Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Ireland

Italy

Kazakhstan

Kosovo

Latvia

Lithuania

Luxembourg

Malta

Moldova

Netherlands

Norway

Poland

Portugal

Romania

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Tajikistan

Turkey

Ukraine

United Kingdom

Uzbekistan

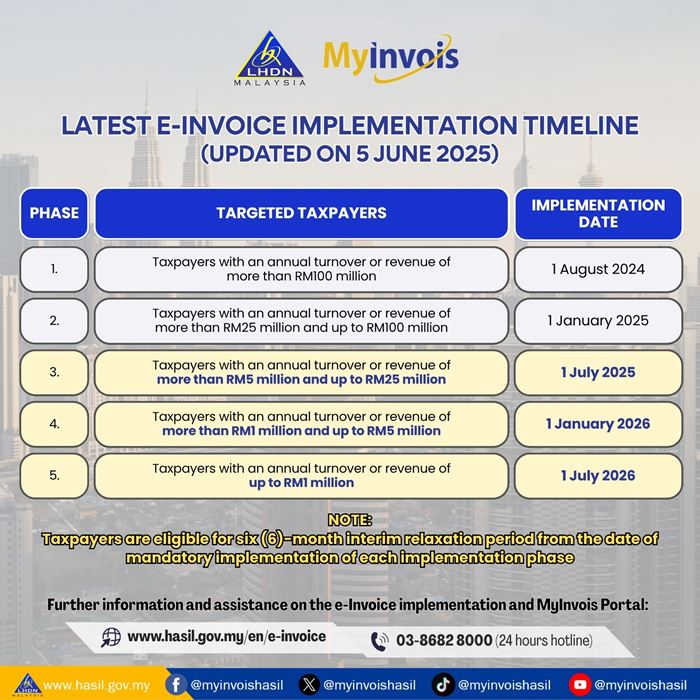

Latest E-Invoice Implementation Timeline

- Taxpayers with annual income or sales below RM500,000 are exempted from e-invoicing requirements for the time being.

- The implementation of e-invoicing for taxpayers with annual income or sales between RM1 million and RM5 million will be deferred to 1 January 2026.

- Implementation for those with annual income or sales up to RM1 million will be deferred to 1 July 2026.

- The mandatory e-invoicing implementation date for taxpayers with annual income or sales exceeding RM5 million and up to RM25 million will be 1 July 2025.

- Taxpayers are still eligible for the six (6) month interim relaxation period from the updated date of mandatory implementation.

- From 1 January 2026, businesses must issue individual e-invoices for transactions exceeding RM10,000 and the use of consolidated e-invoices for such transaction are not allowed.

The infographic below shows the updated e-invoice implementation timeline issued by the Inland Revenue Board of Malaysia (IRBM) on 5 June 2025:

Unsure Which Tier Applies to You?

More articles and insights

IRBM update (June 2025): Employment contracts pre-2025 exempt from stamp duty. 2025 contracts get penalty waiver if stamped by Dec 2025.

Key 2025 Malaysia tax updates: New 2% dividend tax rules, Labuan Foundation amendments & shipping tax treatment under PR 1/2025.

Malaysia's 2024 Transfer Pricing Guidelines introduce new thresholds, LVAS safe harbor rules, and stricter penalties. Key updates for MNEs explained.

Stay up-to-date with our newsletter

Our Tax Experts

We help you to make smart decisions that have lasting value. Working with you, we will help you to successfully adapt and overcome challenges you may face, both today and in the future.