Transition planning

Actioning your ambition

Financial services firms’ focus on sustainability has increased significantly since the Paris Agreement began driving a greater level of global and national action on climate change. But progress has certainly been incremental, with the majority of focus on still improving understanding of climate-related risks and emissions reduction.

Many insurers have developed Net Zero strategies and set decarbonisation targets, as well as adopted industry-recognised disclosure frameworks.

This focus has expanded in recent years to include a wider set of sustainability-related issues, in particular, nature and biodiversity, and social factors. Although the emphasis has been on what firms aim to achieve rather than how they’ll get there, we’ve also seen a trend toward more practical action, which is where robust and credible transition plans can add genuine value.

What is a transition plan?

A transition plan is a forward-looking, time-bound roadmap that outlines how an organisation will adapt its business to manage climate-related risks and opportunities, and to limit and mitigate the impact of its business and its value chain. The focus of much of the available guidance around transition plans, included by the Transition Plan Taskforce (TPT), is on environmental issues, but they can be applied to support a wider sustainability agenda.

Good transition plans focus on clear actions. They define the tangible steps an organisation will take towards its overall targets, goals, or objectives, assign responsibility for their delivery, and establish effective mechanisms for monitoring progress and staying the course, supported by well-defined and established governance and accountability.

Transition Plan Taskforce and regulatory timelines

The TPT released its Disclosure Framework in late 2023, followed by sector-specific guidance in 2024. The expectation is based on communication by the Financial Conduct Authority and the government that the TPT recommendations will be incorporated into the new UK Sustainability Reporting Standards, due to be released in the middle of 2025. This is consistent with other regulatory reviews being undertaken by the Prudential Regulation Authority.

In addition, the Climate Financial Risk Forum is also considering developing materials on Transition Finance, alongside the key themes for the year, adaptation and climate financial resilience (nature and short-term scenarios). Lloyd’s of London is expected to act on these developments, building on their Insuring the Transition Roadmap. This could include requiring managing agents to publish credible plans and integrate climate into underwriting and investment decisions.

The European Union (EU) initially set high expectations with the shortest deadline, by expecting to disclose detailed transition plans under the Corporate Sustainability Reporting Directive. The recent EU Omnibus proposal, however, has signalled a ‘slow down’ and likely changes to requirements for a lot of companies. In other jurisdictions, such as Switzerland, mandatory transition plans are moving forward.

Components of a transition plan

The TPT Framework aligns to existing standards and initiatives – including the Taskforce on Climate-related Financial Disclosures, the International Financial Reporting Standards Sustainability Disclosure Standards (S1 and S2), and the Glasgow Financial Alliance for Net Zero – in offering a structure for what a good transition plan should contain. It rests on three core principles with the following components.

Ambition clearly articulated

- Strategic ambition in driving all the activities.

- Implications of the strategic ambition on the business model and value chain.

- Key assumptions and external factors on which the transition plan depends.

Action in the form of a roadmap for delivery across short, medium, and long term

- Implementation strategy covering the direct and tangible actions that are being undertaken or planned, across products and services, policies and conditions, and financial planning, to achieve its strategic ambition.

- Engagement strategy describing the engagement activities with the value chain, industry, and government, public sector, and civil society, that are being undertaken or planned, in order to achieve its strategic ambition.

Accountability to ensure oversight and integration

- Metrics and targets set drive and monitor progress towards its strategic ambition.

- Governance structures and organisational arrangements are put in place to embed the transition plan.

A transition plan should align with business strategy and planning, and link to and inform decision making in respect of portfolio management and risk selection, asset allocation and investment decisions, product development, and capital expenditure.

This isn’t starting from scratch

We often hear that firms are reticent to continue to add artefacts to an already long list of sustainability disclosures. We see developing transition plans as an opportunity to simplify and streamline the sustainability reporting framework.

Most organisations are already taking action and have many of the elements of a transition plan in place, such as strategy, targets, and certain metrics. However, for most, this is not joined up. There is a lack of clarity between the actions taken and how these contribute to delivering the strategy. Monitoring of progress is often also still immature.

By breaking down high-level ambitions and targets into manageable actions, firms can demonstrate more clearly how they will deliver, but also understand where their greatest levers for impact lie.

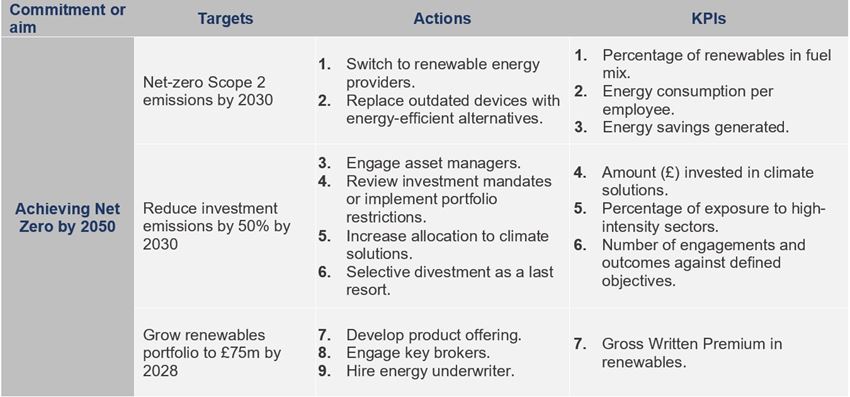

The table below shows a simple example of how an ambition can be translated into targets, actions, and key performance indicators (KPIs).

What lessons can we learn from work to date?

- Use what you already have – For most companies, developing a transition plan doesn’t mean starting from scratch. By pulling together various threads and getting clear on the actions, you can simplify your approach and focus your efforts.

- Focus on the most material areas – Prioritise material actions in line with business priorities and where you can have the greatest impact.

- Engage subject matter experts across the business – Involving the business will ensure the activities are practical and will help establish much needed buy-in.

- Assign ownership for actions – Ensure governance structures in place to oversee delivery are well established and that accountability and responsibilities are understood.

- Don’t let perfection get in the way of progress – Planned actions and mechanisms to implement them should be realistic, but it’s often the case that the intended outcomes will be achieved in stages.

Implementing effective transition plans for Net Zero success

Transition plans can help organisations to think through how they will deliver on their goals and targets. As regulators, investors, clients, and employees increasingly scrutinise how Net Zero ambitions are being implemented in practice, firms that can demonstrate a clear and integrated plan will be better positioned to respond to evolving risks and capture opportunities, as well as meet diverse stakeholder expectations.

Whether you’re just starting your transition plan, want to understand your gaps, embed your transition plan, or look to develop a transition planning review framework, contact Alex Hindson or your usual Crowe contact for more information or support.

Contact us

Insights