Listing on Bursa Malaysia - 2024 IPO Highlights and Insights

Wealth creation has evolved, and one notable method is listing a company on the stock exchange. A listed company’s shares become a versatile currency, useful for acquisitions and growth. A larger, more competitive company attracts future investors, creating a cycle of success.

Opportunities abound beyond just issuing shares. Access to capital markets through bonds, convertible loan stocks and more, opens doors to innovation and growth.

In 2024, Bursa Malaysia celebrated a record 55 IPOs, a 72% increase from 2023. This milestone reflects the Exchange's appeal and the continuous efforts to enhance market competitiveness.

We are honored to share our expertise on IPOs, drawing from our extensive experience as IPO advisers, reporting accountants, listed company auditors, tax consultants and internal auditors. If you're considering an IPO, we'd love to chat and embark on this exciting journey with you.

Remember, “If you want to go fast, go alone. If you want to go far, go together.”

Together, let's make your IPO a success!

Download Now

How to list on Bursa Malaysia?

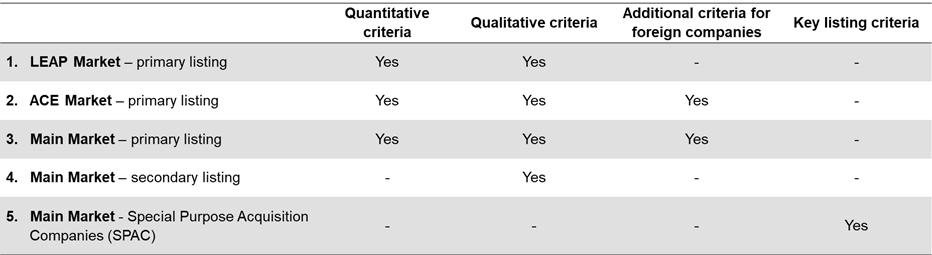

All listing candidates have to meet certain criteria whether quantitative or qualitative. Details of criteria which are not elaborated in this report can be found on Bursa Malaysia's website.

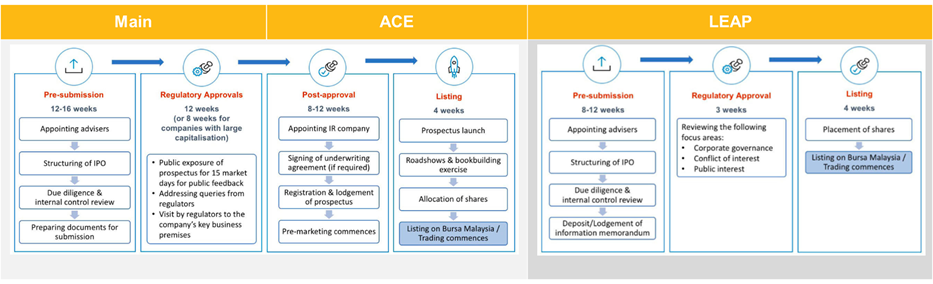

Listing process

The listing process is shown below and the time frame from submission of the listing documents to the Securities Commission until actual listing can be up to 7 months.

The diagrams below are obtained from Bursa Malaysia’s website and publications.

What are the costs of listing?

The costs of listing depend on a number of factors which are principally the size of the listing and the market listed on. A summary of the main costs involved are as follows:

|

|

Type of expense |

Basis of expense |

|

1. |

Bursa processing fee |

|

|

|

a)Main Market

|

RM80,000 & 0.05% of the total market value of securities to be listed and nominal value of any additional securities issued or to be issued subject to a maximum of RM800,000 (inclusive of fees for review of asset valuation, if any) |

|

|

a)Ace Market

|

RM30,000 |

|

|

a)LEAP Market

|

RM9,000 |

|

|

|

|

|

2. |

Fee for registration of prospectus payable to Securities Commission

|

RM15,000 for Main Market and Ace Market

|

|

3. |

Fee for lodgment of Information Memorandum (LEAP)

|

RM500 |

|

4. |

Initial listing fee |

a)Main Market and Ace Market – 0.01% of the total market value of share capital (Minimum of RM10,000 for ACE Market and RM20,000 for Main Market; and maximum of RM20,000 for ACE Market and RM200,000 for Main Market).

b)LEAP Market - RM3,000

|

|

5. |

Annual listing fe

|

a)Main Market – 0.0025% of the total market value of share capital (Minimum of RM20,000 and maximum of RM100,000).

b)Ace Market - 0.012% of the total market value of share capital (Minimum of RM10,000 and maximum of RM20,000).

c)LEAP Market - RM5,000

|

|

6. |

Professional fees (legal advisers, reporting accountants, auditors, valuers, company secretary, internal auditors, independent market researchers, etc) |

Volume of work and complexity involved |

|

7. |

Issuing house |

Volume of work and complexity involved |

|

8. |

Investment Bank’s fees |

|

|

|

a)Advisory fee

|

Volume of work and complexity involved |

|

|

a)Underwriting and placement fee

|

Usually 2% of shares underwritten or placed |

|

|

a)Brokerage fee

|

Usually 1% of shares offered to Malaysian public via ballot |

|

9. |

Printing charges, advertising and miscellaneous |

As incurred |

Overall estimated costs of listing:

|

Type of fees |

Main Market |

ACE Market |

LEAP Market |

|

Approximate minimum fees |

RM5+ million |

RM4 mil to RM5 mil |

RM1 mil to RM2 mil |

Read More

Latest News & Insights

Stay up-to-date with our newsletter

Our experts