In 2025, the Department for Business and Trade (DBT) conducted a consultation on adopting IFRS sustainability standards into UK regulations in the form ofUK Sustainability Reporting Standards (UK SRS), following the United Kingdom’s earlier signalling of this intention.

The Financial Conduct Authority (FCA) has now launched a Consultation Paper, CP26/5, to discuss how these sustainability reporting requirements are incorporated into listing rules, with the result that the current Taskforce for Climate-related Financial Disclosure (TCFD) requirements will be retired. The consultation was launched on 30 January 2026 and is due to close on 30 March 2026.

What is changing?

The FCA has launched a consultation which is focused on the retirement of the current mandatory TCFD disclosures for UK-listed firms. This will result in a phased implementation of the new UK SRS requirements. Climate disclosures previously aligned to TCFD will now be used to report against the new UK SRS S2 standard. However, the full UK SRS framework goes well beyond TCFD.

The structure of the UK SRS reporting framework is largely unchanged, keeping consistent with the familiar four pillars of reporting:

- Governance

- Strategy

- Risk Management

- Metrics and Targets

Key subtleties of the proposals

Within this broad approach, there are some subtleties to the proposals to be aware of.

The FCA is recognising that many firms find it more difficult to report on their Scope 3 emissions (those outside their direct operational controls), as compared to their own direct and purchased energy generation (Scope 1 and 2).

On this basis, the FCA is suggesting that these Scope 3 emissions, which are broken down into 15 distinct categories, will be reported on a ‘comply and explain’ basis, unlike Scope 1 and 2 disclosures, which will be mandatory.

Currently, the majority of firms are required to report on Scope 1, 2, and some categories of Scope 3 already within their Streamlined Energy & Climate Report. Because of this, Scope 3 emissions are already often selectively reported on, with a focus on those categories that are internally determined to be most material; firms may continue to use the ‘comply or explain’ arrangements to maintain this approach.

The FCA have also recognised that the introduction of broader sustainability reporting, under UK SRS S1, is a step change in the breadth and depth of disclosures, which until now have been limited to only climate aspects. They have adopted a similar basis to Scope 3 emissions, where reporting against this standard will be on a ‘comply or explain’ basis.

A number of listed firms already report on sustainability factors in their annual reports, and this new standard will provide a more standardised and consistent basis in future. Firms often use a materiality assessment to explain which sustainability matters are important to their organisation and why these are the focus of their reporting.

| What does comply or explain really mean? It’s important to remember that comply or explain is not a ‘get out of jail free’ card. Firms that do not wish to report, opting for the explain route, will have to justify their approach. Materiality assessments, rooted in reality, can help justify your approach. |

The FCA are treading lightly when it comes to how firms produce transition plans toward net zero. There is a delicate balance to be struck, given that the DBT undertook a market consultation in the second half of 2025 on transition plan adoption, and they have yet to reach conclusions on next steps.

The UK SRS S2 standard does refer to transition plans, and as a result, the FCA is requiring firms to confirm whether they have a plan in place and where it is disclosed. This requirement itself is subject to a ‘comply or explain’ requirement. This mirrors the retiring TCFD framework, where transition plans were included as a recommendation. Accordingly, most large listed firms have a transition plan in place, although it may not follow a specific standard such as that provided by the UK Treasury-backed Transition Plan Taskforce (TPT).

Further developments are expected for listed firms on transition plan reporting once the government confirms its policy position.

The FCA is consulting on a proposal to require firms to disclose whether they have sought and obtained independent assurance over their sustainability disclosures, and if so, whether this was to a limited or reasonable assurance level. This requirement is not subject to a ‘comply or explain’ provision, and no explanation is expected.

On the same day as the FCA consultation was launched, the DBT concluded its consultation on establishing a governance framework for sustainability assurance.

Key outcomes

- The Financial Reporting Council will be tasked with creating a voluntary register of sustainability assurance providers.

- This oversight function will be placed on a statutory footing.

- An interim, non-legislative regime will be introduced from mid 2026.

These measures mark the first step toward a more formalised assurance ecosystem ahead of anticipated mandatory requirements later in the decade. However, many firms are already obtaining independent assurance on key sustainability-related data, recognising the benefit of acting early.

Which entities are impacted?

The proposed framework closely aligns with the existing reporting framework.

- Only firms already subject to TCFD reporting will be captured by the new requirements.

- It is assumed that the disclosures will be incorporated into the Annual Report and Accounts (ARA).

- Firms are given some freedom as to where it sits with the ARA, but the strategy section is currently the most used.

When is it changing?

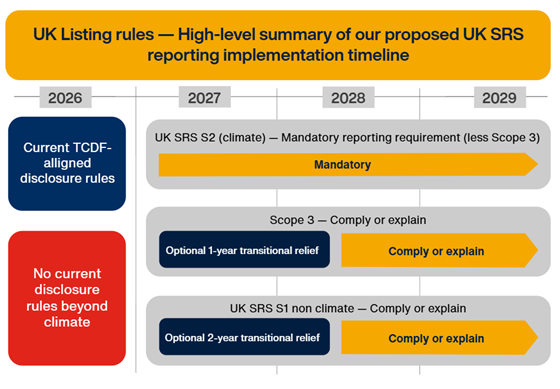

There are some key milestones to note with an overall timeline summarised in Figure 1.

- The FCA expect to finalise their policy statement in the autumn of 2026.

- The rules will come into force for accounting periods starting on or after 1 January 2027, reporting in 2028.

- Firms will be able to continue reporting on their FY2026 performance under the current TCFD regime, or choose to adopt the new UK SRS framework for FY2026 on a voluntary basis.

- Scope 3 greenhouse gas emission reporting will be required for the accounting period starting on or after 1 January 2028, reporting in 2029.

- Wider UK SRS S1 sustainability disclosures may be deferred until the accounting period starting on or after 1 January 2029, reporting in 2030.

What does this timeline mean for firms?

In practical terms, this means firms need to work through their appetite to engage early with UK SRS reporting or take a wait-and-see stance. This will play out in three decisions.

- Strategically decide if firms want to go early with SRS S2 reporting for FY2026 reporting in 2027, or take another year and perhaps run a parallel process internally to gain learning.

- Agree on an appropriate ambition on whether to publish Scope 3 greenhouse gas emissions data

- Determine whether to address wider SRS S1 sustainability reporting early, or alternatively adopt a slow-burn approach, making use of the exemption options, including not reporting and responding to the ‘comply or explain’ provision.

Ultimately, this will come down to what shareholders and the investment community expect of listing firms and whether delaying or avoiding certain disclosures, which in practice many large firms already have in place, would be a 'good look'.

Figure 1 - Summarised timelines for implementation

What are the next steps?

Moving towards these new reporting requirements can feel like a big step. Consequently, you may want to consider starting with a gap analysis and strategic action plan . Following the gap analysis, most organisations start by undertaking a dry-run reporting cycle. So the reporting cycle for FY2026, conducted in 2027, may be such an opportunity.

It is recognised that completing both a TCFD and UK SRS disclosure in the same year places additional burdens on firms. Some firms may then decide to ‘go early’ by reporting on a voluntary basis against the new standard, and adopting a ‘TCFD Plus’ strategy, where additional elements are included in formal reporting where available.

How Crowe can help

We support organisations with maturing their approaches to sustainability reporting, including reviewing their operating models, reporting control environments and ultimately providing independent assurance over disclosure.

If your organisation would support in moving its disclosure processes to the next level and preparing for the adoption of UK Sustainability Reporting Standards as part of its annual reporting cycle, please reach out to Crowe and put the necessary arrangements in place ahead of the reporting deadline.

For more information, please contact Alex Hindson or your usual Crowe contact.

Contact us

Insights