The Nature and Extent of Pensions Fraud

The latest data valuing the level of fraud in the UK pension sector

For the first time, we are able to provide a realistic estimate for the impact of fraud on the UK pension sector. Our report discusses the ways in which the pension industry is vulnerable to malicious cybercrime attacks and fraud attempts from both internal and external parties, and puts a value to it.

While there is a vast honest majority in this sector, like in other sectors there is also a small dishonest minority and that minority can cause serious damage.

Download our full report for the key steps towards better protection.

Key highlights:

- Since 2009, losses owing to fraud have risen by over 55%.

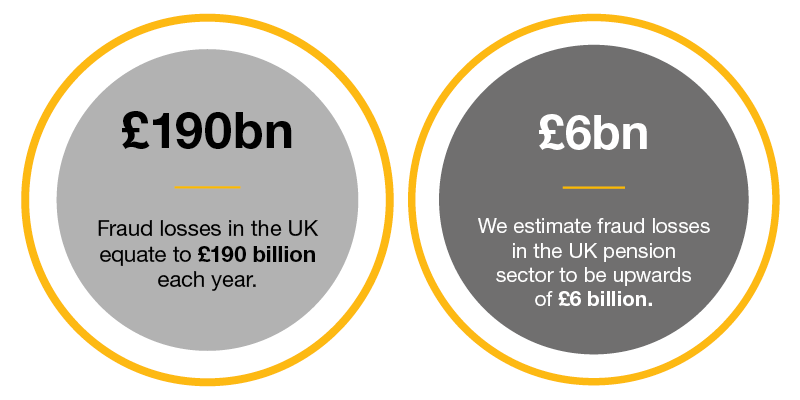

- Fraud losses in the UK equate to £190 billion each year.

- We estimate fraud losses in the UK pension sector to have reached £6 billion.

- Organisations should expect losses attributed to fraud to account for 3-6%.

The pensions sector remains at critical risk to fraud, given the scale, sum and diversity of investments pension schemes are responsible for, combined with counter fraud and cybercrime processes which are not yet fully adapted to very rapidly evolving threats.

The report specifically looks at UK based pension schemes and provides real life case studies which highlight areas where fraud can occur, such as:

|

|

Fraud against pension schemes is serious because of both its scale and impact. A greater understanding of the real financial cost of fraud will drive further and faster progress in ensuring that pension schemes are properly protected.

It is time for the pension industry to review whether it is doing enough. Think of the extensive protection the banking sector places around comparatively small sums held in current accounts versus the less extensive protection around much larger sums in pension pots. This simply does not add up. There are gaps in the resilience of pension schemes and their administrators to fraud and cybercrime. The sector must come together to drive up standards of awareness and preparedness.

Download The Nature and Extent of Pensions Fraud

Please complete the fields to receive the full download of our report.

Thank you for your interest in our report.

Download 'The Nature and Extent of Pensions Fraud' [pdf]

Crowe take data protection extremely seriously; we will never provide your details to any third party. View our full Privacy Policy.

Contact us