TCFD best practices for large insurers

We have compared the Taskforce on Climate-related Financial Disclosures (TCFD) reports of 10 insurance organisations. These organisations have the highest market shares in the UK and participated in the Climate Biennial Exploratory Scenario (CBES) exercise.

We have observed their practices on the disclosure of climate-related financial information and identified some of the best practices in the industry for the TCFD’s pillars.

- Governance - The best-performing organisations linked the remunerations of their executives with the ESG factors as recommended by the Financial Conduct Authority (FCA).

- Strategy - While data and modelling limitations still prevail in respect of climate modelling, the best performers gave more details on their next steps and how they intend to improve their climate modelling in the future.

- Risk management - The best practice is to disclose the processes in identifying, assessing and managing climate risks at a more granular level using categories such as geography.

- Metrics and targets - An example of best practice is the inclusion of a physical risk heat map, in addition to the disclosures of basic metrics (Scope 1, 2 and 3 emissions) and other metrics such as temperature alignment.

The main takeaways

|

Context

The Financial Stability Board (FSB) created the Taskforce on Climate-related Financial Disclosures (TCFD) to help organisations to disclose climate-related information, such as the climate-related opportunities and risks that they might be exposed to. The FSB has published recommendations for completing TCFD which includes guidance for sector-specific analysis. This is supplemented by additional supporting guidance on:

- scenario analysis for non-financial organisations

- risk management integration and disclosure

- metrics, targets and transition plans

- the use of scenario analysis in disclosure of climate-related risks and opportunities.

As of 6 April 2022, TCFD reporting is mandatory for all public companies, large private companies and some larger limited liability partnerships.

We have compared the TCFD reports published for the years 2020 and 2021 of 10 of the UK’s leading insurers including general, life and composite. Collectively, they have the highest market shares in the UK and were also selected in the CBES exercise. We have identified the best practices currently seen across TCFD’s four key pillars, and summarised the common alliances and memberships across these organisations.

Figure 1: TCFD Recommendations

Governance

We can surmise from the TCFD recommendations that, under the ‘Governance’ section, insurers should aim to:

- describe the board’s oversight of climate-related risks and opportunities – by disclosing “processes and frequency by which the board and/or board committees (e.g., audit, risk, or other committees) are informed about climate-related issues, and how the board monitors and oversees progress against goals and targets for addressing climate-related issues”

- describe the management’s role in assessing and managing climate-related risks and opportunities - by providing details on their organisational structure and on the “processes by which management is informed about climate-related issues, and how management (through specific positions and/or management committees) monitors climate-related issues”.

Given the fairly prescriptive nature of this pillar of TCFD, we observed a fairly narrow spread of governance disclosures. All organisations describe how their Board and different committees oversee climate-related risks and opportunities, supplemented in most cases by an organogram. Most organisations describe the role of the executive management in evaluating and managing those risks and opportunities.

Some elements of best practice are emerging through organisations that create an explicit link between executive remuneration and key Environmental, Social and Governance (ESG) factors. While this is not required by regulators, the Financial Conduct Authority (FCA) mentioned in their ‘Dear Chair of the Remuneration Committee’ letter dated 2 August 2022, that they “believe that linking progress against these commitments to a measurable proportion of pay could be effective in encouraging individuals to take accountability for change”.

Although third-party assurance is not a TCFD requirement, around half of the insurers in the sample make use of limited scope assurance, as defined by the International Standard on Assurance Engagements (ISAE) 3000, especially for the validation of their metrics.

Strategy

This pillar requires disclosure of the actual and potential impacts of climate-related risks and opportunities on the organisation’s business, strategy and financial planning, where such information is material over short, medium and long term.

All the insurers analysed listed some transition risks (reputational, technology, policy and legal, market), which are risks associated with transitioning to a lower carbon economy, and some physical risks (acute and chronic), which could cause damage to the organisation’s assets and indirectly impact their investments. The European Insurance and Occupational Pension Authority (EIOPA) opinion published on 19 April 2021, provides a matrix which maps climate change risks to prudential risks (including underwriting, market and credit risk). While this is not explicitly used by any of the insurers we reviewed, this would form a valuable tool for risk identification where some insurers are clearly struggling to map climate risks to those risks they are more used to assessing. The best practice was the addition of liability or litigation risks as supplementary climate-related risks. Litigation risks can arise either directly, where an adverse event or impact may be attributable to a corporation or government, or indirectly, where organisations’ emissions can be argued to be responsible for adverse impacts. Some lawsuits and penalties are also being brought against organisations accused of greenwashing, as they have disclosed misleading information on their climate and sustainability-related performance to the public and governments.

It is clear from the TCFD reports that the top strategies to decarbonise portfolios are:

- increasing green investment

- coal divestment

- engagement with high Greenhouses Gases (GHG) emitters

- developing exclusion policies.

Additionally, it should be noted that while Net Zero underwriting is a novel topic, some of the leading organisations have recognised it to be an issue, and have partnered with Net Zero Insurance Alliance (NZIA) and Partnership for Carbon Accounting Financials (PCAF), to develop a methodology for carbon attribution in respect of underwriting, which was published in November 2022.

While most insurers focus on carbon offsets, the leaders in this space have ambitions that target their emission reductions and thus aim to offset only a minimum portion of their emissions. The ‘net’ of Net Zero has long caused contention with some in the climate area, and leaders recognise that removal of emissions is a stronger action to take, as opposed to offsetting emissions, where technologies and calculations remain uncertain and the risk of these offsets being overstated is high.

Insurers are also required to carry out scenario analysis to determine the resilience of the organisation’s strategy under different scenarios. Organisations that have participated in the Climate Biennial Exploratory Scenario (CBES) tend to use the three CBES scenarios; Early Action (EA), Late Action (LA) and No Additional Action (NAA). Other organisations tend to use equivalents or variants of those scenarios, such as temperature pathways. Good practice in scenario analysis involves being up-front on the limitations of data available and their modelling of climate risks. Insurers are typically well versed in describing the uncertainty inherent in long-term projections, but this may be more of a challenge for organisations outside of financial services who do not have a history of reserving for long time horizons.

The best performers in strategy typically provide more information on their next steps and how they intend to enhance their climate modelling in the future, for instance, by improving their data capturing processes and fine tuning their own software and models. Data reliability and consistency remains a key challenge for understanding climate risk. The leading insurers have put in place steps to ensure they work towards the necessary improvements in the data they are using.

Risk management

The risk management pillar requires organisations to disclose the processes needed to identify, assess and manage climate-related risks and how these are integrated into the organisation’s overall risk management.

Risk management is yet another fairly prescriptive pillar where we observe limited variation in disclosures, as all organisations describe the recommended processes and how they are incorporated in organisations’ overall risk management in their Own Risk Solvency Assessment (ORSA). However, according to the EIOPA, no more than 13% of the 1,682 reinsurers refer to climate change risks scenarios in their ORSAs. This prompted EIOPA to publish their final application guidance on 2 August 2022, which crystallises the materiality assessment for climate risks and climate change scenario design for reinsurers. In the UK, the Prudential Regulation Authority (PRA) released the SS3/19 in April 2019, which set out their expectations on how insurance organisations and banks should approach and manage climate-related financial risks. The PRA also published ‘Dear CEO’ letters in 2020 and 2022, which provided examples of effective practice for the management of climate-related risks.

Best practice for insurance organisations includes them disclosing the processes for identifying and assessing climate-related risks “on re-/insurance portfolios by geography, business division, or product segments, including the following risks:

- physical risks from changing frequencies and intensities of weather-related perils

- transition risks resulting from a reduction in insurable interest due to a decline in value, changing energy costs, or implementation of carbon regulation

- liability risks that could intensify due to a possible increase in litigation”.

Additionally, insurance organisations will need to “describe their processes for prioritising climate-related risks, including how materiality determinations are made within their organisations” and describe “key tools or instruments, such as risk models, used to manage climate-related risks in relation to product development and pricing, the range of climate-related events considered, and how the risks generated by the rising propensity and severity of such events are managed” (TCFD’s Recommendation of the Task Force on Climate-related Financial Disclosures).

Metrics and targets

Metrics

As stipulated by the fourth pillar of the TCFD framework, organisations should disclose metrics, including Scope 1, 2 and 3 emissions to assess and manage relevant climate-related risks and opportunities, where such information is material.

In this section insurers diverge the most, as there is a huge range of available metrics, from the mandatory disclosure of GHG emissions, to more complex metrics used to evaluate the climate-related risks and opportunities. Best practice generally consists of providing details on voluntary metrics, in addition to the mandatory ones. Such metrics should contribute to a better explanation of the risks and should be accompanied by a full description of the limitations of their data and the underlying calculations.

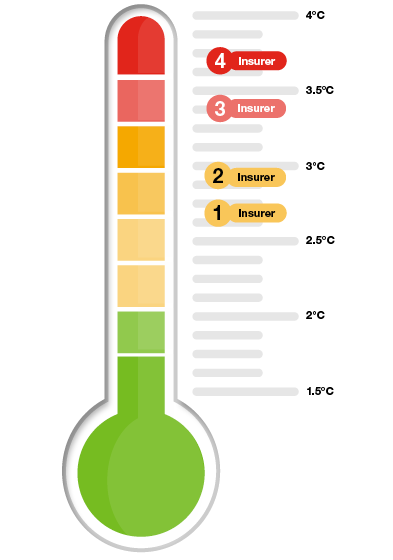

One of the simplest and easiest to explain metrics is temperature alignment or Implied Temperature Rise (ITR), which was provided by four insurers. From the comparison of the TCFD reports, some insurers went further and split this ITR metric by assets (corporate bonds, equities and sovereign bonds).

There are other metrics that stood out from the comparison of the TCFD Reports:

- Carbon Intensity = Total Carbon Emissions ÷ Sum of revenues of securities in the portfolio.

- Green revenues – the revenues derived from products / services that deliver environmental solutions.

- Annual Expected Loss – the economic loss resulting from climate risks, in particular physical risks.

- Climate Value at Risk (VaR) – quantile of the distribution of aggregate losses.

- Weighted Average Carbon Intensity (WACI) – portfolio exposure to carbon-intensive organisations. WACI is expressed in tons CO2e amount of emissions per USD million of revenues, allowing more direct comparisons of the emissions of different sized organisations.

Many insurers also include a physical risk heat map, a geographical analysis of their own physical risk exposure and the real estate assets across different areas in UK, thus showing nuances in regional differences. This is especially relevant for organisation that have a particularly large physical risk exposure and is therefore a best practice example of how to evidence the analysis conducted.

Additional TCFD guidance for insurance organisations stipulate that insurers should “provide aggregated risk exposure to weather-related catastrophes of their property business (i.e., annual aggregated expected losses from weather-related catastrophes) by relevant jurisdiction. Insurance organisations should describe the extent to which their insurance underwriting activities, where relevant, are aligned with a well below 2°C scenario, using whichever approach or metrics best suit their organisational context or capabilities. Insurance organisations should also indicate which insurance underwriting activities (e.g., lines of business) are included and disclose WACI or GHG emissions associated with commercial property and specialty lines of business, where data and methodologies allow.” The TCFD supplemental Guidance on Metrics, Targets and Transition Plans gives more examples of the seven categories of metrics: GHG emissions, transition risks, physical risks, climate-related opportunities, capital deployment, internal carbon prices and remuneration. These would be deemed best practice for the metrics disclosure section.

Targets

The most common target by far is to achieve Net Zero by 2050. Only one insurer in the sample was more ambitious and targeted Net Zero by 2040. Given that 2050, and even 2040, are long-term targets for any organisation, best practice in targets setting involves the creation of robust and achievable interim targets. The insurers we reviewed have disclosed targets for 2022, and every five to 10 years between now and their Net Zero targets. It should be obvious that it is not necessarily ‘better’ for an organisation to claim they will achieve Net Zero before everyone else, if their plan to get there is inadequate. Therefore, best practice takes into consideration how targets will be achieved, rather than focusing solely on the targets themselves.

As well as emissions targets, many insurers aim to phase out coal at more advanced timescales. One of the other laudable practices that we have observed, is that many organisations provide information on the amount they have invested so far, or are planning to invest in green assets or green infrastructure projects.

Alliances and memberships

Although not a pillar of TCFD, most insurers are members of groups and alliances that can help validate and strengthen their commitment to Net Zero. Most leading insurers are members of the Net Zero Asset Owner Alliance (NZAOA), which has committed to transitioning their investment portfolios to Net Zero GHG emissions by 2050. One of the popular frameworks is the Principles of Sustainable Insurance (PRI) which underlies the Net Zero Insurance Alliance (NZIA). The latter is committed to transitioning their insurance and reinsurance underwriting portfolios to Net Zero by 2050.

Fewer organisations have signed up to the Principles of Responsible Investment (PRI), whose main aim is to incorporate environmental, social and governance factors in their investment-related decisions, or the Climate Action 100+ (CA100+), which is an investor-led initiative to engage with the major carbon emitters, so they take required action in respect of climate change.

Additionally, few organisations are part of the Renewable Energy 100 (RE100) group, which is committed to “source 100% renewable electricity throughout their entire operations by a specified target year”.

Only one company in the sample is a member of ClimateWise which “supports the insurance industry to better communicate, disclose and respond to the risks and opportunities associated with the climate-risk protection gap”. The seven ClimateWise principles have been aligned with the TCFD recommendations since 2019.

Conclusion

The TCFD Report comparison exercise is designed to shed light on the current and emerging best practices for insurers who have already published, or are planning to publish their TCFD or other climate-related reports in the near future. The TCFD’s annual Status Reports show that there has been an increase of 26% in the number of organisations disclosing climate-related financial information.

It is clear that some insurers are treating climate reporting as a tick-box exercise, and equally clear that those insurers are failing to learn valuable lessons about how best to collate, interpret and present climate information that the leading insurers are learning today. Insurers who find themselves behind the curve should consider emerging best-practices alongside the TCFD framework, as guidelines to better understand how climate risks and opportunities could affect their business model. This will help them to critically assess their approach to analysing their exposure to those risks and opportunities and, ultimately, ensure disclosure is aligned to genuine business activity as well as the metrics they use, while also taking into consideration what other peers are doing in this respect. Value can be gained from going beyond mere compliance and using TCFD reporting as a means to identify gaps in climate-related financial risk management. Ultimately, a robust approach to disclosure is a key measure to ensure a sustainable, resilient business in the long run and to build stakeholders’ confidence that action is being taken at an appropriate rate.

Additionally, insurers should consider all the disclosure regimes they are exposed to and strive to create a ‘master list’ of all their reporting and strategic requirements, rather than comply to TCFD’s key pillars as a stand-alone exercise. This would allow them to understand the underlying process and be more efficient in meeting various reporting requirements beyond just TCFD reporting. This could potentially mean combining TCFD within some broader ESG reports to not only capture the operational efficiencies of doing so, but better create a ‘single version of the truth’ in reporting. On that note, insurance organisations should also be on the lookout for the Transition Plan Taskforce which has launched ‘a gold standard’ currently under consultation, which if adopted by UK government, would require large listed organisations to report every year against TCFD, and every three years to provide a Transition Plan, giving updates in the intermediate years in their TCFD reports.

Start the conversation

Our ESG team has significant experience supporting organisations on their climate-reporting journey. For more information, please contact Justin Elks, Alex Hindson or Lloyd Richards.

Insights

Contact us