Mind the tax gap

How can HMRC close it?

The tax gap is estimated at £46.8 billion or 5.3% of tax owed, this gap is the difference between what HMRC should and in reality, does collect. The National Audit Office (NAO) recommends improvements for HMRC to reduce the size of the tax gap. What could this mean for future compliance activity?

HMRC’s strategy to close the tax gap and tackle error and fraud has shifted in recent years, moving away from traditional ‘respond’ techniques, (e.g. statutory enquiries) towards ‘promote and prevent’ activity (e.g. One To Many approaches, also known as nudge letters) which aim to provide a wider solution to a volume problem.

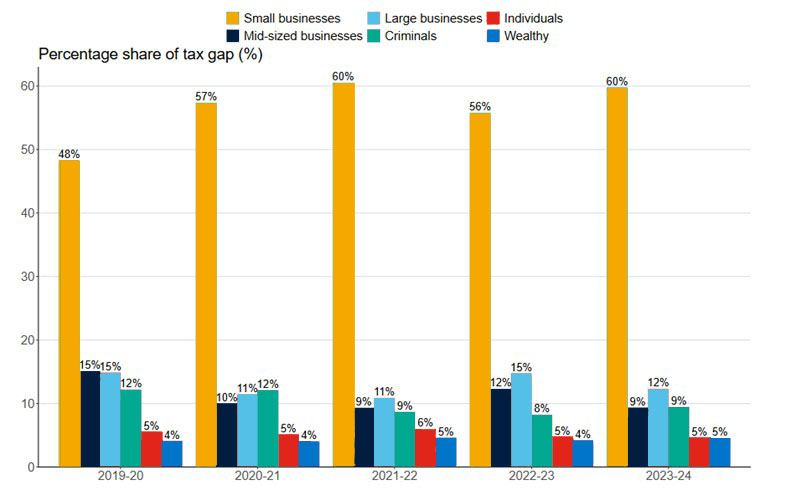

As over 60% of the tax gap relates to small businesses. This has increased year on year since 2017/18, when small businesses made up 37% of the tax gap. Perhaps HMRC is getting better at identifying error and fraud, therefore increasing the values identified, but the uplift suggests they are also getting worse at prevention.

The NAO report produced in November 2024, highlighted three main ways that HMRC can receive more of the tax revenue it is due, and in doing so reduce the size of the tax gap.

- Ensure that it understands the impact of its compliance work, including relative rates of return, so that it can target activities to bring in the most tax revenue.

The NAO repeated comments from its 2022 report (“Managing tax compliance following the pandemic”) that while there is “’little doubt’ that HMRC’s compliance work offers good value for money”, “the compliance yield measure ’needs to be sufficiently robust and transparent to instil confidence in the absolute levels of return it can generate’”. - Make it easier for taxpayers to comply and get help, so they pay the right amount of tax.

It is well publicised that contacting HMRC by phone has become increasingly difficult and frustrating for taxpayers, and agents, alike. The NAO repeated its earlier findings that “around a third of calls to HMRC advisors weren’t answered in 2023-24, falling short of HMRC’s target to answer 85% of calls.” - Ensure that tax rules are well designed and straightforward.

The NAO signpost their 2024 report “Tax measures to encourage economic growth” in which they discuss the way government evaluates tax reliefs, finding that more focus is needed to assess whether reliefs are working, with prompt action to address fraud and error in the system where needed.

HMRC investigations

With a large proportion of the tax gap relating to small businesses, it would be reasonable to expect HMRC staff to focus their compliance efforts on closing the tax gap in this area.

HMRC has increasing volumes of data available both internally and externally, such as banking information via the Common Reporting Standard and its own intelligence gathering system ‘Connect’, which contains over 50 billion lines of data.

While it is encouraging to see HMRC use the information available to tackle error and fraud, there will always be a degree of collateral damage that occurs when there has not been accurate interrogation of the data to identify problems.

Labour’s first budget announced their commitment to additional funding to close the tax gap. This will include overhauling HMRC’s IT system to improve its debt management and ensure tax debt enquiries can be dealt with faster, hopefully improving the productivity of the organisation.

5,000 additional compliance staff are being recruited, and 1,800 debt management staff will also be maintained and recruited. HMRC’s services will be also digitised to make it easier and simpler for taxpayers to self-serve and manage their tax affairs.

These focused strategical measures and additional resource are intended to support HMRC to close the UK’s tax gap, by bringing in an additional £6.5 billion over the next five years. Labour state that the revenue will go directly to funding UK public services and fixing the foundations of the economy.

This increase in resource will presumably assist HMRC in addressing the NAO recommendation that HMRC need to improve its ability to help customers comply and get the right level of help. Without this support and while tax rules remain complex, there are bound to be people who do not pay the correct amount of tax, whether that be through genuine misunderstanding or deliberate conduct.

The report also recommends HMRC should focus resource where it will have the biggest impact, therefore, it seems that small businesses will be under HMRC’s spotlight. Dealing with any kind of HMRC investigation is a headache that most small business owners can do without.

How we can help

As HMRC seeks to approach compliance using innovative strategies, and with increasing powers to do so, it is important to seek professional help before responding to any kind of HMRC investigation.

We can help you understand your tax obligations, provide guidance on how to manage any risks and guide you on the documentation you should be retaining to evidence any decisions the business is making. We can also assist in bringing your affairs up to date, making tax disclosures where necessary.

For more information, get in touch with a member of Crowe's Tax Resolutions team or your usual Crowe contact.

Contact us

Related insights