Implementation of Pillar Two Global Minimum Tax in Malaysia

The year 2025 marks a new dawn in the Malaysian tax landscape with the implementation of the Global Minimum Tax (“GMT”) regime for large multinationals, aligned with international tax development towards a fairer corporate taxation system.

Multinationals with annual revenues of at least EUR 750 million, in at least 2 of the 4 consecutive financial years immediately preceding the tested financial year, shall be subject to either the Multinational Top-up Tax (MTT) or Domestic Top-up Tax (DTT), stipulated in Part XI of the Malaysian Income Tax Act 1967.

The Finance (No. 2) Act 2023, enacted on 29 December 2023, provides that Part XI shall have effect for the Financial Year beginning on or after 1 January 2025 and subsequent Financial Years. Malaysia’s GMT framework is principally derived from the OECD’s Global Anti-Base Erosion (GloBE) Model Rules.

Top-Up Tax Mechanism

The DTT or MTT seeks to ensure multinationals pay a minimum tax of 15% to the Inland Revenue Board of Malaysia (MIRB) using a top-up mechanism, where their effective tax rate is below 15% in Malaysia and/or all countries they operate.

Domestic Top-up Tax (DTT)

DTT, also referred to as the Qualified Domestic Minimum Top-up Tax (QDMTT), applies to Malaysian constituent entities (CEs) of both foreign and Malaysian Ultimate Parent Entities (UPEs) where the Effective Tax Rate (ETR) in Malaysia falls below 15%. Under this mechanism, Malaysia is entitled to impose and collect the top-up tax to ensure that Malaysian subsidiaries of multinational enterprise (MNEs) groups are subject to a minimum tax of 15% to the MIRB. This approach safeguards Malaysia’s taxing rights by allowing it to collect the top-up tax before any foreign jurisdiction can do so under the GMT framework.

The computation of DTT is inherently complex and technical, and is governed by the following formula:

DTT = (15% - ETR) x Net GloBE Income

Where:

- ETR = Adjusted Covered Taxes of CEs divided by the Net GloBE Income of the jurisdiction (i.e. Malaysia) for the Financial Year

- Net GloBE Income = GloBE Income less GloBE Losses, of all CEs located in the jurisdiction (i.e. Malaysia) for the Financial Year

- GloBE Income = Financial accounting net income (or loss) add GloBE adjustments

“GloBE adjustments” include adjustments made to exclude certain income (e.g. dividends from controlled entities, equity gains/losses), inclusion of certain expenses (e.g., stock-based compensation, accrued pension costs), etc. These adjustments are made to align the financial accounting income with a standardised measure of taxable income.

Multinational Top-up Tax (MTT)

MTT applies to Malaysian-headquartered UPEs that have CEs operating in foreign jurisdictions with an ETR below 15%. Under the Income Inclusion Rule (IIR), Malaysia is entitled to collect the top-up tax from the Malaysian UPE on the low-taxed income of its foreign subsidiaries. This mechanism ensures that the overall group is subject to a minimum global tax rate of 15%. The IIR grants taxing rights to the jurisdiction of the UPE in this case, Malaysia, allowing it to impose the MTT.

The formula for calculating the MTT is as follows:

MTT = (15% - ETR) x Excess Profit

Where:

- Excess Profit = Net GloBE Income - Substance-Based Income Exclusion (SBIE)

- SBIE = Jurisdictional payroll carve-out and the tangible asset carve-out for each CE

The exclusion of SBIE from Net GloBE Income is intended to acknowledge genuine economic activity within a jurisdiction, as evidenced by the employment of personnel and the utilisation of tangible assets in that jurisdiction. The SBIE for a jurisdiction is calculated as the sum of 5% of eligible payroll costs and 5% of the carrying value of eligible tangible assets located in that jurisdiction. For the initial eight years of implementation (i.e., from 2025 to 2032), Malaysia applies higher transitional percentages to both components to ease the impact of the GMT. If a jurisdiction's SBIE amount equals or exceeds its Profit (Loss) before Income Tax, it suggests that the jurisdiction is unlikely to have significant excess profits. Consequently, the Tested Jurisdiction may qualify for the safe harbour provision.

The Mechanism

The diagram below illustrates the steps in determining the top-up taxes that would apply under GMT in Malaysia:

A. Determination of Revenue Threshold

An MNE Group must check if it meets the four-year test (having EUR 750 million revenue in at least two out of four prior years).

The consolidated revenue for the current year (Year 2025) is not factored into the four-year calculation to ensure that an MNE Group knows, at or soon after the beginning of the tested fiscal year, whether it will be in scope of the GloBE rules in that year.

As shown in the diagram above, the revenue threshold test looks at the previous four years when assessing whether an MNE Group is within scope. In this instance, the consolidated revenues were above the threshold of EUR 750 million in two out of four prior years, i.e. in 2022 and 2024. Even though the MNE Group did not have more than EUR 750 million in consolidated revenues in all four years, it meets the threshold test.

Once the MNE Group identifies whether it meets the GMT four-year consolidated revenue threshold test, the next step is for the MNE Group to determine/allocate the CE’s income.

B. Determination of CEs

A CE is any legal entity, such as a company, that is part of an MNE Group. In addition, a CE also includes an arrangement that prepares separate financial accounts, such as a partnership or trust, and prepares consolidated financial statements together with other entities in the same MNE Group.

Each CE must determine its Net GloBE Income, such as:

- UPE

- Intermediate Parent Entities

- Operating subsidiaries, branches, and other operational units

- Joint ventures

- Permanent Establishment (PE)

Excluded Entities

The following entities are “Excluded Entities” from the GloBE rules:

- Governmental entities

- International Organisations

- Non-Profit Organisations

- Pension Funds

- Investment Funds that are UPEs

- Real Estate Investment Vehicles acting as UPEs

- Entities with at least 95% ownership by an Excluded Entity, engaged in fund investment or ancillary activities.

- MNE Groups with International Shipping Income, where CE’s shipping income is excluded from GloBE Income calculations.

C. Calculation of Net GloBE Income & Adjustments

The MNE Group may determine the Net GloBE Income via the CE’s Financial Accounting Net Income or Loss, before making any consolidation adjustments that would eliminate income or expense attributable to intra-group transactions.

Certain types of income or expenses are adjusted to arrive at the CE’s GloBE Income or Loss, namely:

- Net tax expenses must be excluded

- Gains or losses from the revaluation of assets or liabilities must be included

- Non-deductible expenses (e.g., fines, penalties, non-compliant tax schemes) must be added back

- Qualified Refundable Tax Credits shall be treated as income

- Dividends from subsidiaries or related parties are excluded

- Capital gains from equity investments are not included

- Asymmetric foreign exchange effects must be excluded

- Profits from international shipping are not part of Net GloBE Income

- Prior period errors affecting taxable profits must be corrected.

- Changes in accounting principles impacting income must be considered

- Gains or losses from the sale of assets and liabilities should follow the Arm’s Length Principle

- Accrued pension expenses that are not fully deductible must be removed.

D. Determination of ETR and Top-Up Tax

Under the GloBE Rules, CEs within an MNE Group must assess their jurisdictional ETR and determine whether a top-up tax applies.

Application of ETR Formula

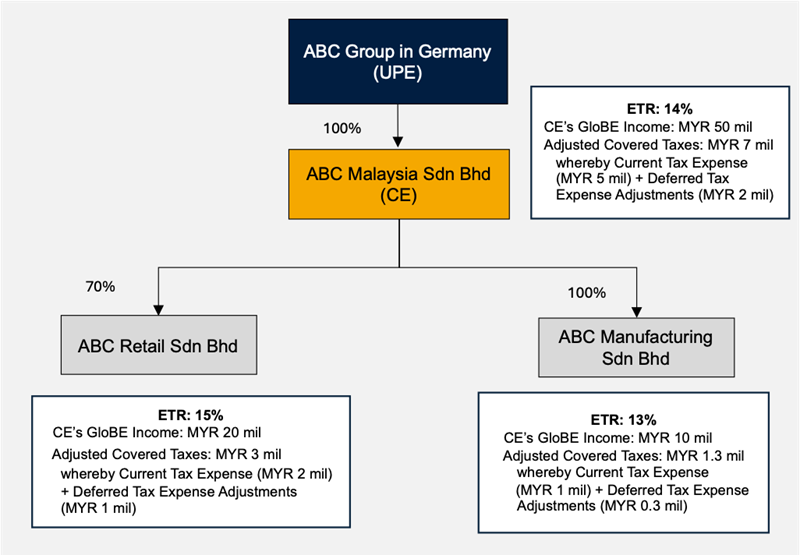

We illustrate an example of ABC Group, headquartered in Germany, with subsidiaries in Malaysia, Singapore, and the US. If ABC Malaysia Sdn Bhd has an ETR lower than 15%, it may be subject to DTT in Malaysia.

The ETR calculation is performed at the jurisdictional level (i.e. Malaysia) for each MNE subgroup. Since tax bases differ across jurisdictions, the GMT relies on financial accounts to build a consistent approach to calculating the ETR:

| ETR= | Adjusted Covered Taxes of each CE in Malaysia |

| Net GloBE Income in Malaysia |

Adjusted Covered Taxes are the current tax expenses reported in the Financial Accounts net income or loss for the financial year. It is to be noted that no Covered Taxes amount may be considered more than once.

- Adjustments to Covered Taxes are:

- Additions: Current tax expenses, deferred tax adjustments, and uncertain tax positions from previous years.

- Reductions: Credits or refunds of Non-Qualified Refundable Tax Credits, tax expenses not expected to be paid within three years

- Deferred Tax adjustments are:

- Deferred tax expenses must be recalculated to reflect the Minimum Rate (15%)

- Deferred tax liability from five years prior must be recaptured

- Allocation of Covered Taxes whereby taxes are allocated among different CEs based on:

- PEs

- Controlled Foreign Company (CFC) Regimes

- Hybrid Entities

- Distributions among CE owners

Example 1: DTT triggered by ETR below 15% in Malaysia

The ETR is calculated at the jurisdictional level (Malaysia) for all CEs. If a Malaysian CE’s ETR is below 15%, Malaysia imposes DTT to bring it up to 15%.

The following is an illustration of ETR calculations for ABC Malaysia Sdn Bhd and its subsidiaries in Malaysia.

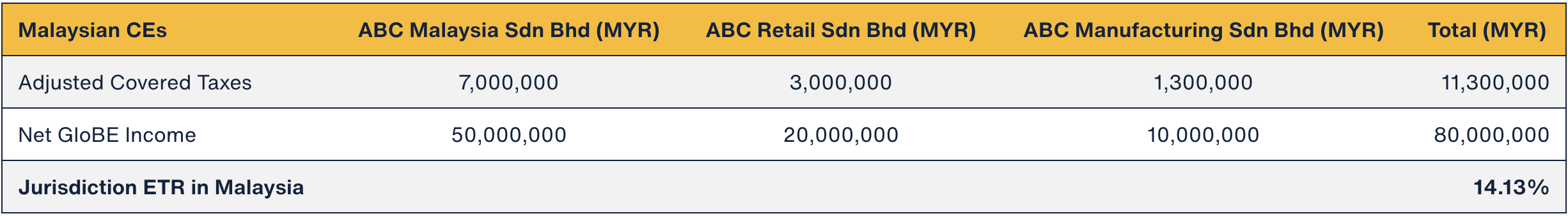

Jurisdiction ETR in Malaysia

Based on the example above, the jurisdiction ETR in Malaysia is computed as follows:

The above example shows that the jurisdiction ETR in Malaysia of 14.13% is below 15%. As such, there will be a DTT of 0.87% (i.e. 15% - 14.13%) in Malaysia.

Tax Administration

GloBE Information Return & Top-up Tax Return

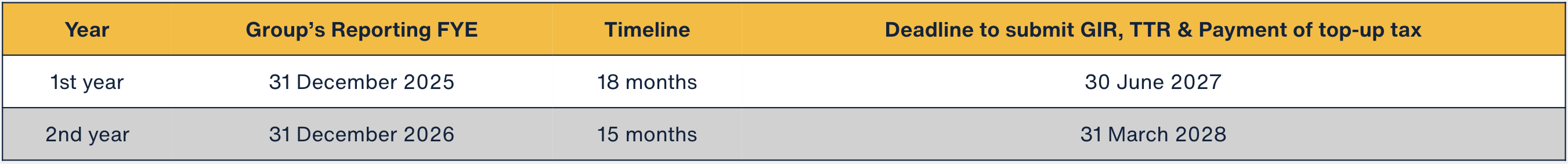

Under the OECD’s Pillar Two GloBE Rules and Malaysia’s implementation of the GMT, top-up tax is calculated at the jurisdictional level, but returns are submitted by each CE that is liable for top-up tax in that jurisdiction. Every CE of an MNE Group shall submit to the IRBM a GloBE Information Return (“GIR”) and a Top-up Tax Return (“TTR”) for each Financial Year electronically not later than 15 months from the last day of the Reporting Financial Year, specifying the amount of tax payable, if any, for that year.

As a transitional measure, for the first financial year when an MNE Group is required to file the GIR and TTR, it is given an additional time, i.e. 18 months to do so. The returns filed by the CE shall be deemed to be a notice of assessment by the Director General of Inland Revenue. The due date of payment of tax shall fall on the same date as the tax filing, i.e. last day of the 15th month from the close of the Reporting Financial Year.

An example of the timeline is illustrated below:

Having said that, there is an exemption given on GIR if the prescribed form has been filed not later than 15 months from the last day of the Reporting Financial Year by the UPE or Designated Filing Entity (“DFE”) of the MNE Group that is located in a jurisdiction that has a Qualifying Competent Authority Agreement in effect with the Government for the Reporting Financial Year. Generally, the GIR should be filed by the UPE or DFE to disclose the details of the top-up tax calculation and is to be submitted to IRBM. The IRBM will then exchange such information with relevant tax jurisdictions. Whereas, the TTR needs to be submitted by each CE in Malaysia which discloses the tax liability of each CE. The TTR is intended to be a simplified return as compared to the GIR.

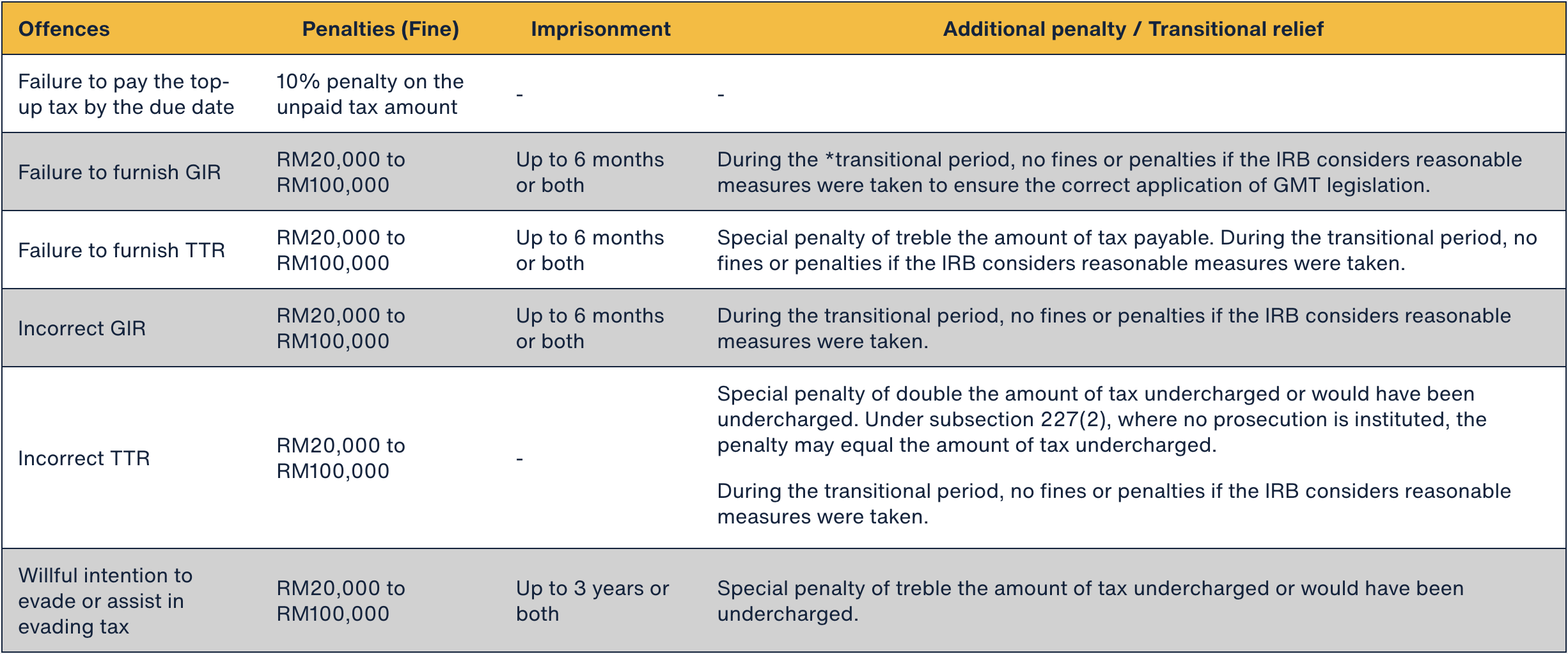

To understand and comply with these new compliance requirements, companies should mobilise the necessary resources to gather the information and perform the calculations to avoid any unforeseen surprises in the future.

The table below summarises the penalties under the ITA for non-compliance offences related to GMT:

*Note: Transitional period applies to Financial Years starting on or after 1 January 2025, not exceeding 31 December 2026, and not ending after 30 June 2028. By 30 June 2028, it is expected that all affected entities will have had at least one full financial year under the new regime.

Ramifications for MNEs in Malaysia

The implementation of GMT will have several implications for businesses in Malaysia:

- Malaysia’s competitive tax incentives may be affected, as ETR below 15% may trigger top-up taxes. MNEs must evaluate the sustainability of existing tax incentives and explore alternative tax-efficient structures.

- MNE Groups must reassess tax strategies to optimise ETR while ensuring compliance.

- Complexity in tax calculations and filing requirements will require robust accounting systems.

- Transfer Pricing structures must align with the arm’s length principle to prevent disputes.

- MNE shareholders may face reduced dividend payouts due to the additional tax burden.

- Under IAS 12 Income Taxes, MNEs must make additional disclosures in their financial statements and record accruals for potential Top-up Tax exposure, ensuring full transparency.

As Malaysia adopts these international tax standards, keeping abreast of the legislative updates and engaging in strategic planning will be crucial for multinational businesses. Early understanding of the impact of the GMT and preparation will be critical to an effective and efficient implementation.

MNE groups falling under the GloBE Rules should consider the following:

- Conduct impact assessments to identify potential risk areas.

- Develop systems to handle GloBE Rules calculations efficiently.

- Engage in tax planning to minimise exposure to top-up taxes.

- Prepare for GIR and TTR filing, ensuring compliance with the reporting obligations.

Need clarity on Pillar Two and its impact on your business?

FAQs on Global Minimum Tax in Malaysia

Other articles

Stay up-to-date with our newsletter

Our expert