Authors: Mark Allen, Partner and Pete Marshall, Assistant Manager, Corporate Finance.

The second quarter of 2025 closed with notable developments in the UK technology sector, underscoring both resilience and opportunity. While the full impact of recent policy moves remains to be seen, the UK government continued to signal strong support for the industry. Key announcements included the introduction of the Cyber Security and Resilience Bill – timely in the wake of cyberattacks on major UK retailers, and a strategic partnership with Google Cloud aimed at modernising legacy public sector IT infrastructure and upskilling 100,000 civil servants by 2030.

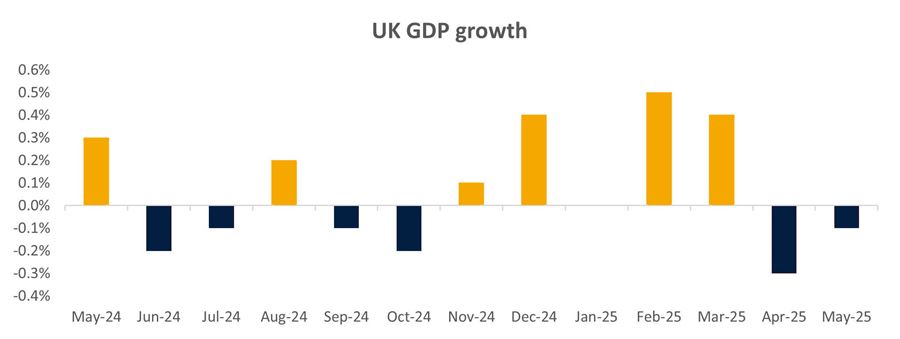

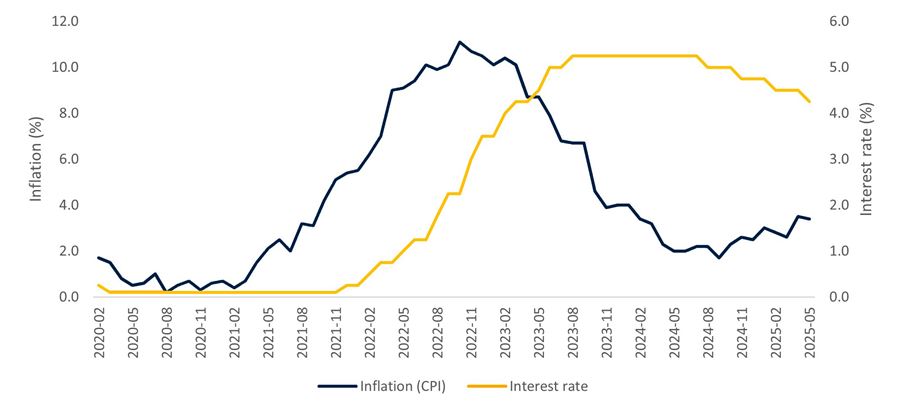

On the macroeconomic front, the UK economy unexpectedly contracted in May, defying Reuters forecast of 0.1% growth. As illustrated in the GDP chart below, growth has been inconsistent over the past year which is driving weaker investment sentiment in many industries, including technology. The surprise downturn this month, despite a temporary pause in Trump-era tariffs, has increased speculation around earlier than expected interest rate cuts, even as inflation has risen in the last few quarters (with the latest CPI reading in June of 3.6%). Meanwhile, rumours of increased income taxation continue to dominate headlines, reflecting the broader economic challenges that come with increased spending and rising government debt levels.

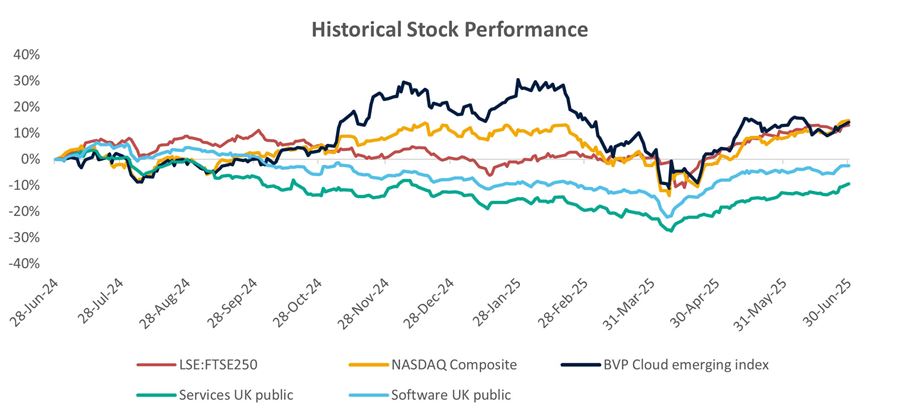

Despite these headwinds, equity markets showed resilience. The FTSE 250 climbed 18% over the quarter, buoyed by easing trade tensions following the 90-day suspension of US tariffs. Across the Atlantic, optimism surged as US tech indices hit record highs, with the NASDAQ soaring 30% in Q2.

Encouragingly for the UK tech sector, deal activity held up well. Quarter on quarter, total deal volumes rose 9% to 175, while deal values surged 82% to £9.4 billion, driven by several high-profile transactions that closed in the quarter. These include the merger of VMO2's business comms and IT business with Daisy group and the SBO of Wireless Logic.

Highlights

- VMO2 merger with Daisy: VMO2 has announced plans to merge its business communications and IT operations with Daisy Group, creating a £3 billion telecoms company. VMO2 will hold a 70% stake in the new entity, while Daisy will hold the remaining 30%. The combined business is expected to serve around 700,000 customers and emerge as a stronger competitor to the dominant UK telecoms provider, BT.

- Data Protection and Copyright Amendments Bill: Passed by Parliament on the 11 June 2025, this significant legislation modernises the UK’s data laws to foster innovation, economic growth and public trust. It is a vital start in positioning the UK to become a global leader in AI and AI safety.

- Sharp stock market rebound in Q2: The tech-heavy Nasdaq saw a strong rebound in Q2, driven by a broader tech-led rally. Contributing factors included the easing of tariff concerns (with Trump’s pause announcement sparking a 9% surge in a single day), robust tech earnings, subdued macroeconomic data in the US, and continued speculative momentum into high-growth, low-profitability tech firms.

Observations

- Cybersecurity remains a top target for investors:

Cybersecurity continues to attract strong interest from PE and large IT service providers, driven by its growth potential and stickiness of revenues. Notable deals this quarter include Transputec’s acquisition of Armadillo and Redsquid’s acquisition of ZeroDayLab. The increasing threat of data hacking and prevalence of high profile data breaches remain a driver for cybersecurity outperformance. - PE-backed acquirers become more prominent:

In Q2 2025, 45% of recorded deals involved a PE or venture capital backed acquirer – up from 39% in the previous quarter and 40% in Q2 2024 – as investors look to put capital to work and pursue inorganic growth strategies. International buyers remained the second most active acquirer in the UK technology M&A market, accounting for 23% of deals. The remaining activity was relatively evenly distributed among owner managed businesses, PE platform deals and listed companies. - Valuations - IT services: Resilient, but below the 2022 highs:

Transaction values in the IT services sector remain resilient, though they continue to trend below the elevated levels seen in 2022. EV/EBITDA multiples have normalised from an average of mid-teens to a range of 8-12x, where the specific multiple will be largely influenced by factors such as historical/projected growth, repeatability of revenues, scale, end-user market dynamics and the quality of management. Exceptional, best in class businesses may still command premiums in the mid-teens and above, however. - Valuations - Software: 5x sales no longer the norm:

Typically valued on a multiple of revenue or ARR rather than EBITDA, transaction values in the software sector have also experienced a fall from the elevated levels of 2022. While 5x revenue used to be the standard for a software business, the range now sits between 3-4x revenue. Software valuations will be impacted by the level of contracted recurring revenue, growth, customer churn, the size of the addressable market and profitability or the path to profitability. The premium valuations in software we are seeing at the moment (closer to 10x revenue or above), are typically for AI or AI native businesses.

Outlook

We maintain our cautious but optimistic outlook on the UK technology M&A market. It remains constrained by the macroeconomic backdrop, there is still too much uncertainty which is holding back business owners from making key corporate decisions and interest rates need to fall further to start unlocking the debt markets and increasing PE activity. Suppressed growth increases the importance of cost control and balance sheet strength. Riskier strategic decisions are harder to justify and investment decisions are therefore slower and often being disrupted by operational challenges.

However, there remain signs for optimism, including larger deals that closed this quarter and key sub-sectors that continue to drive activity such as cybersecurity, fintech and HCM (as previously highlighted).

It is pivotal for technology business owners to be prepared well ahead of time for a transaction in this market, as scrutiny in DD processes is high. Repeatability of revenue stands out as the key metric that acquirers are focused on at the moment to derisk an acquisition. This alongside quality of earnings, operational efficiency and a large and growing addressable market remain key to obtaining a premium valuation in this market.

Spotlight on technology VC funding

The UK has retained its position as the number one destination in Europe for tech sector investment. According to Dealroom Data, UK Startups and scaleups raised £7.4 billion in the first half of 2025 – up 16% from the same period last year. The total surpasses the combined investment into France and Germany.

The increase in funding was primarily driven by activity in enterprise applications, fintech and media. London dominated the landscape, accounting for 77% of total capital raised. Major funding rounds exceeding $100 million included DAZN, Rapyd and Dojo.

This momentum underscores the UK’s status as one of the most attractive global hubs – second only to the US, for building and investing in technology businesses. It is expected to further fuel economic growth and job creation across the country.

Capital Markets

IPO markets globally remain cautious, with investors continuing to focus on quality, sustainability, and profitability. Global IPO activity held up surprisingly well given the backdrop of inflation, geopolitical tension, and interest rate uncertainty. While larger-cap activity remains slow, AIM has continued to attract founder-led businesses, private equity-backed exits, and sector specialists seeking long-term growth capital.

There was only one technology IPO in the UK in the period, Sundae Bar. We have seen a decline in take private activity by overseas buyers after this was a prominent feature of 2024, but the environment still feels like we are more likely to see removals rather than additions of technology companies from the public markets. Deliveroo was taken private by Doordash in the quarter and there are still rumours over the take private of Alfa Financial Software, as two examples.

In Q2 2025, global equity markets experienced a volatile but ultimately strong rebound. The tech heavy Nasdaq, the BVP Cloud emerging index and the FTSE 250 all delivered a double-digit share price gain, whilst our UK software and services indexes underperformed.

SME Focus

Key highlights in the lower mid-market

- Deal volumes hit lowest levels in last five years: Transaction activity in the lower mid-market has declined significantly, feeling the pressure more acutely than the broader market. While the lower mid-market is typically more shielded from macroeconomic pressures, confidence is impacting deal activity.

- Uptick in IT Consulting deals: There were 17 IT consulting deals in the quarter, compared to 11 last quarter. A standout deal in the quarter was the investment into digital transformation consultancy Enfuse group by Agathos.

Crowe Activity

Q1 2025 transactions we advised on:

- Dotdigital Group plc acquires influencer and affiliate marketing platform, Social Snowball

- BGF investment in retail technology consulting business PMC

Case study – BGF investment in PMC Global HoldingsBGF completed a minority investment in PMC Global Holdings Limited (PMC), a commerce technology services provider founded by Paul Mason in 2001. Crowe completed both the financial and tax due diligence on behalf of BGF. |

Sources for article: Pitchbook, Megabuyte, ONS, Bank of England

Supporting you

Contact us