Use and enjoyment

Understanding its impact on supplies of services

VAT rules can be complex, and one area that frequently raises questions is the use and enjoyment rule. Many of our clients seek clarity on how this applies, particularly for electronically supplied services, because it’s application can have quite significant impacts with regard to accounting for VAT on supplies.

The provision exists to ensure that VAT is charged where a service is actually used, rather than where it is contractually supplied. Below we have outlined the rules and key points to consider with regard to its application.

What is the use and enjoyment rule?

Use and enjoyment rules override the normal UK VAT place of supply rules in cases where they would create an unfair VAT outcome. The aim is to ensure taxation aligns with actual consumption.

In the UK the general rules for the place of supply of services is as follows:

- for Business to Business (B2B) supplies, the place of supply is where the recipient is located

- for Business to Consumer (B2C) supplies, the place of supply is where the supplier is located.

However, there are several exceptions to the general rule and use and enjoyment is one of these. An example of the use and enjoyment rules kicking in would be:

- A UK business buying telecoms from an EU supplier.

Normally, under the general B2B rule, the place of supply would be the UK, and the UK business customer would account for UK VAT under the reverse charge mechanism. However, if the UK business customer uses these services outside of the UK for call centres that are physically located in France for example, then the use and enjoyment rules shift the place of supply to the location where the service is consumed (i.e., France in this instance).

- A UK supplier of broadcasting services to private customers in Spain.

Although the place of supply would typically be Spain, where the customer belongs, use and enjoyment rules override this if the services are enjoyed in UK. Therefore, the place of supply becomes the UK and hence UK VAT should be charged.

What does the use and enjoyment rule apply to?

It is important to fully understand what it is you’re supplying and who you are supplying your services to. It isn’t unusual for recipients to have establishments in more than one country, and for use and enjoyment purposes it is important to identify these at the outset.

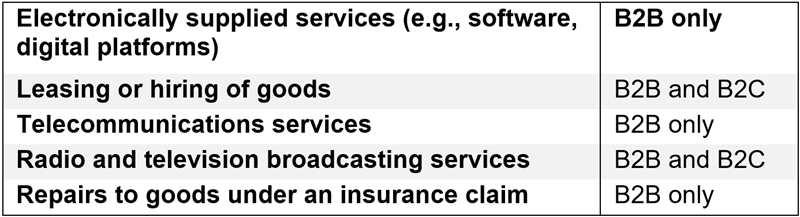

The use and enjoyment rule applies only to the following services

The VAT treatment in these cases depends on specific circumstances and businesses must assess these carefully before raising invoices.

Some key points to be aware of include:

- a UK business supplying services to which the use and enjoyment rules apply to a non-UK customer may still be required to charge UK VAT if the service is used and enjoyed in the UK

- some countries apply different use and enjoyment rules, meaning VAT obligations may shift based on consumption

- applying an incorrect VAT treatment can lead to assessments and penalties being levied by tax authorities

- there is the possibility that the use and enjoyment rules result in the service being deemed to be ‘used and enjoyed’ in more than one country. An apportionment will then need to be made to ensure VAT is accounted for in the correct place and at the right time.

Master service contracts

Where services are covered under a master services contract (MSC) and delivered across multiple jurisdictions, determining the place of use and enjoyment can be complicated.

For example, if there is a centralised IT service provided to branches in the UK, Germany, and the US but the main contract is with a UK entity, there are some points to take into account:

- service allocation: The business should apportion the value of the service provided based on where it is consumed

- evidence required: HMRC might query if the business keeps records and/or tracks where the services provided are consumed

- partial application: If part of the service is used and enjoyed in the UK, UK VAT would apply on that part

- changes over time: If the service is used and enjoyed in a different location over time, VAT treatment should be reviewed and changed accordingly.

Next steps

Application of this rules varies by business and determining the correct VAT treatment isn’t always straightforward. If you’re unsure how these provisions affect your business, our VAT specialists can provide tailored advice. For further information please contact Rob Janering, or your usual Crowe contact.

Contact us

Insights