Embedding sustainability

Seven key insights from our sustainability survey

In November and December 2023, we completed a survey to understand the ‘state of play’ with respect to sustainability within the UK and Bermudian insurance and reinsurance markets. In this first of a series of articles, we explore the progress being made on integrating sustainability into key business activities, draw out seven key insights and set out the challenges and tips for 2024. Our subsequent articles will explore the governance and operating model aspects of our survey findings.

In our recent article on sustainability operating models, we outlined the need for organisations to have a clear philosophy which links sustainability to purpose and profit. We noted that many insurers were still grappling with this, and our recent survey provides valuable market insight on how well insurers are progressing in embedding sustainability.

There was great interest in the survey, with several respondents asking for feedback sessions. This targeted survey captured views from sustainability and climate risk teams and had a 45% response rate. 55% of respondents were from the general insurance sector, with the remainder being reinsurers and life or health insurers. Organisation size was split evenly between large organisations (over 1000 employees) and smaller companies. 62% of organisations were based in the United Kingdom, 22% in Bermuda and remainder in Continental Europe.

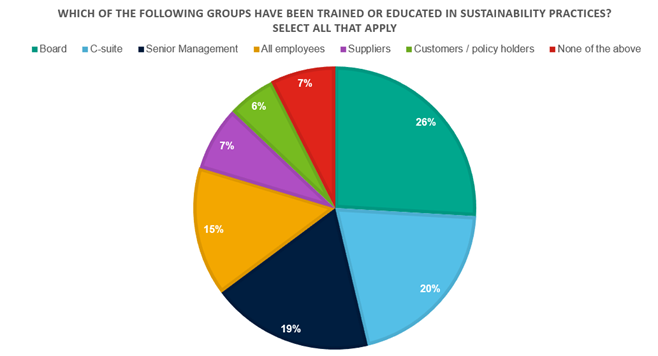

Training and education appear to have been more senior leadership focused (figure 1).

On the one hand, this is positive, especially when the board and management team take ownership and show leadership. However, implementation across organisations and out to customers, suppliers and clients remains a work-in-progress.

Progress in embedding sustainability will lag, especially where the rank-and-file employees are not aware of the organisation’s sustainability philosophy, goals, or objectives and their potential role and contribution.

Figure 1 – Rollout of training and education

The level of integration of sustainability is highest in risk management and investments (figure 2).

This makes sense given the significant regulatory and reporting pressure in the UK and Bermudian markets. The relative maturity of the asset management industry presents an opportunity for investment functions within insurers to draw on this expertise to advance their understanding of environmental social and governance (ESG) exposures.

Figure 2 – Extent of functional embedding of sustainability

Many organisations appear to have built their programmes bottom-up (figure 3), with many having energy efficiency, procurement, investment, and community-related policies.

Considerably less have an overarching sustainability policy in place. Again, integrating sustainability into the core business remains a work-in-progress with product innovation and underwriting programmes lagging in other areas.

Figure 3 – Extent of embedding into policy frameworks

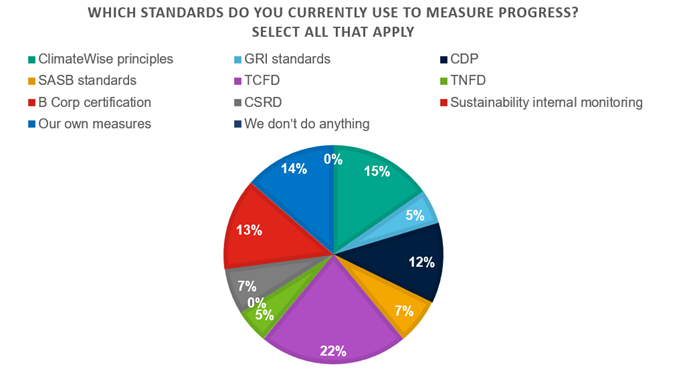

There is limited agreement of how to use external standards to measure progress across sustainability programmes (figure 4).

Task Force on Climate-Related Financial Disclosures (TCFD) remains the leading climate-related gold standard, with ClimateWise being a popular industry-benchmark, in itself currently aligned to TCFD. A significant proportion of organisations are using their own, internally developed measures, to monitor progress. We fully anticipate this picture changing over the next 18 months as both the IFRS and Corporate Sustainability Reporting Directive (CSRD) reporting frameworks gain traction.

As these two new frameworks claim inter-operability, it might finally be possible to obtain a clear view of maturity across the industry as whole.

Figure 4 – Use of external standards to measure progress.

Sponsorship - Over half respondents identified the primary challenge as internal engagement and management buy-in to the sustainability change programme.

Leaders have many challenges in steering their organisations and it is not always obvious how sustainability contributes to success.

Making a strong commercial case for how sustainability is an enabler and not purely a reporting requirement is important to securing and retaining the sponsorship required to overcome the challenges ahead.

Quotes from respondents included:“Reluctance for top executive buy-in for new initiatives unless it is required by regulations.” "Cross-functional buy-in and engagement to embed initiatives and accountability.” “Cultural change takes time.” |

Talent - The second key challenge was being able to hire the right talent to drive the change programme once sponsorship was in place.

Many survey respondents reported challenges with securing sufficient talent with the right skills.

Given that sustainability is a relatively new discipline within the financial services sector, employees with the technical knowledge, sector experience and interpersonal skills required to engage with leadership and drive a change management programme are in very short supply. Candidates typically have multiple offers and so being able position the organisation’s ambitions effectively, is key to coming across attractive.

Supply chain - The third challenge quoted was putting in place effective processes for working with third parties, such as suppliers, coverholders and outsourced partners to be able to understand and manage their extended value chain climate and human rights related exposures.

Top tips on how to respond to the evolving landscape

Sustainability is still relatively new to many organisations and therefore remains a compelling need to articulate your organisation’s story. This narrative needs to speak to your key audiences including employees, investors, clients, and the board. Unfortunately, sustainability initiatives can often be reactive, responding to commercial or regulatory pressure. The rationale for action is, protect the licence to operate but nothing more.

Having a clear narrative frames many discussions that result from our survey findings in terms of the objectives of the programme, the rationale for investment, and the scope of what sustainability means within your business. Getting this right early on, allows everyone to rally round a clear goal and feel good about the progress being made.

Our point of view is that implementing a sustainability strategy, although it does involve several technical challenges, is primarily a change management exercise.

The implications of this are that all the lessons from other change management initiatives should be taken on board from the onset, in terms of making sure there is clear scope and objectives and that key internal and external stakeholders are identified early. It can be surprising to many, how long it can take to get everyone on board with the ‘why’ and ‘how’ of the change. Too much focus on the ‘what’, may lead to misleadingly fast progress over the initial stages, only for implementation to hit a roadblock when those stakeholders wake up to the full implications of what they have signed up to.

Based on market conditions, many organisations are faced with a choice between hiring or developing their own talent. Like any in-demand finite talent pool, such as capital actuaries during Solvency II, salary packages become inflated, and hiring managers run the risk of feeling that they are paying high salaries without securing the ‘finished product’ in terms of the teams they hire.

Our view is that the solution will be a blend of two solutions.

Firstly, companies should broaden their search and bring in sustainability specialists from other sectors, such as manufacturing or retail, attracted by the stronger regulatory framework and remuneration.

Secondly, we are seeing young professionals, particularly those with underwriting or finance backgrounds, with a passion for sustainability and are seeking to transition to organisations that prioritise sustainability. In either situation, continuing to investment in their professional development and qualifications will be key to getting the right set of skills and building a successful team that stays together to deliver the strategy.

Clearly embedding sustainability into the management of third parties is a key challenge for 2024. Involve the procurement and work closely with them is a theme that keeps coming up as a result of a number of regulatory and market initiatives, including Taskforce on Nature-related Financial Disclosures TNFD, Corporate Social Responsibility Due Diligence Director (CSRDDD) and CSRD.

There are increasingly high expectations being set for vendor due diligence and the need to capture information from suppliers on their sustainability performance and improvement plans. Without a robust means of capturing and processing information from suppliers, it may be challenging to continue to meet external expectations.

2024 is a key year for many organisations in terms of integrating sustainability into core business activities, such as underwriting and new product development. While the survey is now closed, please contact us if you would like to understand how you compare to our respondents.

At Crowe, we support our client’s sustainability journeys by:

- providing clarity on where you are against current market and industry practices and how to close the gap

- providing training and education across all levels of your organisation

- advising on how to resource and structure sustainability functions based on your sustainability strategy and ambition

- working with you to implement and embed climate risk and sustainability factors into your strategy, operational, technology, procurement, people, and cultural practices

- Support you to execute and deliver successful embedded sustainability initiatives.

Please contact Alex Hindson, Buki Obayiuwana, or your usual Crowe contact for more information.

Insights

Contact us