Is Interest-free Intragroup Financing Acceptable? | May 2019

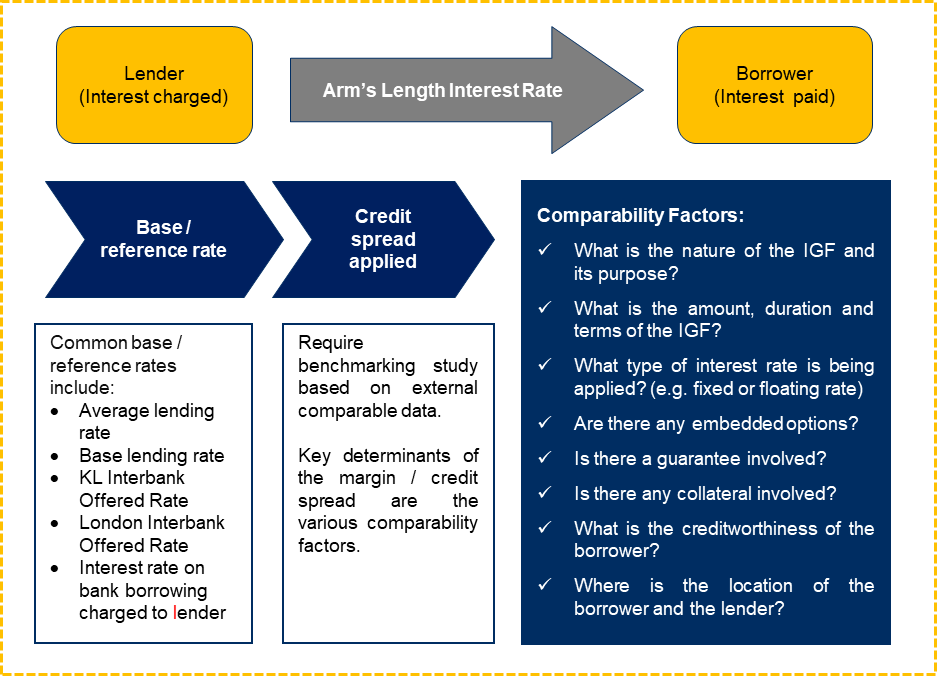

In the Malaysian context, IGF transactions are defined as financial assistance between associated persons that could include loans, interest bearing trade credits, advances or debt and the provision of any security and guarantee (Chapter IX of the Malaysian Transfer Pricing Guidelines 2012 as revised in July 2017).

Financial assistance between associated persons involves a taxpayer that acts as a lender within either a multinational group or a domestic group of companies. The lender proceeds to extend financial assistance, using funds sourced internally or externally, to other members of the group for several commercial purposes. In such a transaction, the person receiving the financial assistance or the borrower is responsible for ensuring that all obligations pertaining to the financial assistance (e.g. the schedule of repayment, collateral provided and quality of any guarantee) are met on a timely basis.

It is imperative for taxpayers to be aware that the term “financial assistance” has a rather broad definition from the perspective of the Inland Revenue Board of Malaysia (“IRBM”). For example, a simple trade credit facility between associated persons, or one person acting as a guarantor on behalf of an associated person, payment of expenses made on behalf, etc. could potentially be labeled as “financial assistance” and therefore the requirements under Section 140A must be observed in those cases. Continue Reading>>>