Tax Penalties - A Necessary Evil

For most governments around the world, tax collections contribute heavily towards the country’s revenue. The same applies to Malaysia which has seen a steady increase in tax collections over the past few years despite economic disruptors such as the Covid-19 pandemic.

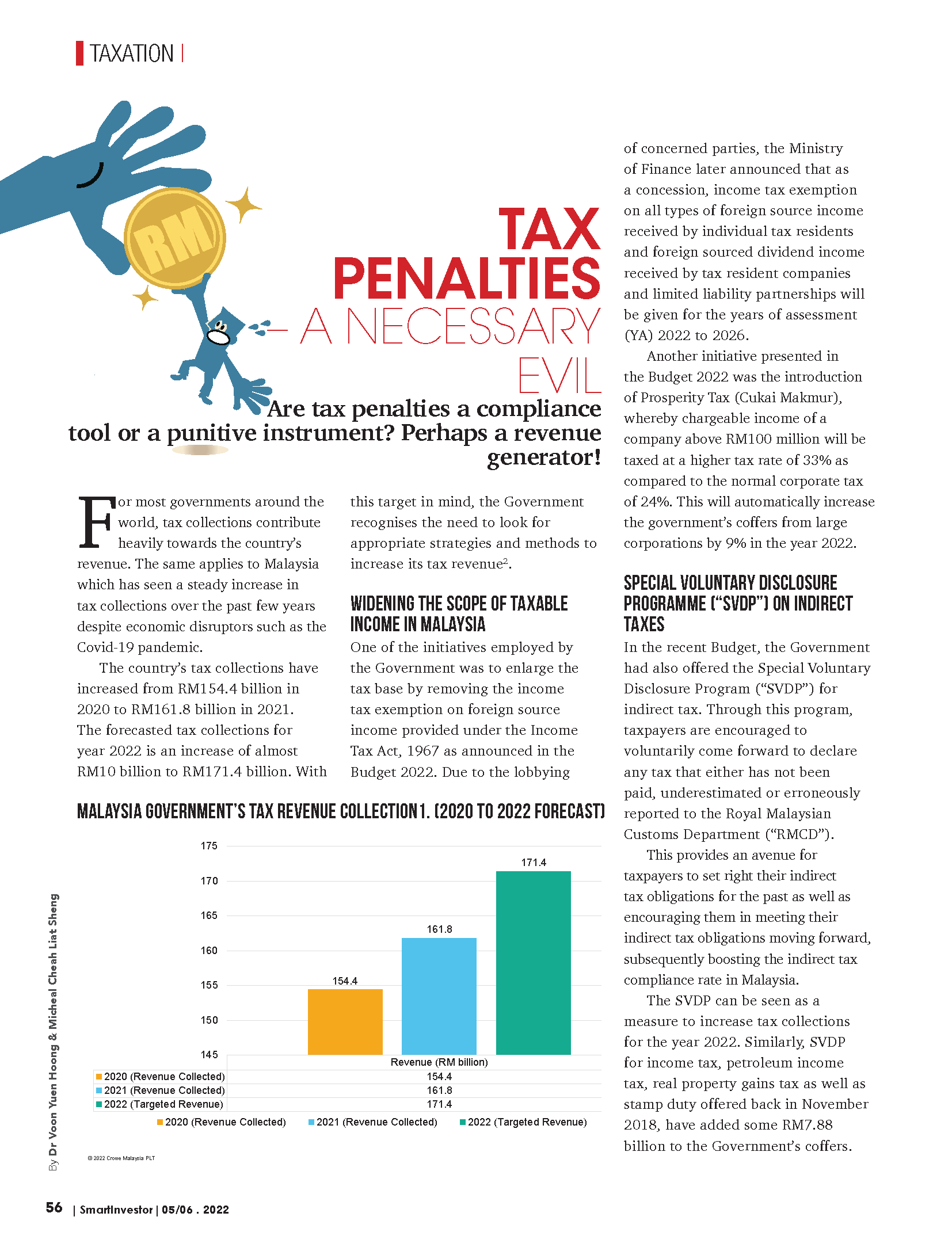

The country’s tax collections have increased from RM154.4 billion in 2020 to RM161.8 billion in 2021. The forecasted tax collections for year 2022 is an increase of almost RM10 billion to RM171.4 billion. With this target in mind, the Government recognises the need to look for appropriate strategies and methods to increase its tax revenue.

This article was first published in the Smart Investor (May/Jun 2022) issue.

Widening the Scope of Taxable Income in Malaysia

One of the initiatives employed by the Government was to enlarge the tax base by removing the income tax exemption on foreign source income provided under the Income Tax Act, 1967 as announced in the Budget 2022. Due to the lobbying of concerned parties, the Ministry of Finance later announced that as a concession, income tax exemption on all types of foreign source income received by individual tax residents and foreign sourced dividend income received by tax resident companies and limited liability partnerships will be given for the years of assessment (YA) 2022 to 2026.

Another initiative presented in the Budget 2022 was the introduction of Prosperity Tax (Cukai Makmur), whereby chargeable income of a company above RM100 million will be taxed at a higher tax rate of 33% as compared to the normal corporate tax of 24%. This will automatically increase the government’s coffers from large corporations by 9% in the year 2022.

Special Voluntary Disclosure Programme (“SVDP”) on Indirect Taxes

In the recent Budget, the Government had also offered the Special Voluntary Disclosure Program (“SVDP”) for indirect tax. Through this program, taxpayers are encouraged to voluntarily come forward to declare any tax that either has not been paid, underestimated or erroneously reported to the Royal Malaysian Customs Department (“RMCD”).

This provides an avenue for taxpayers to set right their indirect tax obligations for the past as well as encouraging them in meeting their indirect tax obligations moving forward, subsequently boosting the indirect tax compliance rate in Malaysia.

The SVDP can be seen as a measure to increase tax collections for the year 2022. Similarly, SVDP for income tax, petroleum income tax, real property gains tax as well as stamp duty offered back in November 2018, have added some RM7.88 billion to the Government’s coffers.

The Government has always recognised the need to improve tax compliance from taxpayers across the board for all types of taxes, i.e. direct or indirect taxes.

One of the ways to increase taxpayer’s awareness of tax obligations and enforce compliance is to impose penalties for an offence. There are penalties under various tax legislation, i.e. Income Tax Act 1967 (ITA 1967), Real Property Gains Tax Act 1976 (RPGT Act 1976), Stamp Act 1949, Sales Tax Act 2018 (Sales TA 2018) and Service Tax Act 2018 (Service TA 2018).

A taxpayer should always be conscious of the tax reporting obligations, and be responsible in meeting those obligations. Failure to do so may result in taxpayers being liable to fines or penalties under the respective legislation as listed in the tables in the Publication.

Taxpayer’s Responsibility

Generally, the imposition of penalties will act as a deterrent for taxpayers from committing tax offences. Studies have shown that imposing an adequate fine that is not excessive, have proven to be a successful tool in discouraging the act of wrongdoings.

Despite having the various penalty provisions in place, taxpayers should take it upon themselves to strive towards achieving 100% compliance in their tax affairs, as tax revenue is a huge contributor towards the development of our nation.

At the end of the day, perhaps tax penalties are all three rolled into one - a compliance tool, a punitive instrument and a revenue generator. In other words, tax penalties are indeed a necessary evil!

Our Expert