert to opine on the matter they are arguing over – however, if either party does not wish to show any form of ‘friendly’ co-operation then they are always more likely to appoint a party appointed expert, possibly in the mistaken belief that they may favour their position.

A common scenario arising from an SJE appointment is the position whereby a ‘shadow’ expert is appointed – this will be an instruction to review the work of the SJE and, although you are not part of the formal court process, your advice will be provided on the merits of the SJE report and where any questions may be raised on specific points.

An expert determination will usually come through an institute like the ICAEW, when parties cannot reach an agreement but do not wish to revert to long and expensive litigation – two rounds of submissions will be made by each party (their original arguments followed by their comments on the other side’s argument) and the expert witness will make a determination that is intended to draw a line under the matter and provide closure for the parties. Alternatively, we can provide advice to a party making their submissions.

In an advisory role the expert might typically be giving provisional advice as to the merits of pursuing a case, advice on how to calculate quantum, or reviewing the merits of a claim that a party is facing – this information would only be made available to the instructing party and would not be admitted into court.

Did you know…In whatever expert role you undertake, you must maintain your independence and base your opinions on the evidence available rather than the entrenched position of the party instructing or paying you. |

For more information, please contact Martin Chapman or your usual Crowe contact.

The preparation of an expert witness report is a crucial process, allowing the expert to assist the court by clearly summarising findings within their area of expertise.

Below is a summary of key information regarding the layout and content of these reports.

General

An expert witness report should provide a concise statement of facts and assumptions used by the expert. It is important that the reader can easily follow the expert’s reasoning leading to the conclusions reached. Any technical matters should be explained in terms that an intelligent layperson can understand. Additionally, the expert should include a summary of the instructions they received to avoid any potential misunderstandings.

Civil Procedure Rules

The report will serve as the primary piece of evidence provided by the expert to the court. As such, the Civil Procedure Rules (CPR) clearly outline what must be included in an expert’s report. It is essential to show that the expert is presenting their own independent professional opinion. Moreover, the CPR makes it clear that the expert’s overriding duty is to the court, not to the party who appoints or compensates them.

Format

- Be consistent with font size and colour: use a readable font and standard font size. Consider using italics to quote someone, bold to abbreviate names, and underline headings and subheadings.

- Resize your images: when adding images, resize them to be clear and visible and maintain consistency in sizing and positioning throughout.

- Number your pages: a table of contents is important for navigating through the report.

- Header: the header should contain the following information on all pages: case number, date, expert’s name and organisation.

- Use the “styles” feature in Microsoft: modifying the different styles can ease the preparation of the report and aid consistency throughout.

- Proofread: review paragraph markups, align your text and edit unreasonable gaps. Ensure tables and figures are aligned consistently throughout.

- Use a template: The Academy of Experts publishes a model template of an expert’s report which has been prepared and approved by senior judges. The template includes a mandatory declaration to complies both with the CPR and best practice.

Did you know…An expert may be employed in various capacities, including, arbitration, tribunals, and litigation. |

For more information on the forensic accounting services we offer, please contact Martin Chapman.

What better way for forensic accountants to get into the spirit of the Olympics than with an article intertwined with Olympic facts. Starting with fact number one which also provides an admittedly slightly tenuous link to expert determinations.

Did you know…The Olympic motto is “Faster, Higher, Stronger – Together”, with “Together” being a recent addition in 2021, to recognise that we can only go faster, aim higher and become stronger by standing together in solidarity. |

Expert determinations can be faster, higher, and stronger than other forms of dispute resolution. For more details on expert determinations, please see our other articles on What is an Expert Determination and Top 10 tips for a successful expert determination. However, in summary, this is a binding form of dispute resolution, usually used in a matter that is technical in nature (such as accountancy). An expert is jointly appointed by disputing parties to provide their expert determination to resolve the dispute.

Faster

Expert determinations are usually much faster than disputes that adopt more traditional legal claim processes. From the point of an expert being instructed, the matter can be resolved in as little as 20 to 30 business days. A typical timetable might be that the parties have five to 10 business days to submit their position to the expert, a further five business days for the parties to respond to each other’s submissions and then 10 to 15 business days for the expert to reach their determination. This process is flexible however, as the timetable and submission process can be adapted according to the needs and complexity of the matter.

Did you know…In the 2008 Beijing Olympics Usain Bolt won the 100m in a world record time of 9.69 seconds, despite his shoelace being untied. |

Higher

Expert determinations can often result in the successful party retaining a higher amount of any award granted. This is because the process can be highly cost-effective, as the parties typically share the costs of the expert determiner. This straightforward process means that there is minimal back and forth correspondence between the parties, and no need for an expensive trial in court, should alternative dispute resolution mechanisms fail.

Did you know…In the 1976 Montreal Olympics, the gymnastics electronic scoreboard could only display three digits, which meant that when Nadia Comăneci unexpectedly scored the highest possible perfect 10.00 score, the scoreboard instead displayed a lowly 1.00. |

Stronger

As previously mentioned, expert determinations are binding on the parties, making them a strong option to reach a full and final resolution. They are not open to challenge or any appeal processes, except in very strict circumstances, where it can be proven that the determination is incorrect due to either fraud or manifest error.

Did you know…Tug of war was contested at every Olympics from 1900 to 1920, with Great Britain being the most successful nation, winning two golds, two silvers and one bronze. |

Together

Our Forensic Services team have extensive experience of being both the expert determiner as well as assisting parties in preparing their submissions to the appointed expert determiner. For more information, please contact Martin Chapman or your usual Crowe contact.

Did you know…In the 1936 Berlin Olympics two Japanese athlete, Shuhei Nishida and Sueo Ōe, cleared the same height in the pole vault, being awarded silver and bronze. Being good friends, they had their medals cut in half, and fused into two hybrid half silver and half bronze medals, which became known as “The Medals of Friendship”. |

In cases where one side is aiming to make a claim — be it for loss of profits, breach of warranty, professional negligence, or similar — it can often be the case that such a claim may be overstated or exaggerated in some way, sometimes artificially and sometimes simply through an incorrect approach to formulating the claim.

Key themes to look out for, which may indicate an inflated claim, include:

- Cause and effect: possibly one for the lawyers to argue, but forming a claim without sufficient evidence to show it was caused by the actions of another can often undermine a claimant’s case. For example, would the business interruption have happened, from the actions of another party, or might those prejudicial events have happened in any event?

- Simple errors in supporting calculations: it is staggering how often you come across simple errors in claims, which inadvertently inflate a claim by an unreasonable sum and, in doing so, undermine the robustness of the overall claim.

- Using estimates when actual data is available: a claim should preferably be based on actual data that can be supported and verified, as opposed to budgets or estimates, although in the absence of ‘live’ data, sometimes budgets, forecasts etc., are the next best option.

- Claiming for something that cannot be justified: occasionally you see a claim where the facts suggest it does not hold merit, either an event just simply could not have taken place, or the timeline of the claim just does not make sense.

- Double counting: a common error in many claims is where an amount is double counted, possibly where a claim has been made, but inadvertently included two bases of assessment, which both fundamentally refer to the same income and/or profit streams.

- Lack of accounting for any mitigating income: a common error in claims where income has been impacted in some way but has led to the business looking for alternate ways of making income, which would not have arisen but for the breach complained – such mitigating income should be considered by a claimant and netted off the claim is to ignore that new income and not deduct it from the claim.

- A lack of a ‘sense check’: the first check that should be made when either formulating, or defending, a claim is whether it passes the ‘sniff test’ i.e., does this claim stack up based on the facts and data presented i.e., has the small corner shop that has been closed for a month, which now claims it has lost millions of pounds in business as a result, really suffered such demonstrable losses?

- Implausible, and unsupported, ‘what if’ scenarios: many claims will look at ‘the next steps’, but for the breach that happened, another stage of work and income generation would have followed - examples include suspiciously long-term renewal of contracts, and generously remunerated non-executive director positions.

- Costs that would have been borne notwithstanding the alleged prejudicial actions of the defendant i.e., there may have been an inevitable impact from the COVID-19 pandemic, the exit of the UK from Europe; or global economic conditions that would have impacted the position of the claimant in any event.

- Has the claim been set out that ticks all the boxes from an accounting perspective, has it followed generally recognised rules and regulations set out under UK and International accounting standards, or has it applied incorrect accounting treatment to inflate the claim.

For more information on the services we offer, please contact Martin Chapman.

Did you know…A poorly formulated, or incorrect claim, can cost a company significant management time, as well as incurring wasted Court costs. |

As forensic accountants, our involvement in the buying and selling of companies is usually required when something has gone wrong and there is a completion accounts dispute, earn-out accounts dispute or warranty claim. Disagreements in the interpretation of share purchase agreements (SPAs) can be the root cause of the disputed matters. Below we set out some real world examples, that based upon our experience, are best avoided.

Ambiguous and / or un-defined terms

We have been involved in matters where warranties have been agreed along the lines of company forecasts being ‘carefully’ prepared, or specific clauses inserted requiring ‘appropriate’ provisions for liabilities to be made.

Ambiguous terms such as these are unhelpful, as each party will undoubtedly have different interpretations as to what ‘carefully’ or ‘appropriate’ means in practice. Leaving room for the application of judgment in accounting practices can lead to vastly different conclusions as to the consideration due under an SPA.

Unrealistic warranties

A warranty we often see proposed at the SPA drafting stage, but thankfully is usually (but not always) removed in the final SPA is that “the management accounts have been prepared in accordance with Generally Accepted Accounting Principles (GAAP)”.

GAAP in the UK is typically FRS102 or IFRS , being the principals dictating how companies produce their annual statutory financial statements. Management accounts, while often having a significant grounding in GAAP in their preparation, are produced internally by a company to assist management in running the business. Differing reported financial performance can arise, for example, when management accounts use interim estimates, instead of detailed calculations that would be required under GAAP.

Having a clause in an SPA that warrants that the management accounts have been prepared in accordance with GAAP likely leaves a seller open to a warranty claim, because management accounts are very rarely, if ever, prepared completely in accordance with GAAP.

Lack of clarity on precedence hierarchies

SPAs typically have a hierarchy set out, that dictates how completion accounts and earn-out accounts are prepared. The most common hierarchy is:

- specific clauses in an SPA take precedence over

- historical accounting treatments in a company’s statutory financial statements, which in turn take precedence over

- GAAP.

We have seen examples where the wording as to the hierarchy applicable is unclear, which can result in buyers and sellers having vastly differing opinions as to how completion accounts or earn-out accounts should be prepared and ultimately the resulting consideration due.

Incorrect internal referencing

SPAs go through numerous different versions during the drafting process. It can be very unhelpful if a clause in an SPA, refers a different clause in the same SPA, but does not reference the correct clause number, or is referencing a clause that no longer exists, owing to drafting revisions.

In worst-case scenarios, this can make clauses have completely different, unintended meanings, resulting in buyers or sellers being unfairly financially worse off in terms of the consideration ultimately paid.

Post balance sheet events

Problems can arise if SPAs are silent in respect of defining a cut-off date for the admissibility of evidence for consideration, when preparing completion or earn-out accounts.

An example where a cut-off date could have a big impact on consideration due would be the parties becoming aware, after the completion or earn out accounts date, that a key customer, owing significant monies, has gone into administration. Without a defined evidence cut-off date in the SPA, disputes could arise as to whether it is correct to write-off these amounts owed in the completion or earn out accounts.

How we can help

Our experienced Forensic Services Team can assist advising, or acting as an accounting expert witness, for buyers and sellers in respect of completion account, earn-out account and warranty disputes. We can also perform the role of expert in expert determination processes (see our Top 10 tips for a successful expert determination article from earlier in the year).

For further information on our forensics services and how we can help you, please contact Martin Chapman.

Did you know…According to the Office for National Statistics, in the twelve months to 30 September 2023, 1,134 UK companies with a value of £1 million or more were acquired, 851 being acquired by other UK companies and 283 being acquired by foreign companies. |

Let’s start with the ‘fairy-tale’ scenario (a particularly appropriate phrase in the context of this article, as will become clear) that the parties are in complete agreement with the £100 million company value concluded by the forensic accounting expert, in which one of the parties holds a 20% shareholding.

At first glance, you would think 20% of £100 million; the shareholding is worth £20 million (applying a simple pro-rata calculation), but that may not be the case. Often, a ‘minority discount’ would be applied to this £20 million, to reflect that the 20% does not give the shareholder control of the company and the decisions made with regards to, for example, its strategy, investment decisions or its use of profits.

Depending on the circumstances, minority discounts can typically wipe out up to 75% of the pro rata value and this percentage can sometimes be even higher. In the context of this £20 million example, a 75% minority discount reduces the shareholding value to £5 million, so the legal arguments put forward as to whether a minority discount is applicable can make a huge difference.

Majority of the time, for this 20% shareholding to be worth the full £20 million, a judge would have to conclude that the company is a “quasi-partnership”, but in what circumstances can this conclusion be reached…

RM & TM [2020] EWFC 41

Take, for example, the Three Little Pigs and their renowned architectural design empire. Ignoring for a second the multiple accusations of health and safety breaches in the press (apparently straw isn’t a safe building material), using case law from RM & TM [2020] EWFC 41, a judge may conclude that a “quasi-partnership” is in effect:

“These are family businesses. The family is likely to act in concert on major decisions, such as sale…Their personal relationships are strong, with no evidence of major internal disputes or quarrels…This, in my judgement, bears all of the hallmarks of a quasi-partnership and I therefore will not attribute a valuation discount.”

FRB and DCA [No 2] BV17D16308 [2020]

A judge may reach a “quasi-partnership” conclusion in respect of The Seven Dwarfs and their international network of diamond mines. Case law from FRB and DCA [No 2] BV17D16308 [2020] is particularly apt given the dwarfs’ insular operations as a reaction to havoc caused when they temporarily let a certain Ms Snow White into their tight-knit organisation several years prior:

“This is the perfect example of a quasi-partnership to which a discount will not attach. I accept that if an outsider were to buy into one of these companies, he or she would expect a discount, but it is in my judgement inconceivable that any outsider would either be permitted ownership or be interested in acquiring it.”

Clarke and Clarke [2022] EWHC 2698 (Fam)

Finally, we highlight the ‘Bag a Royal’ dating app that is taking the world by storm, the latest in a long line of apps published by the well-known behemoths of software development, Cinderella, and the Fairy Godmother. Clarke and Clarke [2022] EWHC 2698 (Fam) would likely be cited in favour of a “quasi-partnership” in respect of this business:

In his oral evidence Mr Clarke stated that he has been trading with his partner, Mr Shadforth, for many years and he would imagine that they would always take decisions jointly.”

How we can help

As forensic accountants, our fully CPR Part 35 / FDR Part 25 compliant or advisory reports set out company valuations in simple and understandable language, showing both the pro-rata and minority discounted valuation of shareholdings as required. It is the responsibility of the parties’ solicitors to make their respective legal arguments as to whether a “quasi-partnership” is in effect, although we may be asked our opinion on accounting matters that might contribute to the conclusion as to whether there is a “quasi-partnership”.

For further information on our forensics services and how we can help you, please contact Martin Chapman.

Did you know…The largest known divorce settlement in the UK is £554 million, being that ordered to be paid by Sheikh Mohammed bin Rashid Al Maktoum to Princess Haya bint al-Hussein in December 2021. |

In the role as expert witness, every case typically starts with a potential instruction either from a firm of solicitors, a corporate entity, or an individual.

A vital first stage of accepting any instruction is to ensure that you are not compromised in your position whereby you must be, and be seen to be, independent. As such, there should not be any material relationship with the parties involved in the dispute that could create a scenario, whereby it appears you have reason to favour one side or the other. A typical scenario that might exclude you from acting on a matter is where your firm act as auditors for one of the parties, or you are personally connected in some way, in either a current or previous business relationship.

The principal way of checking that you are conflict free is to contact the partners of the firm, and should there be any overseas parties involved, a check will also be extended to overseas network offices. An internal check of your own firm’s database of contacts also helps establish that no conflicts exist.

Alongside this, there are certain cases that may need high level clearance from the firm - normally authorised by a small number of partners and senior management nominated to oversee the process – this would cover cases that might be seen as having a public interest perspective, relate to individuals or countries connected with political or civil unrest and/or the level of fees or amount in dispute makes heightens the risk of accepting the appointment. In these instances, the approval committee’s role is to safeguard the reputation of the firm and consider whether the proposed assignment should be undertaken.

Instructions provided to the expert witness would usually include the scope of work being requested (i.e. the work that is to be delivered), how that will be delivered (most commonly through an expert report compliant with either Part 35 of the Civil Procedure Rules, Part 25 of the Family Procedure Rules or Part 19 of the Criminal Procedure Rules) and will typically include the background to the case and a set of guidelines for reporting experts. It may also, at that stage, set out the court timetable, specifically when the report needs to be filed by, and may additionally include the deadline for any joint meetings and statements with the expert on the other side.

In response, an expert would issue their own terms of engagement which is the contract between them and the instructing party that forms the legal basis under which they will act as expert witness. This sets out which members of the team will work on the case and what their hourly charge out rates will be – where possible, a fixed cost of carrying out the work will be provided or, if the volume of work to be conducted is unclear or subject to variation, the terms might allow for charges to be made on a time basis based on those hourly rates.

The other essential element to an expert’s instructions are the timelines - when their report needs to be filed into court, and the various stages of review along the way that are agreed with the instructing party and may be set out in the terms of engagement.

Terms of engagement will also contain the general terms and conditions of business that apply to that expert’s firm, for any of the services it undertakes as a business and form an important legal part of the overall engagement, providing a safeguard for the commercial interests of the firm. This will also include a clause around the limitation of liability that the firm accepts in respect of the engagement.

Should any dispute take place at a later date – about the nature, scope or cost of the work undertaken - it will be the firm’s engagement terms that will act as evidence and, in that respect, their importance must never be underestimated or compromised.

For further information on our forensics services, and how we can help you, please contact Martin Chapman or your usual Crowe contact for more information.

Did you know…It is always worth knowing other expert witnesses to recommend should any issues arise that prevent your firm accepting instructions to act on a case. |

When working on expert witness forensic cases relating to commercial disputes, there are typically five stages that we could see across the life of that case, as outlined below.

- Our initial instructions and work

Every case will start with a set of instructions, most commonly from a law firm, and occasionally, by a company or individual. Conflict checks are executed first to ensure our independence, money laundering checks undertaken to review the integrity of the party instructing us, and engagement terms drafted to reflect our scope of work.

A meeting will then be held to discuss the availability of financial documentation, the scope of work, and any issues we need to be aware of.

Relevant accounting evidence to support a claim can be identified and advice given on disclosure requests to be made to the other side. -

Investigation and consideration

The substance of our work will involve some form of investigation, research, or analysis, with evidence obtained by reviewing a company or individual’s’ accounting records. Incomplete records might typically require further investigation and explanation.

Information from third parties such as banks, customers and suppliers can be useful third party, independent evidence, which can be reviewed to corroborate information seen elsewhere. Further information and documentation may be sourced from the public domain. -

Expert report

An expert report flows from our substantive work, in which a reporting partner will express a formal opinion. The report must comply with the strict requirements set out in the Civil Procedure Rules (CPR) and will ultimately be disclosed, should a settlement not be reached before trial. It’s vital the report be written from an independent and non-partisan perspective, with the ultimate objective being to assist the court.

Conclusions and opinions should be robust and supported by evidence, able to withstand cross-examination and critical analysis. -

Meeting with the other side

Where an expert is appointed by each side, a meeting of experts might typically be held, and a joint statement prepared to assist the court.

This joint statement summarises areas where the two experts agree, and disagree, providing further analysis where relevant. -

Pre-trial support and attending trial

Pre-trial support might include a conference with counsel, and assistance at mediation, while a trial might see the expert supporting the litigation process at court, by giving evidence in person. A forensic accountant can recommend areas of cross-examination to their side’s barrister, on the accounting evidence and can equally be cross-examined on their own work. The expert’s fundamental responsibility is to the court, and not his instructing solicitors.

How can Crowe help?

As highlighted above, commercial disputes can be a complex process. At Crowe, we have an experienced team of forensic accountants who can provide support at every stage of the process, and provide clear, concise advice.

Did you know…There are standard paragraphs which must be included in an expert witness report and templates for these can be found on The Academy of Experts website. |

Simply put, a business interruption is a period where you cannot conduct business as usual due to an unexpected event. If this event is because of the unlawful act by a third party (e.g., due to a breach of contract) or a force majeure event (e.g., due to natural disasters or pandemics), a business may be entitled to claim for their resulting lost profits.

To explore the challenges forensic accountants, encounter when it comes to quantifying such claims, below I consider the recent plight of Livchester United, the most successful ‘fictitious’ football team in Europe.

The flood

Despite being in the north-west of England, famous for its low rainfall, three years ago Livchester’s Oldfield stadium suffered a catastrophic flood, making Oldfield uninhabitable for a year whilst repairs were made. Thankfully, the club had insurance which covered not only the cost of repair but also facilitated a business interruption claim under the Act of God clauses.

The forensic accounting expert had a straightforward claim to quantify (albeit, evidencing and justifying such claims can sometimes be a challenge) and was able to assess Livchester’s lost profit by:

- assessing the profits Livchester would have achieved, but for the flood, had they continued to play at Oldfield as normal

- subtracting the profits that Livchester achieved during the year when they were thankfully able to groundshare with their archrivals Evchester City at The Goodihad Stadium.

The breach of contract

Having begrudgingly spent a year playing at The Goodihad, Livchester were outraged to find out that their Messaldo Stand (the main spectator stand at Oldfield, named after the club legend and the undisputed greatest player of all time), would not be ready for the contracted repair completion date. Livchester had to spend a further year operating with their ground capacity at only 70% of its maximum.

Again, the forensic accountant was on hand to quantify a business interruption claim, this time against the building contractor that had failed to complete the repairs on time. Whilst conceptually, the quantification was a similar approach as prior, comparing actual profits to a ‘but for the contract breach’ scenario, there were several complex circumstances the forensic accountant had to factor into their calculations:

- the return to Oldfield coincided with when Livchester were due to renegotiate significant sponsorship deals. Livchester’s negotiating position was weakened by the lower stadium capacity, meaning that sponsorship revenues were depressed

- Livchester had taken the repairs as an opportunity to build new corporate facilities in the Messaldo Stand. It was challenging to estimate the profits that these facilities would have achieved, as they had no historical record of success.

The compulsory purchase order (CPO)

As if that was not enough, the day after the Messaldo Stand reopened, Livchester received a CPO on Oldfield, as part of the UK Governments HS10 plan to provide the public with high-speed travel to Lands’ End. They had to relocate and rebuild a new stadium fifty miles away, which was very upsetting for the club and its fanbase, with the only silver lining being that Livchester received significant compensation from the UK Government for losing Oldfield as well as being entitled to the loss of profits from the resulting business interruption.

The complexity of the forensic accountant’s work increased further, having to consider similar issues to before, but also this time factoring in ongoing losses into the future. Livchester’s new stadium had a significantly smaller capacity (losing gate and hospitality receipts) and it lost some of its fanbase due to the geographical move, both of which limited how lucrative future sponsorship contracts would be.

How can Crowe help?

As highlighted in the above scenarios, assessing the quantum in a business interruption case can involve factoring in several complex hypothetical assumptions. As forensic accountants we are used to simplifying complexity, setting out reasoned logical and evidenced opinions and conclusions in a simple and straightforward manner.

For further information on our forensics services and how we can help you, please contact Martin Chapman

Did you know…The Association of British Insurers estimated COVID-19 business interruption claims in 2020 to be circa £2 billion. |

In reviewing a set of accounts in your role as an expert witness, it is often just as illuminating to see what is disclosed in the notes, in addition to the headline numbers contained in the primary statements.

Many notes are required under accounting rules, while some may be disclosed at the discretion of the directors, although a common approach (of private companies, listed company rules are more onerous) is often to disclose less rather than more. Some of the notes that an expert will have an interest in, whether it be for the purposes of a valuation or a loss or profits calculation, include (but are not limited to) some of the following areas.

Directors’ pay

This forms a key part of valuations, with an analysis usually forming part of most experts’ reviews, with a view to assessing whether these payments have been made at market rate or may need adjusting to reflect the true cost to any purchaser of the business – total remuneration is normally disclosed along with what the highest director has been paid – bear in mind a director’s remuneration package might include not only base salary but also bonuses, medical and car benefits, and pension scheme options.

Related companies

Disclosure often needs to be made around which transactions have been conducted with parties who are related and potentially not at arms’ length (i.e. not a sum that would be paid to / received from unrelated third parties), again potentially requiring adjustment in any analysis – a common adjustment is rent payable to a related party that might be understated and not at market rate.

Bank debt

Creditors less than and more than one year, relating to bank loans, will be shown in the notes and is an important part of assessing the debt a company has to service and whether that business relies on its own resources to support its working capital requirements or is more reliant on external funding.

Group control

Normally towards the very back of the notes will be disclosure around who the ultimate parent company is that controls the company, it may be the case that this company is the sole subsidiary of a non-trading holding company, or conversely could be one of many subsidiaries held by a large trading parent company with a wide portfolio of operations.

Post balance sheet events

Accounts are drawn up at a specific point in time, such as 31 March, 31 December etc and include the transactions, and year end balances, for that period (resulting in profit or loss, net assets or net liabilities) including the company’s balance sheet which is a snapshot of its financial position at a particular point in time. However, the accounts for a business are prepared after the period has ended and therefore, between the date of the accounts and the date they are signed off, certain events may take place that need to be disclosed, either because they provide further information about something that occurred during the period, or they represent a fundamental change in the nature, assets or debt of the business that merits reporting. Such an occurrence may be something like the sale (or purchase) of a business in, say July, when the company’s year end was March.

Accounting policies

At the start of the accounting notes will be a summary of the accounting policies adopted by the company – certain accounting standards allow an option (e.g. an asset depreciated on a straight line or reducing balance method) and this can have a material impact on the profits recorded by the business, therefore a good understanding of which accounting policies are applied may help in any analysis of that business. This may be particularly relevant to items such as revenue recognition, or businesses that operate long-term contracts.

Provisions

Many companies will disclose provisions, these are typically the Directors’ assessment of future payments due that are currently quantifiable (but not yet payable), and such a provision may be made in the accounts – such items may include provision for a potential tax charge, the costs of legal action, or non-payment of a material debt – certain provisions might be classified as a ‘contingent’ liability i.e. the profit and loss account won’t be impacted for the period but the nature and/or size of the matter is of such significance that disclosure is made in the notes.

For further information on our forensics services and how we can help you, please contact Paul Burchett.

Did you know…Private companies have nine months to file their accounts following their year end (although special provisions were in place during the COVID pandemic that extended this by a further three months). |

Untangling the knots between two parties at the end of a marriage can be a painful and complicated process. The recent high-profile case, Standish v Standish, has thrown the spotlight on this issue, in the context of matrimonial and non-matrimonial assets, with the importance of the source of wealth being a key battleground between the Parties, as the matter has passed through the High Court, Court of Appeal and UK Supreme Court.

The following fictitious divorce case between Jack and Jill, highlights how different assets and arguments might result in vastly different decisions by the Court, when distributing their wealth.

Jack, being the more eccentric of the parties, owned a 24-carat, bejewelled, solid gold crown (which ironically was once broken during an incident where he and Jill, his then fiancé, fell down a hill). It was straight forward for the Court to determine that this was a non-matrimonial asset to be retained by Jack, as he owned it before the marriage, with the crown just sitting in the attic amongst his equally flamboyant vintage waist coat collection during the course of the marriage. Jack was particularly relieved about this given that the crown had risen in value from £10 million at marriage to £30 million at divorce, thanks to the vast increase in the price of gold bullion since 2008.

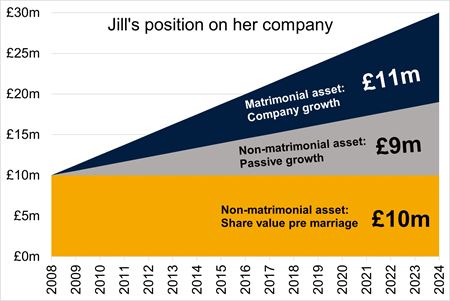

Jill’s situation was more complicated however, as an asset she owned was shares in a bottled spring water company, of which she was the Managing Director (again ironically, the springs’ source is at the top of the hill that Jack and Jill took a tumble down, when the aforementioned crown was broken). Coincidently, the value of her shares in the company had also risen from £10 million at marriage to £30 million at divorce.

Jack argued that all of the growth in the company value since marriage (i.e. £20 million) should be shared equally between the parties, as Jill was only able to build up the company due to their joint, but inevitably different, efforts during their marriage. Jill thought this was incredibly unfair, particularly given the converse position with Jack’s crown where he massively benefited from the passive growth in gold bullion prices without any effort on his part.

Jill argued that some of the growth in the value of the bottled spring water company had happened passively without her efforts. She cited the trend of the increase in value of companies on the London Stock Exchange as evidence that companies are subject to passive growth, in the same way that commodities such as gold bullion are.

Jill calculated that had her company’s value grown inline with London Stock Exchange companies since the marriage, at divorce it would have been worth approximately £19 million; passive growth of £9 million since the £10 million valuation at marriage. Jill’s proposed that only £11 million of her company’s value was a matrimonial asset for sharing between the parties (£30 million company value, less £9 million passive growth, less £10 million pre marriage value).

As the below illustrations demonstrate, the contrasting positions held by the parties in respect of the bottled spring water company, could result in vastly different conclusions as to the value of the ‘matrimonial pot’ to be shared. The opinion of forensic accounting experts could be key to swaying the Court’s verdict on this.

How we can help

As well as providing the ‘usual’ forensic accounting expert witness services in respect of matrimonial matters, such as valuing shares, considering capital extraction from businesses and the corresponding tax implications, we are also comfortable dealing with niche areas that can pop up from time to time, such as passive growth, be that as a single joint expert, party expert or shadow expert.

As an expert witness, the preparation of a report is an important process to assist the Court by summarising findings within your area of expertise. Here are 10 top tips for preparing a good expert witness report.

- The report, if being disclosed in Court, must be compliant with the Civil Procedure Rules (CPR) i.e. compliant with Part 19 (Criminal), Part 25 (Family), or Part 35 (Civil) – this will include such things as including a Statement of Truth, and Declaration of Independence.

- An expert should stick to their field of expertise and not offer advice or opinion on areas outside of this – providing an unqualified opinion on something outside of your immediate expertise only serves to undermine the position of an expert.

- The report should be user friendly – remembering your audience will not necessarily be an expert in the accountancy field. There is often a lot of technical accounting jargon which a Court needs to understand, and sometimes a useful way to communicate this is to include a glossary at the start of the report.

- A good report will “signpost” early on the matters and issues which will be addressed within the report and, for more complex cases, an upfront executive summary may prove beneficial in setting out the conclusions reached, and the opinion of the writer.

- If a report is to include a large amount of tables / analysis, a common approach is to number these to allow quick and easy reference to relevant parts during expert meetings, or in Court procedures. Also consider placing discrete parts into an appendix to make the document more reader friendly.

- Any good expert report should be balanced and not overly weighted to the person instructing or paying them. The Court will give due credit for any points raised that do not necessarily support your instructing party’s case – this makes your report robust, reliable and independent in the eyes of the Court.

- A good report should be the opinion of the person signing it and they should know and understand all details within their report – if elements of the report are ‘over delegated' within the team this can make the expert’s position vulnerable when providing evidence under cross examination.

- A good report “tells the story” i.e. the issue(s) the expert has been instructed to address; the financial evidence that has been available to them; and the expert’s final opinion on the issues, based on the evidence available.

- The report should be clear on the sources of evidence relied upon e.g. company financial data; third party documentary evidence; or reported information from the management of the business – it is important to distinguish between what is the expert’s calculation / opinion, and what is information that has been provided by management.

- If an expert is in doubt as to the reliability of any evidence, they should be prepared to state this and comment that their opinion may change should such evidence turn out to be incorrect, or should further evidence be provided that might lead them to changing their opinion.

If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…The Academy of Experts offers training, including a foundation course which includes report writing. Details of the courses offered can be found here. |

Intellectual property infringements are one of the instances where, as forensic accounting experts, we usually don’t get involved until after liability has already been proven. We are brought into the case knowing there is going to be some kind of award for damages, it’s just a matter of determining how much.

This article examines two of the possible routes that can be taken when quantifying losses, and has been written following a recent case in which Martin Chapman aided his client in receiving a landmark £13.4 million intellectual property infringement damage award, and £900,000 by way of costs (Geofabrics Ltd v Fiberweb Geosynthetics Ltd [2022]1).

Disclaimer: A fictitious case study is used below to demonstrate the possible proceedings following an incident of intellectual property infringement.

We address the case of Rugs Undermining Gravity Limited (“RUG”), a wholesaler of magical flying carpets, having its premier product the FlyRUG, infringed by Making Amazing Threads Limited (“MAT”).

RUG has a key decision to make, with two claim options available to pursue

- Loss of profits: Being the profits that RUG has lost as a result of MAT selling its infringing version of the FlyRUG, the SoarMAT.

- Account of profits: Being the profits that MAT has made as a result of selling the SoarMAT.

n.b. There is a third option available not covered in this article, involving the claiming of royalties.

RUG’s objective is to maximise the damages awarded to them, so what should they do?

Loss of profits

This requires RUG to estimate the additional profits they would have achieved, had the SoarMAT not been available (the “But-for Scenario”). This is where the forensic accountants will come to the fore as they will be able to quantify this, considering for example:

- whether RUG could have charged higher prices

- whether the growth in RUG’s business would have been bigger and / or faster

- how alternative non-infringing products such as the HoverBROOM, would have impacted market share differently.

While inherently complex, this approach has a key benefit for RUG, in that it is the owner of most of the information needed to compile its claim and thus is more able to influence the quantum.

Account of profits

This approach might be used where, for example, MAT is a much bigger brand than RUG and was able to achieve much higher profits than RUG would have been capable of under the but for scenario.

The forensic accountants will be helpful in quantifying these profits, as complex assumptions are involved when assessing which costs (or proportions of costs), are actually attributable to SoarMAT sales. Company overhead apportionment is often a significant battle ground here.

This option can be more straight forward as is based upon what actually happened, rather than the but-for scenario. However, RUG has the disadvantage of not being the owner of the information needed, and is thus reliant on MAT making adequate and accurate financial disclosures. RUG’s forensic accountant can assist in identifying any areas of disclosure that are lacking and critiquing the account of profits presented by MAT, offering their own opinion on quantum.

How we can help

We have a team of experienced Forensic Accounting Experts who are equally comfortable acting for claimant or defendant, providing expert reports and testimony to the Courts. If you would like more information on our services, please get in touch with Martin Chapman.

Did you know…According to an article 2 published by Wolters Kluwer, between 2000 and 2019 there were only four UK patent cases in which damages awards were made by the UK Courts, totalling about €1.6 million. This puts into context the magnitude of the recent £13.4 million award to Geofrabrics Ltd. |

1 https://www.bailii.org/ew/cases/EWHC/Patents/2022/2363.html

2Article published on the Kluwer Patent Blog, dated 13 September 2021, entitled "The Hit Parade of Patent Infringement Damages in Europe: France is Great (Again)" by Matthieu Dhenne, available at: http://patentblog.kluweriplaw.com/2021/09/13/the-hit-parade-of-patent-infringement-damages-in-europe-france-is-great-again/

As an expert witness it is important to demonstrate certain qualities, to assist the Court in making their judgment and to safeguard the reputation of both yourself and your firm. Below is by no means an exhaustive list but includes some of the more important qualities.

Knowing your duty

An expert witness’s overriding duty is to the Court and not the person instructing them or discharging their fees – independence, impartiality and integrity must be maintained notwithstanding any pressure that may come from solicitors, barristers or lay clients to influence your opinion or how the case may be presented.

Consistency

A Court will not look kindly upon any expert that changes their mind all too conveniently, or one that professes a certain approach in one case but then changes that drastically in another matter – if new evidence has arisen a Court will always accept that your opinion may have changed but someone who changes their opinion without due cause will have their credibility quickly undermined.

Fairness

A Court will give more credit to an expert that has considered the facts and evidence of the case without any bias towards his client – one method adopted by many experts is to produce a range of outcomes where the information available to them is not strictly ‘black and white’, providing alternate conclusions based on alternative assumptions. Credit will also be given where the expert accepts and amends their opinion where valid points are made.

Own your report

An expert who puts his name to a report must be mindful that the views and opinions expressed within that report are theirs, and theirs alone – a highly qualified, efficient support team may have assisted in drafting a high quality report but if the expert has not had sufficient input, or gained a detailed understanding on the matter, then their credibility could very quickly be attacked under cross examination.

A good story teller

Give the Court what they need – your accounting input set out in a fashion that sets out the key points, avoids confusing terminology or over complicated calculations, and ‘tells the story’ of what has happened, your opinion, and the key accounting points the Court needs to consider in making its judgement. A Court that doesn’t have to struggle to work out what you have written, and what your opinion is, may assist in seeing your evidence ultimately being favoured.

A good team

Behind every expert is invariably a hard-working team that supports the drafting of the report – ideally the expert will have a team that has a good blend of experience and specialist knowledge that they can draw upon to present the accounting evidence.

Quality

Underlying everything that is produced by the expert witness lies the importance of quality, both from the correct use of basic grammar all the way through to the final opinion you provide. Not only will this assist the Court and reinforce your position as a professional that can be trusted, but it will also see instructing parties refer further work to you.

Timelines

It is important that an expert witness delivers their work to the timelines set by the Court, which includes ensuring sufficient time is set aside for discussions with instructing solicitors and work is appropriately allocated to members of the expert’s team.

Global reach

If you work in a practice that has overseas offices, the option and benefit of having other colleagues from around the globe can assist on cross jurisdiction matters.

Referrals

Finally, a useful quality for any expert witness is to know other experts that cases can be referred to, should the case they have been asked to act on has a conflict to prevent them from acting, or requires a particular specialism which is more suited to another expert.

Further information

If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…Expert witnesses can be subject to personal criticism in judgments made by the Court should the qualities they display fall below the standards expected. |

It is of vital importance, whenever considering making a financial claim in a legal matter, that relevant and sufficient accounting evidence is produced to support that claim.

A recent case

We have recently been involved in a case where the Claimant was seeking to recover damages from former directors of a Company that had been placed into liquidation. There were allegations that the former directors had under declared takings, and retained these personally, rather than recording them within the Company’s accounting records.

HMRC had previously investigated the Company and, at one point, its former advisers had sought to negotiate a settlement of the potential tax liability. The Claimant sought to use this correspondence as its primary evidence to prove that such under declaration of takings had taken place, and consequently the directors should be held to account for this amount of money.

We were instructed by solicitors representing two of the directors, to provide forensic advice, and undertook various exercises to assess whether there was any evidence that there had been an under declaration of takings. The records available to us, however, were very poor and broad brush assumptions had to be made.

This involved a critique of the business economics exercise HMRC had undertaken to create their original estimate of the level of under declaration. Key features included the amount of wastage in the sector and the level of customer complaints and credits/non payment of debts.

The Claimant decided not to adduce expert evidence in relation to demonstrating the alleged under declaration of takings, and proceeded to trial solely on the basis of the documentary evidence they had obtained.

At the Pre-Trial Review, the Judge expressed surprised at the lack of forensic accounting evidence, and, at the hearing, attempted to recreate his best assessment of what appeared to have taken place. It was gratifying to note that the thrust of his analysis mirrored that which we had previously prepared.

Summary

In summary, the Judge found that the Claimant had not discharged the burden of proof to establish that their allegations were properly made out, and awarded significant costs against them.

This case demonstrates the importance of assessing what evidence is required to be collated or adduced, in order to demonstrate that a claim has been properly set out, otherwise the consequences can be both costly and damaging.

Further information

If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…It is often of benefit to approach a forensic accountant early in a case to identify how best to demonstrate the losses arising. |

Back in the day the expression “hired gun” was sometimes levelled at certain expert witnesses (and not just accountants) implying that they were singing to their instructing solicitor’s tune. However, moving into the 21st century and that expression has now thankfully fallen out of parlance. We as forensic accountants, in our role as an expert witness, recognise our duty and responsibilities are to the Court, and not the person instructing us or settling our fees. This can lead to tensions between us and the legal team in terms of their roles as advocates, and us as independent reporting accountants.

But ultimately, when litigation is in full swing, independence is at the heart of all the work we do and reinforces our credibility, being seen as the product of our own opinion based on the financial evidence gathered.

It does, of course, mean taking a strong stance if Counsel or instructing solicitors want you to adopt a particular approach which does not reflect your opinion. Being resilient is vital, both for your own reputation as an expert witness, and also for the legal team and their client, as independent evidence will gain more credibility from the Court than reports that are seen to be unfairly weighted towards the client. There have been several cases in recent years where we have been initially asked to discuss the merits of a claim, very sizeable in many cases, where our independence has led to advice that there is not a claim that can be properly supported, or that the claim as presented is nowhere near as large as initially considered.

Our independence is always checked at the outset through conducting conflict checks to ensure no accusation of bias, or “marking your own homework” can be levelled. For instance, if you are reviewing the accounts of a company that your firm has audited for many years, or reviewing the performance of a company one of your partners may have an interest in, or similar.

Ultimately, the Court wants an Expert Witness to assist the Court by providing a report that makes technical accounting jargon, or rules, easy to understand, provides the Judge with relevant information upon which to base their ruling, and for the report be unhindered unduly by the influence of the clients’ advocates or the parties contesting the litigation. Our duty is to assist the Court, be independent and be seen to be independent, serving as an aide to the Court rather than produce further conflict or confusion.

How we can help

We can help in relation to expert determination proceedings, and have considerable experience both as advisers to the parties, and of acting as the expert determining the dispute. If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…That an Expert Witness’s duty, and responsibility, is to the Court and not the entity instructing or paying them. |

Expert determination is a procedure that involves a dispute, or difference, between two parties which are submitted to one or more experts who make a determination on the matter presented to them. The opinion reached is then binding on the parties, unless they both agree otherwise.

Top 10 tips to consider when carrying out an expert determination

- Do not enter the determination with any pre-determined views. The determination should be established based on the evidence produced and your opinion based on the facts and figures presented by the parties.

- At the outset, agree whether the determination should be ‘speaking’ or ‘non-speaking’. A ‘speaking’ report is set out in traditional format, with full details supporting your final opinion. A ‘non-speaking’ report means you show only your final opinion (i.e. ‘the shares are worth £x’), with no detail provided and no reasons given for that opinion – a ‘non-speaking’ approach can often be advantageous in bringing closure to a case for the parties without the need for protracted argument.

- Gain a good understanding of the underlying issue and the respective positions of the parties, it is also useful to know the source of information that the parties have used. For example, have they relied on management, draft or final audited accounts?

- Ensure the parties are fully briefed on the determination procedure and the process that will unwind in respect of when submissions are due. A timetable helps the parties plan and to move on with their existing businesses.

- Make sure the parties understand how many rounds of submissions will be made (normally two) and what they can, and can’t, comment upon – at some point representations must close and the parties thereafter should not be allowed to make further comment unless specifically requested by the expert.

- Allow each party to have the opportunity to make its fullest representations, ultimately a fair determination can only be reached based on full and open submissions made by the parties.

- Gaining third party evidence (to inform further on a certain industry, economic trend etc) may provide valuable additional information that either corroborates information submitted, or supplements it, and can provide valuable independent evidence.

- If required, seek additional legal advice to advise on matters such as shareholder agreement definitions, or other important legal angles.

- Determinations typically involve two rounds of submissions, and therefore a natural delay will take place, it is therefore important to schedule the work alongside other case matters, to enable work to flow smoothly and efficiently.

- Make sure the parties do not stray from the issues at hand and their submissions are focused at addressing the core argument, or dispute.

If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…An expert determination is usually quicker, cheaper and less formal than arbitration or litigation. |

Forensic accountants are often instructed on professional negligence disputes.

In professional negligence cases the defendant may be a firm of solicitors, accountants, or architects that have previously provided some form of advice or work which is now alleged to have been below the standard expected, causing a financial loss.

The claimant must prove three areas:

- that a duty of care was initially owed by the defendant

- that duty of care was breached

- that breach was the cause of loss to the claimant.

The latter is a crucial part in any professional negligence claim as unless a direct correlation can be made between the negligent advice/work and any resulting loss, a Court is unlikely to find in favour of the claimant.

Our work and how we can help

There are two broad alternate aspects to any work we undertake – firstly reviewing the work undertaken by an accounting professional to identify whether it has been performed in an acceptable manner, or secondly reviewing the claim on the assumption that work was negligent but being instructed to assess any loss arising.

The test for professional negligence (e.g. an accountant) is fundamentally what you would expect a reasonably competent accountant to have done based on the accounting and auditing standards, generally accepted accounting principles, and practices that were in place at that time. It is not the case that you are giving an opinion on what you would have done at the time but rather, from your experience of conducting similar work and familiarity with other accountants’ work, whether you consider the defendant has carried out their work to a reasonable standard.

As the expert witness must have relevant contemporaneous experience, our forensic team will frequently work alongside experts from other disciplines within our firm to provide a seamless service.

In terms of any resulting award made by the Court, the defendant professional will usually carry insurance against such claims being brought against them and that insurance company will make the funding decision as to the appointment of an expert witness to prepare a report, based upon advice provided by the defendant’s solicitors. The financial consequences of a claim will depend upon the impact on the claimant’s business, but will frequently be assessed in the same manner as a loss of profit or business interruption claim.

Further information

If you would like more information on our expert witness service please contact Martin Chapman.

Did you know…Professional negligence is when a professional fails to perform their responsibilities to the required standard or breaches a duty of care, which results in financial loss, physical damage, or injury to a client / customer. |

There are various traits that are important to possess to enable you to represent your client in expert witness work. More importantly, the skillset is needed to deliver your prime responsibilities to the court, and ultimately lead to a fair assessment upon which the Court can make their judicial decision.

In years gone by, there was an overwhelming feeling - that ultimately led to reform - that experts were often regarded by those instructing them as ‘hired guns’, making the evidence fit the conclusion that would best assist their clients.

So what does it require to be an expert witness?

Our overriding duty is to the Court, and not the party instructing or paying us. Ultimately, we must maintain our independence notwithstanding any pressures exerted either from solicitors or lay clients. There have been various cases we have been instructed on where we have had to tell our solicitors – “sorry, but your case can’t be supported on the evidence available”, this is not what the solicitors or client may necessarily want to hear but to avoid such a conversation would be to undermine your own opinion and work.