LEAP-ing your environmental strategy forward by integrating nature

Insurers and financial institutions understand that nature is an emerging issue, with increasing potential regulatory requirements, reputational focus, and financial risk. Additionally, there is an increasing realisation that an effective and truly credible climate strategy cannot consider nature. Even so, climate change, without nature considerations, is still at the forefront of environmental strategies.

Previously, we explored how organisations can assess their nature and biodiversity-related Dependencies, Impacts, Risks, and Opportunities (DIROs). For financial institutions, however, integrating nature-related considerations into climate strategies presents challenges. A primary barrier is that most DIROs are embedded within underwriting and investment portfolios, making them less visible and harder to manage directly. This raises important considerations:

- Are current due diligence processes sufficient to identify exposure to biodiversity-sensitive areas and thus reputational risk?

- Are underwriting models evolving to reflect the increasing severity and frequency of nature-related claims?

- Are you maximising opportunities to innovate by developing products and services that not only mitigate nature-related risks but also contribute to positive environmental outcomes?

Use existing processes and frameworks

Effectively managing nature-related DIROs does not mean reinventing the wheel. Organisations can leverage existing frameworks and processes to embed nature considerations into their broader environmental and risk management strategies. To help address these challenges and unlock opportunities, we propose integrating nature-related considerations into the following existing frameworks:

Nature should be included within your DMA. This not only means evaluating how nature impacts your organisation financially, but also how your activities affect nature and biodiversity. A robust DMA should encompass the entire value chain - including underwriting and investments - and consider a wide range of potential DIROs.

Nature-related risks and opportunities should be managed through your existing enterprise risk management (ERM) framework. This involves identifying relevant DIROs, assessing them based on likelihood and magnitude, and prioritising them according to your organisation’s materiality thresholds. While the overall process remains consistent, identifying nature-specific IROs may require additional nuance. However, internationally recognised frameworks exist to support organisations. We recommend using the LEAP approach (Locate, Evaluate, Assess, Prepare) as outlined in our previous article, to guide this process. Organisations must focus on what is material, but maintain visibility on any emerging risks.

Nature-related risks can, and should, be incorporated into climate scenario analysis (CSA). The amount of detail and integration of nature within your CSAs should be proportionate to how material the risks are, as evaluated through the risk assessment process. CSA can also help to inform these assessments to enhance accuracy. At a minimum, nature should be considered in scenarios where it has the greatest impact: CSAs used to inform the risk identification and assessment processes and CSAs involving forest fires, drought or flooding should explicitly account for nature-related drivers and consequences.

Nature underpins climate mitigation and transition planning. Healthy ecosystems are vital for net zero as they absorb carbon and regulate temperature. As such, protecting and restoring nature is essential to any credible transition plan. The Transition Plan Taskforce (TPT) definition of a transition plan already includes the need to protect and restore nature. Furthermore, the UK Government has been seeking feedback on whether nature should be included alongside climate considerations. Governments, regulators, and standard setters are waking up to the fact that a credible transition plan includes nature and organisations should act early and integrate it now.

One of the most significant challenges in managing nature-related DIROs is the availability and quality of data. Most organisations are unlikely to have robust, accessible, and nature-specific data readily available for analysis. For instance, nature-related assessments often require location-specific information - something not typically captured in standard due diligence or client onboarding processes. This challenge is not unique to nature; it mirrors broader climate data issues, such as the need for more granular emissions data to support accurate carbon accounting. As such, nature-related data should be incorporated into existing data improvement strategies. This includes engaging with stakeholders across the value.

One area where organisations may have to start from scratch is building a suitable suite of tangible metrics and KPIs that are simple to monitor and report. Unlike climate, where CO₂ is a unified metric, nature and biodiversity has a complex range of different indicators and metrics, reflecting the complexity of different ecosystems. Developing KPIs, baselines, and credible transition pathways for nature will take time and careful consideration.

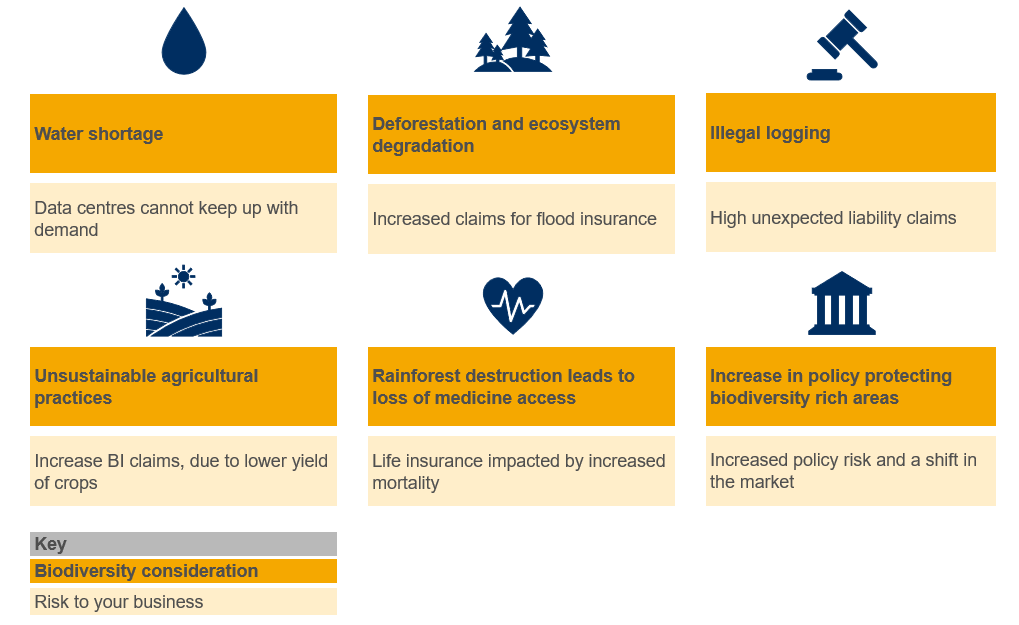

Examples of nature-related risks for financial institutions

Integrating nature into strategy secures long-term business value

Nature and biodiversity risks are not future issues, they represent current material business impacts that demand strategic attention. As regulatory expectations evolve and ecosystems face increasing pressure, organisations that act early will be better positioned to manage risks and maximise opportunities. By adopting a materiality-led approach and embedding nature-related considerations into existing frameworks, organisations can build a robust and actionable strategy. The time to act is now, aligning nature and climate strategies will not only strengthen resilience but also unlock long-term value.

Through our practical and experienced team, our Consulting team continues to support our clients in setting their own agenda to address rapidly changing sustainability and climate-related requirements.

Please contact your usual Crowe contact for more information.

Contact us

Insights