Crowe Chat Vol.2/2021

Accounting & Audit

Business Combinations under Common Control means the combining of entities or businesses which are ultimately controlled by the same party or parties both before and after the business combination i.e. mergers and acquisitions of companies within the same group. Presently, the accounting standard IFRS 3 Business Combinations sets out reporting requirements for business combinations and requires the use of the acquisition method.

What is the scope?

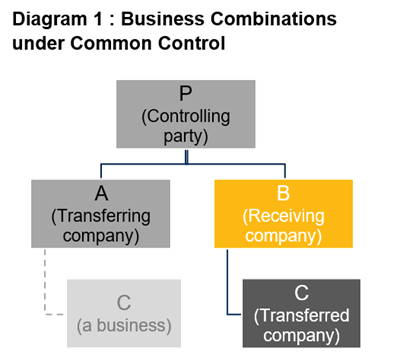

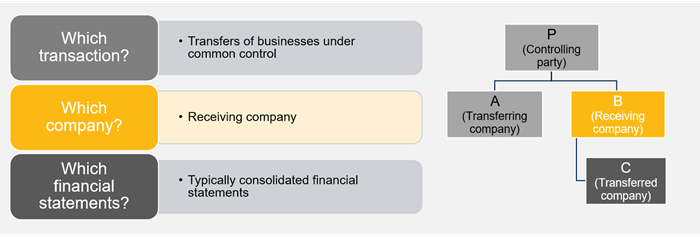

Business combinations under common control are combinations in which all of the combining entities or businesses are ultimately controlled by the same party, both before and after the combination. Diagram 1 illustrates a simple example of a business combination under common control. Companies A, B and C are controlled by the same party which is Company P. Company C is transferred from Company A to Company B.

The scope of transactions considered in this Discussion Paper is limited to those in which a business is transferred. It does not cover transfers of assets under common control or transfers of companies that do not have a business. As shown in Diagram 1, Company C is a business and its transfer is within the scope of the project. Further, the project is considering the reporting requirements on consolidated financial statements of the receiving company which is Company B in Diagram 1. The project is not considering the reporting requirements of other parties affected by the transactions (Company P, A & C).

Summary of scope of the discussion paper

When to apply the acquisition method and the book-value method

| A single method in all cases? | Neither the acquisition method nor a book-value method should apply in all cases |

| How to ‘draw the line’? | The acquisition method should apply when non-controlling shareholders are affected |

| What about the cost-benefit trade-off? | There is an exception to and an exemption from the acquisition method for cases where costs outweigh the benefits |

| When to apply a book-value method? | A book-value method should apply in all other cases |

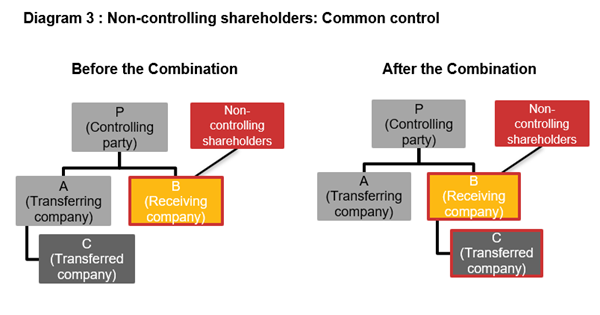

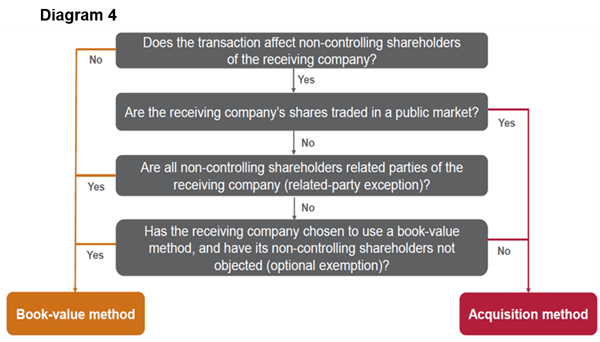

Diagram 3 illustrates a business combination under common control that affects non-controlling shareholders (NCS) of the receiving company. Company B gains control of Company C. As a result, the NCS of the receiving company acquire an ownership interest in the business transferred to the receiving company. The Board’s view is that the acquisition method should be applied for business combinations under common control that affect NCS of the receiving company. For all other business combinations under common control, a book-value method should be applied.

Receiving Company Shares

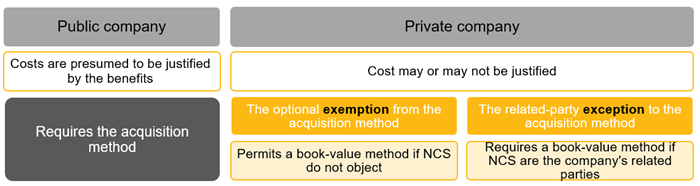

Whether the shares of the receiving company are publicly traded or privately held would determine which accounting method should be used to account for the business combinations under common control. The Board’s view is that publicly traded receiving companies should be required to apply the acquisition method. When the receiving company shares are privately held, the Board is suggesting special conditions for private companies, namely:

- The optional exemption from the acquisition method – the receiving company is permitted to apply the book-value method if the NCS do not object

- The related-party exception to the acquisition method – the receiving company is required to apply the book-value method if the NCS are the company’s related parties.

Diagram 4 summarizes the criteria that would determine when a receiving company should use the acquisition method and when it should use a book-value method.

How to apply a book-value method

Assets & liabilities

IFRS Standards do not specify a book-value method. In practice, a variety of book-value methods are used e.g. using the transferred company’s book values or the controlling party’s book values. These book values differ if the transferred company was previously acquired from a third party.

The Board’s view is that the receiving company should measure the assets and liabilities received at their book values reported by the transferred company (Company C) and not the controlling party’s book values.

In practice when applying a book-value method, companies measure the consideration paid at fair value or book value or, in the case of consideration paid in the receiving company’s own shares, at their par value or a nominal value.

The Board’s view is that the consideration paid should be measured as follows:

- If consideration is paid in assets - at the book values of those assets.

- If consideration is paid by incurring a liability - at the amount determined on recognition of that liability by applying IFRS Standards.

In addition, the Board should not prescribe how the consideration paid in the receiving company’s own shares should be measured.

Difference

When applying a book-value method, any difference between the consideration paid by the receiving company and the book value of the assets and liabilities of the transferred company received in a business combination under common control is typically recognized within the receiving company’s equity.

The Board’s view is that it should not prescribe in which component, or components, of equity the receiving company should present that difference.

Diagram 5 : The Board’s views on a single book-value method

| Assets and liabilities received | Measure at transferred company's book values |

| Consideration paid | Generally measured at book value at the receiving company |

| Difference | Recognize as an increase or decrease in equity |

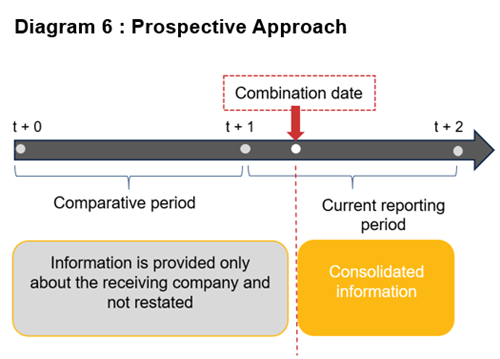

How to provide pre-combination information

The Board’s view is that the receiving company should include the transferred company in its financial statements from the date of combination and, hence, should not restate its pre-combination information i.e. use the Prospective Approach.