Tax Incentive For Green Initiatives

Going green permeates every aspect of society and more needs to be done to roll back the negative effects of global warming and pollution. If your company is involved in green tech or adopted green tech for your business purposes, check out the tax incentives available.

Adoption of green technology is a global megatrend. Malaysia has stepped up its commitment to be a carbon neutral country by 2050 through its many initiatives set out in the Green Technology Master Plan Malaysia 2017 to 2030 and the Twelfth Malaysian Plan (2021 to 2025).

The Ministry of Environment, Science, Technology, Environment and Climate Change (MESTECC) is tasked to implement the green technology agenda, supported by other agencies such as Malaysian Green Technology Corporation (MGTC) and Sustainable Energy Development Authority (SEDA).

Green Technology Tax Incentive in Malaysia

The government has mooted various initiatives to accelerate green technology adoption by the private sector. For easier financing access, the introduction of Green Technology Financing Scheme 2.0 (GTFS) helps to provide financial aid to companies, with the government guaranteeing 60% of the loan amount and providing a 2% rebate on the interest or profit rate charged.

On the tax front, various types of tax incentives (hereinafter known as Green Technology Tax Incentives) are available to service providers and consumers of green technology assets to help to reduce the cost of doing business and encourage investments for the consumers of green technology.

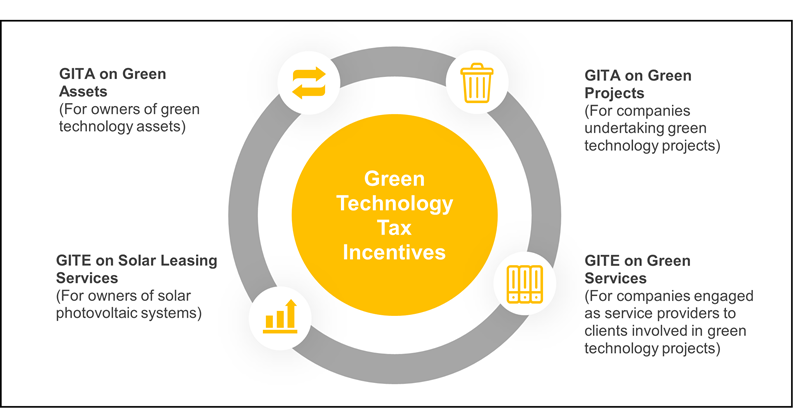

There are four broad categories of Green Technology Tax Incentives, namely:

- Green Investment Tax Allowance (GITA) on Green Assets

- GITA on Green Projects

- Green Income Tax Exemption (GITE) on Green Services

- GITE on Solar Leasing Services

Diagram 1: Four categories of Green Technology Tax Incentives

I. GITA for Green Assets – For Owners of Green Technology Assets

The GITA Asset incentive is applicable to companies that acquire approved green technology assets for their businesses’ own consumption, with such costs incurring from October 25, 2013 to December 31, 2023. Registered green products are listed in the MyHIJAU Directory (https://dir.myhijau.my/directory), which serves as a reference for Green Technology Tax Incentives and related green technology initiatives.

The purchase of green assets registered in the MyHIJAU Directory would need to be verified by the MGTC before such assets are eligible for the GITA incentive. The application for verification should be submitted to the MGTC at least two years from the date of invoice of the assets purchased.

A company that is granted with an approval for GITA asset is eligible for the Investment Tax Allowance (ITA), which can be offset against 70% of statutory income.

II. GITA on Green Projects – For Companies That Undertake Green Technology Projects

The GITA Project incentive is applicable to companies that undertake qualifying green technology projects for business purposes or own consumption. These include activities in the generation of energy in a form of electricity, heat, steam and chilled water using renewable energy sources such as biomass, solar power, etc. for their business consumption.

The second type of GITA Project incentive relates to companies investing in a commercial or industrial building certified with a Green Building Certificate approved by the government.

III. GITE on Green Services – For Companies Engaged as Service Providers for Clients involved in Green Technology Projects

The GITE Services incentive is applicable for those listed under the MyHIJAU Directory which provide green technology services to their clients embarking on green technology related projects. Based on the MyHIJAU Directory and the MIDA Guidelines, the list of qualifying green technology services includes system design, feasibility study, advisory, consultancy, testing and commissioning services in various sectors such as renewable energy, energy efficiency, electric vehicles, green building, green township, green data centres, etc.

A green technology service provider is eligible for tax exemption on the income derived from providing such qualifying services, with approval is granted by the MIDA, upon an application being made by the service provider. The income tax exemption is equivalent to 70% of the statutory income derived from providing the qualifying green services for a period of three years of assessment, and the window of application to MIDA is from January 1, 2020 to December 31, 2023.

IV. GITE on Solar Leasing Services – For Owners of Solar Photovoltaic System

Lastly, the GITE incentive is available for investors of solar photovoltaic systems (Solar PV). This incentive was introduced in the Budget 2020 to avail companies approved to undertake solar leasing activities by SEDA and listed in its Registered Solar PV Investor (RSPVI) Directory. An RSPVI is an investor who provides Solar Power Purchase Agreement (PPA) or Solar Leasing services to Net Energy Metering (NEM) customers. This incentive is applicable to companies that possess a minimum installed capacity of 3MW solar PV projects aggregated under the NEM. To qualify, the company must submit an application to the MIDA for its approval within January 1, 2020 to December 31, 2023.

Qualifying companies undertaking solar leasing activities can enjoy tax exemption equivalent to 70% of the company’s statutory income for a period of five years or 10 years depending on the installed capacity listed below:

- Between 3MW – 10MW (5 years)

- Between 10MW – 30MW (10 years)

Table 1 sets out the summary details of the eligibility criteria and conditions to fulfill in order for a company to qualify for the Green Technology Tax Incentives under either GITA or GITE.

|

Item |

GITA On Green Assets |

GITA on Green Project |

GITE on Green Services |

GITE on Solar Leasing Services |

|

Equity Conditions |

Not applicable |

Not applicable |

Not applicable |

60% must be held by Malaysians |

|

Conditions |

|

|

|

|

|

Incentive Period |

Assets purchased from 25 October 2013 until 31 December 2023 |

3 years from the YA in which the first qualifying capital expenditure is incurred and applications received from 1 January 2020 to 31 December 2023. |

3 years from the YA in which the first invoice is issued and applications received from 1 January 2020 to 31 December 2023. |

Up to 10 years depending on the capacity, commencing from the date of first invoice issued by the RPVI to lessee. A company shall be required to submit an application to the MIDA for its approval within the window of application from 1 January 2020 to 31 December 2023. |

|

Government Agency for submission of application |

MGTC |

MIDA |

MIDA |

MIDA |

|

Government Agency for technical verification |

MGTC |

MGTC |

MGTC |

SEDA |

|

Tax Incentive |

A company granted approval for GITA Asset can qualify for ÏTA calculated on 100% of the qualifying capital expenditure incurred from 25 October 2013 to 31 December 2023. The ITA can be offset against 70% of statutory income for the relevant year of assessment. |

A company granted with GITA Project status can qualify for ITA calculated on 100% of the qualifying capital expenditure incurred within a period of 3 years from the date of first qualifying capital expenditure incurred (as verified by MGTC). The ITA can be offset against 70% of statutory income for the relevant year of assessment.

|

A green technology service provider approved by the MIDA shall enjoy income tax exemption equivalent to 70% of the statutory income derived from providing the qualifying green services for a period of 3 years of assessment commencing from the year of first invoice relating to green technology services is issued. |

A company granted with GITE Leasing incentive by MIDA shall enjoy income tax exemption equivalent to 70% of statutory income for a period of 5 years or 10 years depending on the installed capacity listed below: •Between 3MW – 10MW (5 years) •Between 10MW – 30MW (10 years)

|

Applying for Green Technology Tax Incentives

The application for the Green Technology tax incentives can be straight forward if the necessary application requirements are adhered to. The key considerations regarding a successful application for an approval by the authorities are meeting the submission timeline and having proper supporting documents.

A. Timeline for submission of application

Time is of the essence in ensuring a successful application. Once the eligibility is ascertained, the applicant needs to start organising the team to work on the submission documents immediately. There are two timelines to watch out for in the application to MIDA:

- The application documents should be received by the MIDA on or before December 31, 2023 (unless extended by the government in the future)

- The date of submission of an application to the MIDA should not be later than the date of the first qualifying capital expenditure incurred (for GITA Project incentive) or date of the first invoice issued (for GITE incentive)

B. Supporting documents

A concise, precise and “simple-to-understand” project proposal would enable the authorities to understand the green project undertaken by companies and expedite the whole application process. As a high-level guide, the project proposal should encapsulate the following contents:

- Brief background of the company and the management team

- Description of the business activities and the nature of the green projects / assets

- Explanation on the technology aspect of the green assets or green technology, and its connection to achieving reduction of greenhouse gas emission, minimisation of the degradation of environment, promotion of health and improvement of environment, conservation of the use of energy, water, or other natural resources, etc.

- State the benefits of the project to Malaysia, from both the economic and social context

“MUTUALLY EXCLUSIVE” RULES

There may be circumstances whereby a company can be eligible for more than one type of tax incentive for the same project. The basic principle for the government to grant tax incentive is that the applicant should not be given more than one type of tax incentive on the same subject, i.e. tax incentives are mutually exclusive.

This mutually exclusive principle could even extend to a group of companies. For example, a company within a group of companies will not be able to claim the GITE on the similar project undertaken by another company in the same group that is already enjoying the GITE incentive. Hence, the company has to evaluate the tax benefits of choosing one incentive over another, so that it can maximise its tax savings.

To enjoy these incentives and ensure a smoother experience in its application process, companies should seek guidance and assistance from the relevant authorities and experts.

This article was first published in the Smart Investor (Mar/Apr 2022) issue.