Transfer Pricing Documentation under the Malaysian Transfer Pricing Guidelines 2012

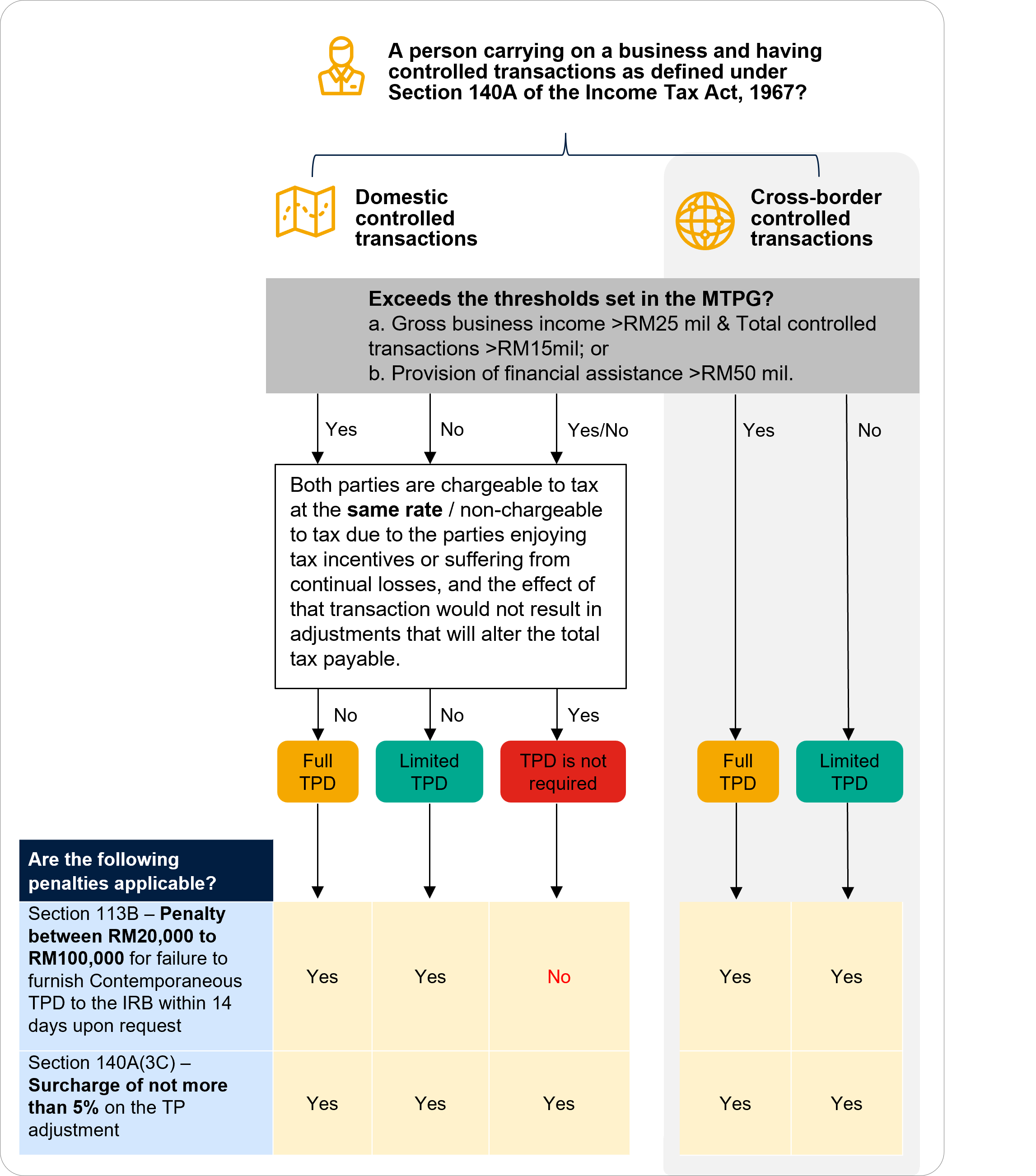

Companies are required to prepare Transfer Pricing Documentation or TPD when they enter into business transactions with their related parties. According to the Inland Revenue Board’s (“IRB”) Transfer Pricing Guidelines 2012 (“MTPG”), the extent to which a TPD is to be prepared would depend on a few factors.

According to Paragraph 1.3.1 of the MTPG, companies falling under certain thresholds mentioned below are required to prepare a comprehensive set of TPD, i.e. Full TPD:

- Non-financial transactions: where a person carrying on a business has an annual gross income exceeding RM25 million, and total amount of related party transactions exceeding RM15 million per annum; or

- Financial transactions: where a person provides financial assistance exceeding RM50 million.

Paragraph 1.3.2 of the MTPG states that any person falling outside the scope of 1.3.1 may opt to comply with TPD requirements under paragraph 11.2.4 by providing certain information such as (a) Organizational Chart, (c) Controlled Transactions and (d) Pricing Policies only, i.e. Limited TPD.

Further, pursuant to Paragraph 1.3.3 of the MTPG, TPD is not applicable to transactions between persons who are both assessable and chargeable to tax in Malaysia and where it can be proven that any adjustments made under the Guidelines will not alter the total tax payable or suffered by both persons.

Despite the guidelines provided in the MTPG, due to lack of details provided by the IRB, companies are often faced with the dilemma on how best they can meet the TPD requirements under Paragraphs 1.3.1, 1.3.2 or 1.3.3 above, to ensure full compliance with the law vis-à-vis minimizing compliance costs.

What are the latest IRB’s guidelines on TPD requirements?