Academies Accounts Direction 2023/24

The new Academies Accounts Direction for 2023/24 (the AAD) was released in March 2024. The general theme is business as usual with most changes being relatively modest in nature. In this article, we outline the key changes that you need to be aware of.

Changes to the AAD

Interaction between the statutory accounts and other financial returns

The AAD this year acknowledges the consistency problems that can occur when the statutory accounts are finalised and approved before the Academy Accounts Return (AAR), which is generally submitted later in January. The AAD encourages academy trusts to check the accounts against the AAR guidance and validation rules before they are approved to minimise AAR validation issues.

The AAD also reminds academy trusts that by adopting the DfE Chart of Accounts, the use of automation technology can further reduce validation and consistency errors and allow automatic upload from your finance system directly into the AAR.

Improving consistency with the AAR has been a key focus here at Crowe for several years, not least because the quality of the AAR (and in particular the benchmarking sections) is increasingly important when comparing your trust against other schools via the Schools Financial Benchmarking website.

Academy trusts wishing to take advantage of automated upload to the AAR should ensure their finance system offers the standard COA functionality- and is brought up to date for any late client adjustments/audit adjustments arising during the audit. Even then an element of manual input will still be required in the AAR.

Governance statement – review of effectiveness

The conclusion section of the governance statement has been enhanced to make it clear that the review of effectiveness regarding internal controls, should extend beyond financial related issues. This broader remit requires the review of the effectiveness section to include governance, risk management and control.

This is a sensible amendment given that an academy trust’s review of effectiveness will be informed by a wide range of assessments including the internal scrutiny function, and financial management and governance self-assessments. The revised conclusion simply mirrors the wider range of risk assessments and reviews that are now expected of academy trusts as the sector continues to mature.

Sector themes

The ESFA has released an overview of the key themes arising from its 2022/23 assurance processes which sets out common reasons for qualified audit and regularity opinions.

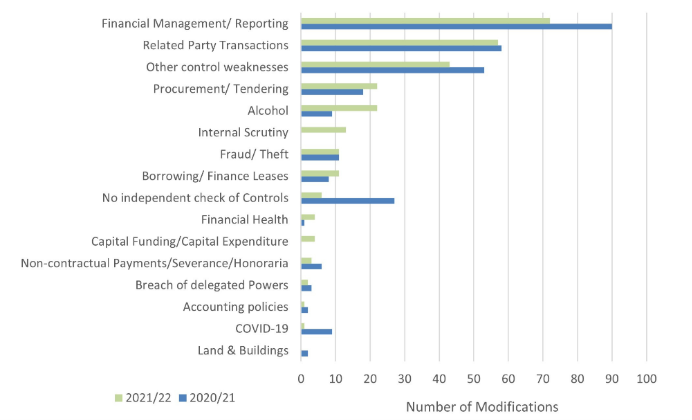

The table below shows the most common breaches of the Academy Trust Handbook that led to qualified regularity opinions during 2020/21 and 2021/22.

Some of the key themes noted in the AAD are also themes that we see as external auditors. Below we have set out areas to consider in advance of the next audit cycle:

- Internal Scrutiny scope and arrangements being set by the internal scrutineer or even by management. The scope of the planned internal scrutiny work should be informed by the academy trust’s risk register and be agreed between the ARC, the trust board, and the internal scrutineer.

- The Trustees Report not providing an accurate representation on the academy trust’s performance and key developments during the year. Proforma text or text that remains unchanged from the previous year is still all too common across the sector.

- Succession plans for outgoing Accounting Officers should be planned well in advance to ensure that handovers are carried out on a timely basis. We have seen instances where qualified regularity reports have been issued where the incoming Accounting Officer could not sign the regularity and compliance statement because the handover process had been insufficient.

Paragraph 2.57 of the AAD includes a useful list of the types of information the Accounting Officer should consider before signing the Accounting Officer’s Statement on Regularity and Compliance.

- High risk (Red) recommendations in the audit findings reports not being actioned on a timely basis. During the audit cycle, the ARC should challenge management on when and how each key deficiency is expected to be rectified.

Options for valuing land and buildings

The AAD this year provides welcome guidance on how an academy trust may go about obtaining a value for leasehold buildings transferring into the trust. Options include:

- obtaining a valuation from a chartered surveyor

- obtaining a valuation from the relevant local authority

- obtaining a valuation from the construction company, where appropriate

- assessing the value of any assets from a transferring academy trust

- assessing valuation certificates provided by DfE.

Options 1 to 3 provide the most accurate forms of valuation whereas option 4 and 5 are likely to only be suitable as a way to benchmark an alternative valuation assessment to check for reasonableness.

It is the responsibility of the academy trust to ensure any valuation that is used is in line with the requirements of FRS102. This will mean reaching an agreement with your auditor. Simply because the AAD now includes various options does not mean they will automatically be accepted by audit firms.

Other changes to the model accounts/financial reporting requirements

Disclosure of material grants

The previous iteration of the AAD made it clear that material grants should be disclosed separately. This remains the case for 2023/24 however the AAD now specifically mentions 16-19 core education funding as one of those grants that will require separate disclosure if material.

Payroll costs

In addition to the existing disclosure requirements, payroll costs for 2023/24 should also include other benefits that are paid on behalf of an employee. FRS102 defines employee benefits as - "all forms of consideration given by an entity in exchange for services rendered by employees" and examples provided in FRS 102 (other than wages, salaries, social security and pension costs) include non-monetary benefits such as medical care, housing, cars.

LGPS pension scheme assets

Many LGPS actuarial valuations last year returned net asset positions. Our view, as a firm, was that the likelihood of those assets ever being recovered was remote and as such should not be recognised on the balance sheet. We considered this to be a significant judgment that should form part of the significant judgments and estimates section and pensions notes included in the statutory accounts.

The ESFA has this year reminded academy trusts that the recognition, or otherwise of an LGPS pension scheme asset, is likely to constitute a significant judgment which should be disclosed in the financial statements.

If you would like to discuss any of these topics in more detail, please contact your usual partner or Matt Doyle Healey.

Alternatively, if you would like to be part of our termly Academies Discussion Group, please let contact [email protected] with Academies Discussion Group in the subject line.

Related insights