Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Ireland

Italy

Kazakhstan

Kosovo

Latvia

Lithuania

Luxembourg

Malta

Moldova

Netherlands

Norway

Poland

Portugal

Romania

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Tajikistan

Turkey

Ukraine

United Kingdom

Uzbekistan

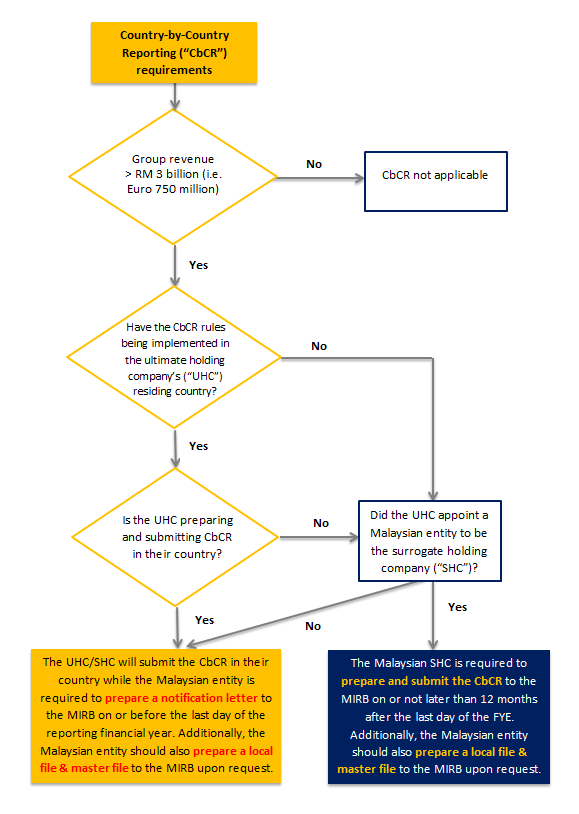

Guidance on Country-by-Country Reporting Requirements in Malaysia

Since the release of the Action 13 on Base Erosion and Profit Shifting (BEPS): Transfer Pricing Documentation and Country-by-Country Reporting (“CbCR”) by the Organisation for Economic Co-operation and Development (OECD), many countries have jumped on the bandwagon to introduce CbCR laws or rules in their countries, including Malaysia. The Malaysian Government has recently issued Income Tax (Country-by-Country Report) Rules 2016 (“CbCR Rules”) on 23 December 2016 to prescribe the rules relating to the compliance of CbCR rules in Malaysia with effective from 1 January 2017. Click to learn more >>>