Where will the world of Sustainability be in 2030?

Through our ongoing work exploring developments in sustainability over the past 18 months in particular, we have to recognise that it has been a period of rapid change, with multiple new regulatory requirements and a fast-maturing landscape for financial services firms.

Now is the time to take a step back and think more strategically. What could this landscape look like by 2030? It is often the case that firms have set short-term targets around various aspects of sustainability performance improvements to be delivered by the end of the decade. However, often strategic efficiencies can be overlooked, especially when reporting against or aligning to different sustainability frameworks.

Let’s think forward and then plan backwards. What should sustainability managers and their executive teams be prioritising in 2026 to build a strong platform for the anticipated future? What no-regrets investments are needed now, and what can wait?

Sustainability expectations are moving rapidly despite geopolitical headwinds

2024 and 2025 have seen a significant set of changes in global sustainability standards.

- The International Sustainability Standards Board’s (ISSB) IFRS S1 (Sustainability) and IFRS S2 (Climate) standards came into effect from 1 January 2024, subject to national adoption.

- The European Union implemented its broad Corporate Sustainability Reporting Directive, which applied in phases, starting with public interest entities and then large private entities in the second phase. Many firms were engaged in double material assessments and gap analyses through 2024, only to find the goal posts moved by the Omnibus review in early 2025. Reporting is expected to resume in 2027 and be subject to independent limited assurance.

- Across different jurisdictions, prudential regulators are tightening the expectations on banks and insurers, not least the Prudential Regulation Authority Consultation P 10/25, reviewing its earlier Supervisory Statement SS 3/19 on climate risk management. Regulators in a number of jurisdictions, including Switzerland, Canada, Australia, Bermuda and Singapore, are undertaking similar exercises on various timelines. These are also starting to require disclosures related to Nature and Biodiversity.

- In the UK, the government signalled adoption of IFRS standards in the form of UK Sustainability Reporting Standards (UK SRS), but the consultation was delayed until the second half of 2025. It is expected that these standards will replace the current Taskforce for Climate-related Financial Disclosure requirements on large and listed firms from the end of 2026.

- A second government consultation, involving the adoption of the Transition Plan Taskforce recommendations to require large and listed firms to publish a detailed net zero pathway document. Finally, the United Kingdom Government Department for Business and Trade launched a consultation on establishing an oversight regime for sustainability assurance in June 2025. The proposals foresee the eventual introduction of mandatory assurance over disclosures against the UK SRS, which could be expected to take effect from the end of 2027.

What might expectations of UK-based financial services look like by 2030?

Many firms are ‘in the trenches’ responding to each additional external expectation, sequentially. However, strategic planning requires a long-term view to be taken so that the whole picture of what expectations on financial services based in the UK might look like by 2030.

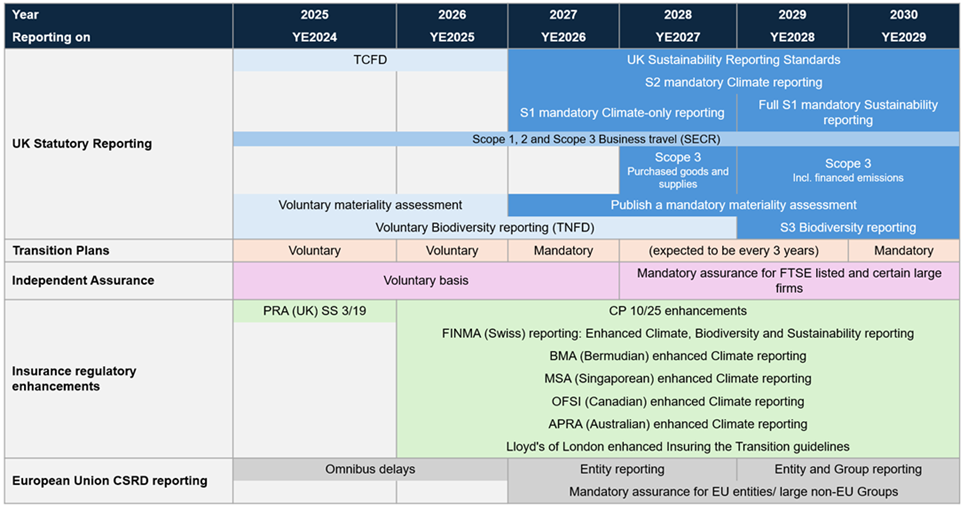

Allowing for a little speculation on when certain items might land, or what size of firms they might affect, we have drawn up a typical route map of what to expect in Figure 1. This can be used to recognise that a holistic view is needed, especially when it comes to decisions around operating models or investments in reporting tools and systems. Sustainability initiatives may be a driver to make the case for investments in automation and artificial intelligence, alongside other business cases.

One can immediately see that there is a complex, interconnected infrastructure with several opportunities for synergies and tackling key processes in a coordinated manner across a group.

Figure 1 – What a route map to 2030 could look for a typical international financial services group.

What practical steps should organisations take now?

The key features of this future landscape are likely to include the following.

- Meeting requirements driven by statutory financial reporting as well as sector regulatory expectations.

- Broadening of climate-related reporting and regulations to cover wider sustainability requirements, initially covering biodiversity, but expected to extend to social factors.

- Transition Plan reports requiring consistent monitoring of progress against public commitments.

- Increasingly, disclosures will be subject to independent external assurance.

- So, what does this mean for your planning in 2026? We have identified six no-regret actions that organisations can take to future-proof their sustainability programmes.

It is important to consider how the firm is organised to deliver this suite of requirements. Does the business have the right level and type of resources, and are functions organised across the business with smooth business processes, clear ownership and effective controls? This process may lead to changes in resourcing types and restructuring of functional reporting lines.

Our Operating Model survey has seen a shift towards a hybrid model, a small central sustainability function and teams embedded within other functions and business units, with growth in particular within the financial reporting team.

As sustainability requirements become more formalised and mature, annual reporting requirements are increasing. This requires greater coordination across different types of disclosures within complex organisations. Many clients are now starting to invest in software systems to help capture, manage and in some cases, automate reporting procedures.

Within five years, we expect organisations to face multiple disclosures, including voluntary schemes, with growing expectations for independent verification to a limited assurance standard. Effective assurance relies on the organisation having documented policies, procedures and methodologies that systematically describe how sustainability information is captured and managed. A credible audit trail from source to disclosure is also essential to demonstrate reliability. Meeting these expectations will require strong governance, effective process controls and an appropriate level of automation.

What we have described is a significant level of change within the sustainability space, with continuous enhancement over the next five years. It is important to ensure that the board and executive leadership are aware of the implications and that they have their expectations actively managed around what it takes to prepare the organisation effectively. Some organisations may choose to provide regular education sessions for the board, while others might establish a steering committee in place to ensure cross-functional oversight of the sustainability programme.

Clearly articulating a holistic view of what lies ahead, across what is for many organisations the strategic planning horizon, helps ensure resources are allocated appropriately and governance structures are in place to guide and monitor progress. Management teams often welcomes this proactive approach.

Only time will tell if our predictions are accurate. However, firms would benefit from having a roadmap and taking control of their sustainability strategy and operating model, rather than allowing themselves to be buffeted by external changes.

Planning for 2030 starts now

The sustainability landscape is evolving rapidly for financial services firms. By 2030, expectations will likely look very different. Now is the time to take a holistic view of your strategy, plans, capabilities and resources. A helpful approach is to lay out a long-term route map that can be built out and matured over time, to ensure it is appropriately integrated into business activities.

Crowe’s experienced team continues to support clients in setting their own agenda and responding confidently to rapidly changing sustainability expectations.

If you would like to discuss how we can help your organisation prepare for what’s ahead, please get in touch.

Contact us

Insights