Better Lease Accounting

Understanding FRS 102 and lease accounting for charities and non profits

The latest addition to our Better series, Better Lease Accounting, provides a comprehensive overview of the changes to lease accounting resultant from the latest iteration of FRS 102.

Providing a clear explanation of the guidance and over 40 worked examples to help make it come to life, this guide clearly explains the changes to lease accounting within FRS 102 and the steps organisations will need to take to determine the correct accounting treatment.

The guide also comes with a complimentary Excel workbook, our FRS 102 Lease Implementation Tool. This tool has been developed to help support charities in applying the updated lease requirements.

Please note: Charities must prepare their accounts in accordance with the Charities SORP (FRS 102) (hereafter ‘the SORP’). At the time of writing, the SORP is out for consultation and has not yet been updated to reflect the latest amendments to FRS 102. The aim of this guidance document is to help charities understand the updated requirements, utilising simplified examples and illustrations. It does not introduce any requirements beyond those specified in FRS 102.

This is a significant change in financial reporting for charities and non profits who follow the SORP, and the sooner you can start to understand the changes, the better prepared you will be to manage and mitigate any impact.

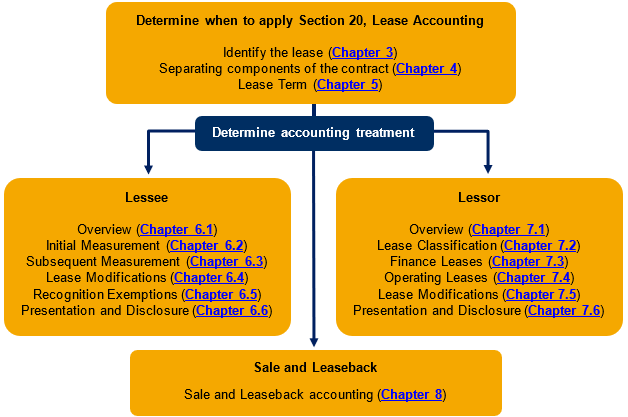

Our guidance is set out in the same order as the requirements of FRS 102. You can visualise this in the diagram below.

The update to FRS 102 provides a single framework for lessee accounting, offering a more faithful representation of leasing transactions. The classification of leases as either operating or finance leases for lessees has been removed, replaced by on-balance sheet lessee accounting. Minimal changes have been made to lessor accounting.

Under FRS 102, lessees must apply a modified retrospective approach, recognising a lease liability for the obligation to make lease payments over the lease term and a corresponding right-of-use asset in the Statement of Financial Position (Balance Sheet). Practical exemptions exist for short-term leases and leases of low-value assets.

If you’d like to discuss the impact of FRS 102 on your charity, please contact Naziar Hashemi, or your usual Crowe contact.

Reports, briefings, newsletters

Resource library

Contact us