Crowe Chat Vol.14/2020

Tax

Introduction

Section 99 of the Income Tax Act, 1967 (ITA) provides that a taxpayer who is aggrieved by an assessment which has been made on him for any year of assessment (YA) by the Director General of Inland Revenue (DGIR) is entitled to appeal against

that assessment.

Previous PR

The previous PR 12/2017 - Appeal Against An Assessment And Application For Relief was issued on 29 December 2017 and was last amended on 25 September 2018.

New PR

The Inland Revenue Board of Malaysia (IRBM) issued PR 7/2020 - Appeal Against An Assessment And Application For Relief on 7 October 2020.

Details of new PR

The objective of this PR is to explain the procedures with regard to appeal and application for relief in line with the provisions of the ITA including the procedures for submission of the Notice of Appeal (Form Q) and the Notice of Late Appeal (Form N).

The salient changes in this new PR are:

- appeal against best judgement assessment; and

- limitation of period for application of extension of time (Form N).

Appeal Against Best Judgement Assessment under Subsection 90(3) of the ITA

Effective YA 2019, if the best judgement assessment has been made under subsection 90(3) of the ITA against a company, limited liability partnership, trust body or co-operative who fails to submit the Income Tax Return Form, the appeal against the best judgement assessment shall be made by submitting Form Q together with the Income Tax Return Form for the YA involved not later than thirty (30) days after the notice of assessment has been served.

If the best judgement assessment has been made against a person other than a company, limited liability partnership, trust body or cooperative society, the appeal shall be made by submitting Form Q not later than thirty (30) days after the notice of assessment has been served.

Limitation of Period for Application of Extension of Time (Form N)

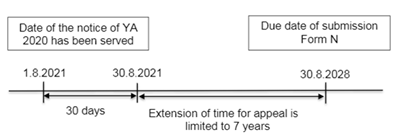

Effective YA 2020, Section 100 of the ITA provides that the application of extension of time (Form N) to the DGIR must be furnished within seven (7) years from thirty (30) days after the notice of assessment was served.

An example on the limitation period is as follows:

PR 8/2020 – Taxation Of A Resident Individual Part I - Gifts Or Contributions And Allowable Deductions

Introduction

In ascertaining the total income of a tax resident individual, gifts and / or contributions made by an individual to the government and approved institutions or organisations are allowed as deductions from his aggregate income. Certain deductions are also allowed to be deducted from the total income in determining the chargeable income of an individual.

Previous PR

The previous PR 4/2018 - Taxation Of A Resident Individual Part I - Gifts Or Contributions And Allowable Deductions was issued on 13 September 2018.

New PR

The Inland Revenue Board of Malaysia (IRBM) issued PR 8/2020 – Taxation Of A Resident Individual Part I - Gifts Or Contributions And Allowable Deductions on 9 October 2020.

Details of New PR

The new PR has been updated to take into account the changes in law in the YA 2019 and YA 2020:

| Changes

|

Effective |

|

Restriction on deduction of gifts and/or contributions made by an individual to the government and approved institutions or organisations is increased from 7% to 10% of the aggregate income. |

From YA 2020 |

|

Subsection 44(11D) of the ITA was introduced to allow a deduction in respect of gift of money in the form of wakaf or endowment. |

From YA 2020 |

|

Medical expenses for serious disease treatment is extended to include fertility treatment. |

From YA 2020 |

|

Maximum amount of deduction for child care fees is increased from RM1,000 to RM2,000. |

From YA 2020 |

|

Maximum amount of deduction for net contribution into the SSPN account is increased from RM6,000 |

For YAs 2019 and 2020 |

|

Maximum amount of deduction for payment of insurance premium and contribution to an approved scheme is increased from RM6,000 to RM7,000. |

From YA 2019 |

Income Tax Exemption On Financial Assistance Received Under The Employment Retention Program

Introduction

The Employment Retention Programme (ERP) was introduced under the PRIHATIN economic stimulus package as an immediate financial assistance for employees who have been given notice to take unpaid leave due to the COVID-19 pandemic. Employees earning wages not exceeding RM 4,000 a month who agreed to take unpaid leave with their employers and participate in the ERP may receive financial assistance of RM600 for a period of up to six (6) months. The funds are channelled from SOCSO to the employees through the employer’s account.

New Exemption Orders

Income Tax (Exemption) (No. 4) Order 2020 and Income Tax (Exemption) (No. 5) Order 2020 were gazetted on 22 October 2020.

Details of New Exemption Orders

Employers are exempted from the payment of tax in respect of any financial assistance fund received under the ERP.

Service Tax Update – Group Relief For Taxable Services

Introduction

With effect from 1 January 2020, group relief is granted even though the taxable service is provided to a third party outside of the same group of the companies, with a condition that the total value of taxable services to third party outside the same group of companies does not exceed 5% of the total value of services provided by the company within a period of twelve (12) months.

Updated Service Tax Guide

The Royal Malaysian Customs Department (RMCD) published the updated Guide on Professional Services on 6 October 2020.

Details of Updated Service Tax Guide

Further clarification has been provided by the RMCD on the calculation of the 5% of the total value of taxable services where the taxable services here mean the total value of the “same taxable service” instead of ALL the taxable services provided by the Company.

For illustration purposes, the following table represents the value of the taxable services provided by Company XYZ to the company within the same group of the companies and third party

|

Value of taxable services |

Company within the group (RM) |

Third party (RM) |

|

Information Technology (IT) services |

500,000 |

10,000 |

|

Management services |

150,000 |

50,000 |

With reference to the above scenario, since there are two (2) types of taxable services provided by Company XYZ, the calculation of the 5% rule should be based on each type of the taxable services provided by Company XYZ.

IT Services

Since the total value of the IT services provided to the third party is not more than 5% of the total value of IT services (i.e. 1.96% or RM10,000 / RM510,000), the IT services provided by Company XYZ to the company within the group of the companies is entitled to the group relief.

Management Services

Since the total value of the management services provided to the third party is more than 5% of the total value of management services (i.e. 25% or RM50,000 / RM200,000), the management services provided by Company XYZ to the company within the group of companies and the third party is not entitled to the group relief.

In view of the above, companies are advised to review this 5% of the total value of taxable services on a monthly basis.