Tax Breaks In The Johor-Singapore Special Economic Zone

From Strategy To Savings

The Johor-Singapore Special Economic Zone (“JS-SEZ”) is a collaborative cross-border initiative designed to deepen economic integration and improve connectivity between Malaysia and Singapore. The primary objective is to attract greater investment and create high-quality job opportunities in key sectors such as manufacturing, logistics, tourism, digital services and international business.

Prior to the introduction of this JS-SEZ tax incentive package, tax incentives in Malaysia were primarily governed under the Promotion of Investments Act (“PIA”) 1986 and administered by the Malaysian Investment Development Authority (“MIDA”) and other relevant authorities. These incentives were generally granted to companies undertaking promoted activities or promoted products, as defined by the relevant guidelines.

With the launch of the JS-SEZ, a distinct and targeted tax incentive framework has been established to accelerate the development of southern Johor into a competitive and vibrant economic hub. This new framework specifically supports businesses operating within seven (7) of the nine (9) designated flagship zones.

In this article, we explore the key features of the JS-SEZ, with a focus on the tax incentives available to businesses operating within Flagship Zones A to G.

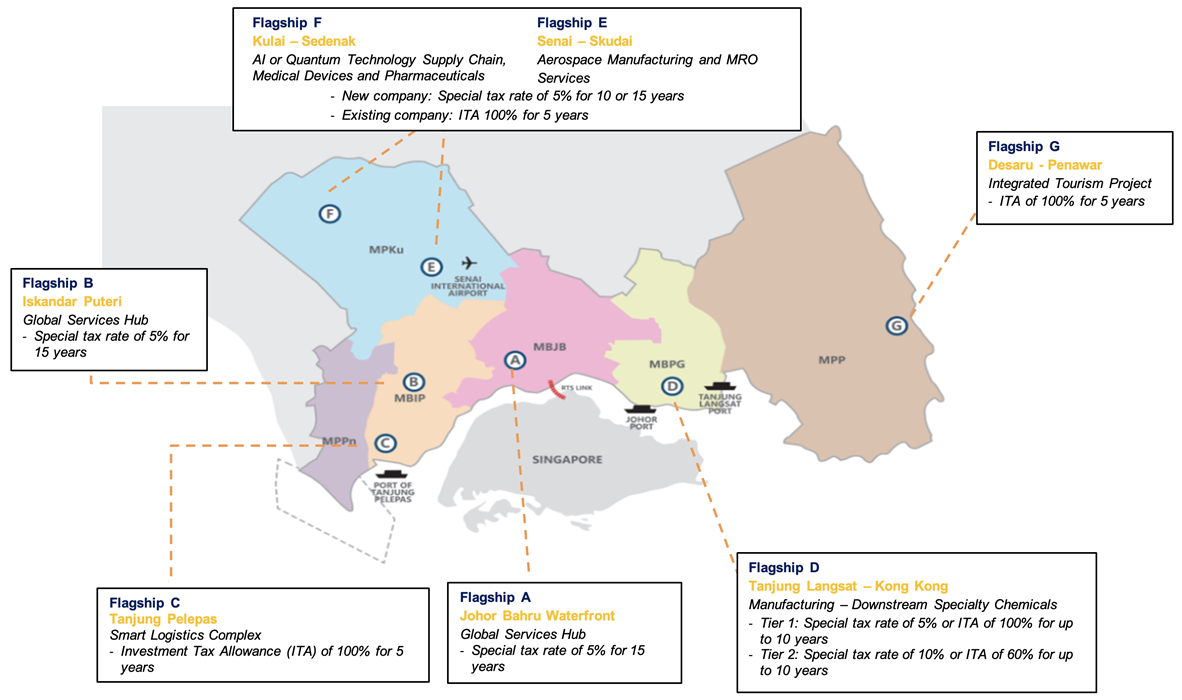

Mapped Overview of JS-SEZ Flagships with Sector Focus

The map below presents the seven (7) designated JS-SEZ flagship zones, along with their respective sectoral focus areas and key activities.

JS-SEZ Tax incentives package

The tax incentive packages for the seven (7) designated flagship areas (A–G) are summarised as follows:

| Flagship | Location | Project Focus | Qualifying Services | Incentive Type |

| A | Johor Bahru Waterfront | Global Services Hub |

|

|

| B | Iskandar Puteri | |||

| C | Tanjung Pelepas | Smart Logistics Complex |

|

|

| D | Tanjung Langsat – Kong Kong | Manufacturing – Downstream Specialty Chemicals |

|

OR

|

| E | Senai – Skudai | Manufacturing Business |

|

|

| F | Kulai – Sedenak |

|

||

| G | Desaru – Penawar | Integrated Tourism Project |

|

|

General Common Eligibility Criteria

| Category | Common Requirement |

| Company status |

|

| Paid-up capital |

|

| Capital expenditure (CAPEX) |

|

| Operating expenditure (OPEX) |

|

| Annual sales turnover |

|

| Workforce composition |

|

| Key personnel |

|

| IR4.0 adoption |

|

| ESG commitment |

|

| Local ecosystem engagement |

|

| Internship & graduate hiring |

|

| Vendor development |

|

| Location |

|

General Common Tax Treatment Across JS-SEZ Incentives

| Aspect | Treatment / Requirement |

| Application timing | Must be submitted to MIDA before commencement of the proposed project. "Commencement" usually means the first sales invoice or first qualifying capital expenditure after submission. |

| Effective date of incentive |

Determined based on:

|

| Incentive confirmation |

Company must apply for determination of the incentive’s effective date:

|

| Annual compliance requirement | Company must submit Annual Compliance Report within 7 months after financial year-end during the incentive period. |

| Condition for claiming incentives |

|

| Separate accounts | Existing companies granted approval for the tax incentive must separately account for incentivised and non-incentivised activities. |

| Withdrawal of incentive | The company may voluntarily surrender the incentive by written notice to the Minister of Finance via MIDA. |

Please note that the criteria and tax treatments outlined above are general in nature and may vary depending on the specific incentive package. Applicants are advised to refer to the official guidelines issued by the MIDA, titled "Guideline for Johor-Singapore Special Economic Zone (JS-SEZ) Tax Incentive Package"1, to obtain the full details. This summary is provided for reference purposes only and does not constitute comprehensive or binding eligibility conditions.

1Guideline for Johor-Singapore Special Economic Zone (JS-SEZ) Tax Incentive Package, https://www.mida.gov.my/wp-content/uploads/2025/04/Guideline-JSSEZ-V2.pdf

Effective Date of Application

Applications shall be made online at https://investmalaysia.mida.gov.my from 1 January 2025 until 31 December 2034.

Conclusion

The JS-SEZ offers broad-based tax incentives aimed at attracting investment across a diverse range of industries, including technology, healthcare, logistics, manufacturing, and tourism. These incentives are designed to directly benefit businesses that qualify under the specific criteria set out in the respective flagship zones. Eligible companies stand to gain substantial tax advantages, which in turn support sustainable development, workforce upskilling and the growth of high-value sectors.

In addition to the direct beneficiaries, certain industries, such as property development, may also enjoy indirect advantages as a result of increased economic activities and infrastructure expansion within the designated zones. This spillover effect further enhances Johor’s potential as a vibrant and competitive economic hub, positioning it as a strategic player in the Southeast Asian economic landscape.

Read more about MIDA Article on Johor-Singapore Special Economic Zone here.

This article is written by Marcus Pua, a Tax Advisory Director with Crowe KL Tax Sdn Bhd. If you wish to seek further clarification on any of the above issues, please contact [email protected].

Other articles

Stay up-to-date with our newsletter

Our Tax Expert