Officially extended the deadline for paying taxes and land lease fee

On April 8th, 2020, in order to support businesses suffering from the Covid-19 epidemic, Government issued Decree No. 41/2020 / NĐ-CP ("Decree 41") providing for extension of deadline for value-added tax (“VAT”), corporate income tax (“CIT”), personal income tax (“PIT”) and land lease fee payments, and the Decree took effect immediately.

1. Regulated entities: including businesses, groups of individuals and households engaged in production and business activities in the fields of agriculture, forestry, fishery, food processing, textile, garment, leather production and wood processing, rail transport, accommodation services, catering services, tourist services ..., small and micro- sized enterprises.

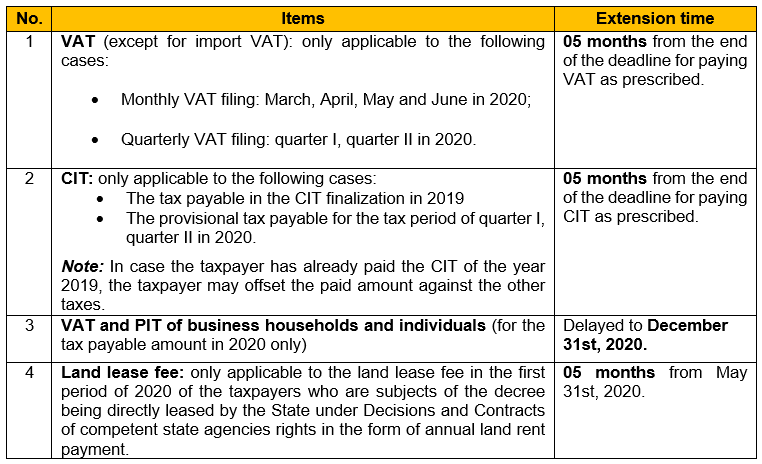

2. Extension of deadline for tax and land rental fee payments

3. Extension procedures

- The taxpayer who is eligible for the extension shall submit the Request for tax payment and land rental fee extension (by electronic or otherwise) using the Form in the Appendix enclosed with Decree 41 to the tax authority for all periods of tax and land rental fee is extended together with the time of submission of monthly (or quarterly) tax declaration according to the law on tax administration.

- In case the written request for extension of tax and land rental fee payment is not paid together with the time of submitting tax declaration dossiers, the deadline for submission is July 30th, 2020.

- Tax authorities are not required to notify the taxpayer of accepting the extension of tax and land rental fee payment. Tax authorities will exam/ inspect later and apply penalty to violation if any.