Transfer Pricing Focus

Increased Challenges in Chracterization of Controlled Transactions

In this issue, we have prepared supplementary info on Transfer Pricing which comprises of the below:

- Transfer Pricing Compliance – What is Inland Revenue Board of Malaysia (IRBM)’s New Focus?

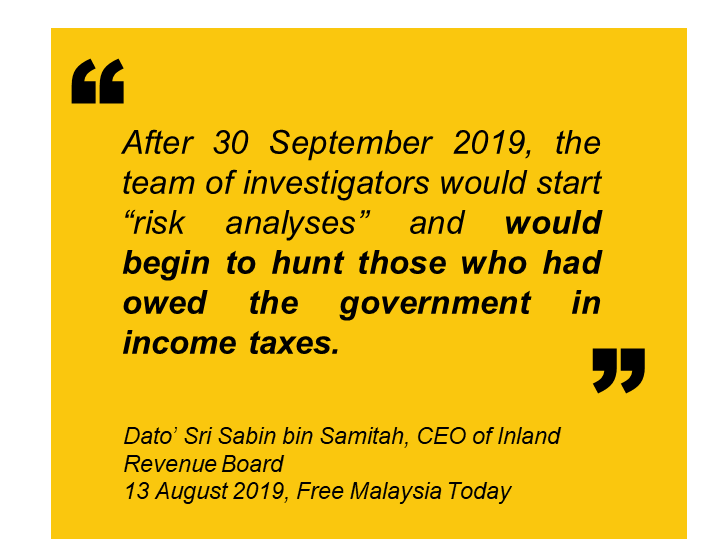

The Special Voluntary Disclosure Programme (SVDP) was launched by the Government since 2 November 2018 to increase tax revenue. With the 30 September 2019 deadline having passed, questions have been raised by the business community on the future plans of the IRBM: Would the IRBM step up the enforcement through increased tax audits or tax investigations? The answer could be found from the following statement:

- Why Characterization is Important in Transfer Pricing?

Characterization analysis of the controlled transaction entered into by the parties who are related to each other, known as associated persons, shall lend support to the arm’s length returns earned by the respective entities.

- Challenges in Characterization in A Post-BEPS (Base Erosion Profit Shifting) World

In the post-BEPS era, i.e. Base Erosion and Profit Shifting Action Plan, with BEPS Actions 8 to 10 seeking to strengthen TP rules, taxpayers need to act mindfully so that their transfer pricing position could withstand the close scrutiny by tax authorities.

- What can the taxpayer do to reduce TP risks?

Check Point: To avoid unwanted shocks to the day-to-day business operations, the taxpayers may wish to assess their readiness on their TP issues. Continue reading...