Mid-market private equity landscape

Outlook and considerations

In 2025, the UK’s mid-market private equity landscape is continuously evolving amid new trends and strategic considerations. With sector-specific rebounds and the rise of serial acquirers, private equity firms are leveraging improved financing conditions and alternative funding sources to drive growth and capitalise on new opportunities. Mid-market companies also have opportunities to expand margins by scaling operations and improving efficiency.

Below is a summary of some of the trends in 2025 so far, that we may expect to continue throughout the year:

More favourable market conditions

We are currently observing a market sentiment where rates and inflation are stabilising, providing more certainty and potentially lowering the cost of borrowing. Financial conditions in the UK are anticipated to improve this year as a result of:

- cuts in interest rates announced by the Bank of England on 8 May 2025

- government initiatives to support business investment

- increased capital availability.

These factors have made acquisition financing more attractive. Historically, private equity has performed well on the back of low interest rates and multiple expansions, enabling firms to pursue additional deals and capitalise on emerging opportunities. Dealmakers are expecting current conditions to enable enhanced financing conditions and stronger portfolio company cashflows, supporting a robust M&A rebound in the second half of 2025.

Private capital is also increasingly serving as an alternative funding source for corporate borrowers. The decline of regional lenders has slowed traditional bank lending, prompting private equity firms, with substantial amounts of “dry powder” (unallocated capital), to step in. This shift is providing companies with flexible financing options and enabling private equity firms to capitalise on attractive investment opportunities.

A maintained focus on fragmented markets

In response to previous market conditions, private equity firms have strategically focused on stabilising and strengthening their current investments rather than pursuing new, potentially riskier opportunities. A key investor strategy has been engaging in buy-and-build initiatives and becoming ‘serial acquirers’ to accelerate growth beyond organic capabilities.

‘Serial acquirers’, especially in the lower mid-market, are becoming prominent by driving long-term value through recurring acquisitions and continually refining their skills and optimising processes.

In fragmented sectors, several private equity firms are strengthening their portfolios by consolidating smaller players to drive growth, lower risk expansion and leverage valuation arbitrage to enhance returns. Within fragmented sectors, companies are often small enough that strategic add-on acquisitions can enhance equity value, particularly in recurring-revenue markets. Conversely, in consolidated and mature sectors, M&A activity tends to have a more limited impact.

Building off the back of a strong 2024, fragmented markets such as financial services and professional services are expected to continue being strong contributors to deal activity.

Increased deal activity from delayed exits

Deal activity in the sector has fluctuated in recent years, influenced by various economic and political factors. However, some investors suggest a bullish 2025 outlook following an uptick in activity in 2024.

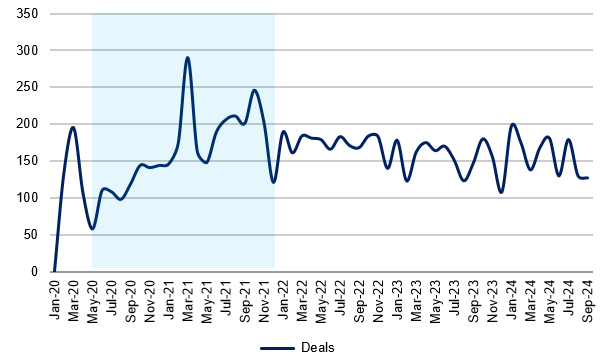

2020 trading volumes were unusually low as a result of the COVID-19 pandemic, although a post-pandemic recovery resulted in high deal volumes as investors took advantage of record low interest rates to execute on a backlog of deals. Exits declined towards the end of FY22, normalising from a post-pandemic recovery. Additionally, several investors resisted exiting portfolio companies due to a strained market. Market challenges persisted into 2024, albeit with a slight pickup in dealmaking.

These reduced exits have delayed and shifted the investment lifecycle of many private equity firms’ portfolio companies, entering the ‘maturity and exit’ stage. With some investors anticipating market improvements that can maximise deal value and returns, there is a substantial pipeline of postponed deals that are now coming to market. Coupling this with interest rates and inflation stabilising, along with substantial capital available, the UK could be set for a more positive deal-making environment in 2025 and increased deal activity.

Source: Mergers and Acquisitions Survey from the Office for National Statistics

The total number of monthly domestic and cross-border M&A involving UK companies. Low volumes following Mar-20 and Nov-21 due to COVID-19 lockdowns.

Deal activity could also be influenced by the broader economic policies of a Labour government, such as higher taxation, which can influence market responses and economic conditions, affecting the exit opportunities and valuations of companies. The Autumn Budget 2024 expedited some deal timelines to ensure completion ahead of potential tax changes, whilst some companies delayed M&A activity to fully assess the impact of any budgetary changes.

Value creation and operational focus in the mid-market

While private equity has consistently generated strong asset-level returns, the mid-market has emerged as a particularly attractive place to invest, given the vast supply of privately owned targets and the greater potential for outsized value creation. By definition, mid-market investments usually have a smaller market share, allowing headroom for organic growth. In contrast, mature market leaders typically have limited potential for future growth.

Following the 2024 budget announcements, private equity firms are expected to maintain a pragmatic approach to cut costs and improve efficiencies. Rising costs – driven by increased national minimum wage, higher National Insurance contributions rates and lower thresholds national insurance thresholds for employers (from April 2025) – will impact portfolio companies’ cost bases.

However, many mid-market companies are prioritising operational enhancements, including talent investment, digital transformation and streamlining processes, to drive value creation and organic growth. We envisage this to continue into 2025, even with increased optimism for a favourable market.

Sector-specific rebounds

In 2025, private equity has seen notable sector-specific rebounds driven by macroeconomic trends and technological advancements. Key sectors experiencing significant growth include technology, healthcare, pharma and renewable energy, benefiting from increased demand, innovation, and supportive regulatory environments. In contrast, industries such as banking and retail are recovering more slowly, reflecting broader market conditions.

The private equity landscape in 2025 is expected to continue being characterised by strategic consolidation, sector-specific growth and innovative financing solutions. As these trends evolve, private equity firms are well-positioned to navigate market complexities and drive sustainable growth.

For more insights or to discuss how we can support your business, contact Dan Nixon or your usual Crowe contact.

View our Corporate Finance latest dealsContact us

Our latest thinking