2025: The year of M&A transaction disputes

The need to sell at speed

In the lead up to the UK Government’s autumn Budget announcement on 30 October 2024, the rumour mill was in overdrive as to what taxation measures would be introduced, to plug what Chancellor Rachel Reeves described as a

“£22 billion black hole” in the public finances. Whilst there are still disagreements as to the size of the black hole, it was clear that tax rises were coming and a significant rate increase in capital gains tax (CGT) was highly tipped to be an ‘easy win’ for the government.

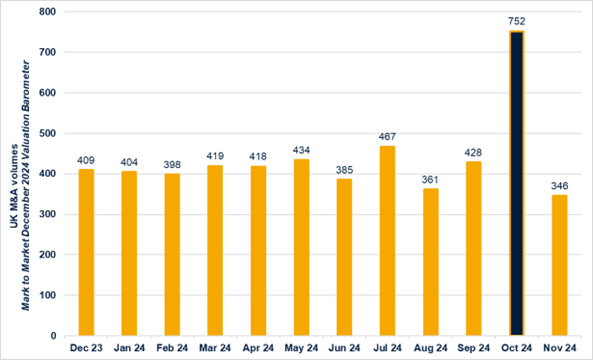

Owing to the impending likely rate increase, shareholders were accelerating plans to dispose of business interests, to ensure they could realise their capital gains and crystallise their tax liabilities at the lower rates applicable prior to 30 October 2024. This resulted in a huge increase in deal volumes ahead of this deadline.

|

|

Crowe’s experience is mirrored by that of the wider economy, as shown by the deal volumes in Mark to Market’s. December 2024 Valuation Barometer.

Source: Mark to Market

The risks of rushing

|

“Like many advisers during the months of September and October 2024, we were asked to assist in sell side processes with a firm pre-budget completion backstop. In some instances, the transactions were at suitably advanced stages, or had been presented as being free of significant complexity, such that we engaged on the work, successfully in all cases. However, there were a number which in our view required substantial input, negotiation and re-work which meant that a close on or before 29 October 2024 would have been, at the very least, a challenge. On the understanding that no extension to the desired timeframe would have been entertained, I suspect a number of these possible transactions may have completed without any, or minimal, M&A adviser input.” Andy Kay, Partner, Corporate Finance |

Take a typical small and medium enterprise (SME) mergers and acquisitions (M&A) transaction in the £10 million to £100 million bracket. Under ordinary circumstances, one would expect the whole process to take anywhere from approximately three to four months in the most straightforward of deals, up to as long as 18 months if negotiations are complex and protracted.

Given that there were only three months between Chancellor Rachel Reeves’ announcement of an upcoming Budget on 29 July 2024 and its delivery on 30 October 2024, a lot of the October 2024 M&A transactions will have likely been undertaken at an accelerated rate.

|

Matteo Timpani, Partner, Corporate Finance |

Rushing an M&A transaction brings with it several risks for both seller and buyer. Inadequate time spent on planning, due diligence, or negotiations could potentially result in a plethora of problems for buyers and sellers, such as:

- the buyer not identifying underlying problems with the business

- the buyer not understanding the true underlying trading potential of the business and overvaluing it

- the seller dealing with a buyer that subsequently mismanages the business in an unprofitable or unethical manner (which can be particularly problematic if the deal has significant earn-out consideration or the seller is to remain in the business post-transaction)

- the seller agreeing to too much of a discount to the consideration to get the deal done faster, which could more than wipe out the benefit of the lower CGT tax charges applicable

- unfavourable clauses, warranties or errors ‘slipping through the net’ into the share purchase agreement (SPA)

- inappropriate deferred consideration mechanisms inserted in the SPA, which will either result in the buyer overpaying for the business or being so unachievable that the mechanism may as well not exist

- inadequate buyer/seller provisions and protections to resolve post transaction disputes.

"The uncertainty of the looming budget and the ability to seemingly negotiate a good deal from buyers that were motivated to avoid potential CGT liabilities, may have been enough to entice buyers to rush through due diligence when time was of the essence. Of course, other protections such as warranties in the SPA could provide a level of comfort but in catastrophic deals, the time limits and restrictions to claim may not be sufficient. We may therefore see an increase in claims seeking to recover losses beyond the warranty provisions such as fraudulent misrepresentation claims.” "The uncertainty of the looming budget and the ability to seemingly negotiate a good deal from buyers that were motivated to avoid potential CGT liabilities, may have been enough to entice buyers to rush through due diligence when time was of the essence. Of course, other protections such as warranties in the SPA could provide a level of comfort but in catastrophic deals, the time limits and restrictions to claim may not be sufficient. We may therefore see an increase in claims seeking to recover losses beyond the warranty provisions such as fraudulent misrepresentation claims.”

Alex Houston, Partner, Forensic Services |

The inevitable increase in post-transaction disputes

If an M&A transaction has been rushed, this increases the likelihood of there being post-transaction disputes stemming from a hurried preparation of the SPA.

|

Martin Chapman, Partner and National Head of Forensic Services |

In our experience, the likely culprits that can cause a problem in an SPA are:

- ambiguous and / or un-defined terms: financial information being warranted as ‘carefully’ or ‘appropriately’ prepared for example, often leads to a disagreement about the level of precision attached to such terms

- unrealistic warranties: if a warranty such as ‘the management accounts have been prepared in accordance with Generally Accepted Accounting Principles (GAAP)’ is included, it can cause problems, as most management accounts will have areas that are not strictly 100% under GAAP

- lack of clarity on precedence hierarchies: if the order in which accounting rules take precedence in the preparation of completion or earn-out accounts is not clear, then this can lead to different interpretations and therefore disagreements when attempting to agree such accounts

- incorrect internal referencing: SPAs go through numerous different versions during the drafting process which can lead to cross-referencing errors. In worst-case scenarios, this can make clauses have completely different, unintended meanings, resulting in disputes.

In our previous article Share purchase agreements: Pitfalls to avoid, we explored the above in more detail, along with some other problems that we have seen arise.

How can Crowe help?

Whether you are buying or selling a company, our FCA Regulated Corporate Finance Team can assist in all stages of the transaction to help achieve the best result for you, aligning our work with your objectives.

Our Forensic Services team can assist in advising, or acting as an accounting expert witness, for buyers and sellers in respect of completion account, earn-out account, warranty and misrepresentation disputes. We can also perform the role of expert in expert determination processes, see Top 10 tips for a successful expert determination.

For further information as to how we can help you:

- For Forensic Services, please contact Martin Chapman or Alex Houston.

- For Corporate Finance Services, please contact Andy Kay, Matteo Timpanior Dan Nixon.

Contact us

Our latest thinking

“In October 2024, our National Corporate Finance Team set a new benchmark with a record number of transactions. This encompassed a diverse range of activities, including buy-side and sell-side capital markets, private company due diligence, and M&A advisory services. We successfully completed 32 transactions; a significant increase compared to the 42 transactions completed throughout the entire calendar year of 2023. While 2023 was a robust year, this volume of deals in October 2024 alone highlights the levels of deal activity seen in the market and our team’s exceptional responsiveness.”

“In October 2024, our National Corporate Finance Team set a new benchmark with a record number of transactions. This encompassed a diverse range of activities, including buy-side and sell-side capital markets, private company due diligence, and M&A advisory services. We successfully completed 32 transactions; a significant increase compared to the 42 transactions completed throughout the entire calendar year of 2023. While 2023 was a robust year, this volume of deals in October 2024 alone highlights the levels of deal activity seen in the market and our team’s exceptional responsiveness.”

“It has been quite some time since the UK market, and the M&A environment within it, was anywhere near a position that could be described as “normal”. In between Brexit, a global pandemic and significant global conflict, UK industry has traversed some rather significant challenges in recent years. Therefore, whilst there remains an awful lot of investor cash available for deployment, capital is rather more cautious. As a result due diligence, and high quality due diligence, is now more important than ever before. Investors are scrutinising performance, historical trends, pipeline, commercial and political risks in more and more detail in order to gain comfort that they understand the business they are investing in. Poorly prepared vendors or insufficient due diligence can cause deal delays and deal failure at worst. If a deal proceeds in the absence of proper diligence the chances of dispute over value further down the line, whether when considering completion accounts or earnouts, is greatly increased. Proper diligence should provide comfort for buyers and sellers with regards to deal certainty.”

“It has been quite some time since the UK market, and the M&A environment within it, was anywhere near a position that could be described as “normal”. In between Brexit, a global pandemic and significant global conflict, UK industry has traversed some rather significant challenges in recent years. Therefore, whilst there remains an awful lot of investor cash available for deployment, capital is rather more cautious. As a result due diligence, and high quality due diligence, is now more important than ever before. Investors are scrutinising performance, historical trends, pipeline, commercial and political risks in more and more detail in order to gain comfort that they understand the business they are investing in. Poorly prepared vendors or insufficient due diligence can cause deal delays and deal failure at worst. If a deal proceeds in the absence of proper diligence the chances of dispute over value further down the line, whether when considering completion accounts or earnouts, is greatly increased. Proper diligence should provide comfort for buyers and sellers with regards to deal certainty.” “I have already noticed a marked increase in transaction disputes over the last 18 months. The challenging economic circumstances appears to have created a wave of buyer regret and an appetite to recoup as much as possible from less successful acquisitions. Or at the most sinister level a buyer 'turning the screw’ and not wanting to pay the full purchase price knowing a seller’s financial position. I envisage the high volumes of potentially rushed M&A transactions in October 2024 will heighten this dispute climate further, whether it be the buyer realising all is not well when they get their feet under the table and pursuing a warranty claim, or stemming from an inability to agree a set of completion or earn-out accounts.”

“I have already noticed a marked increase in transaction disputes over the last 18 months. The challenging economic circumstances appears to have created a wave of buyer regret and an appetite to recoup as much as possible from less successful acquisitions. Or at the most sinister level a buyer 'turning the screw’ and not wanting to pay the full purchase price knowing a seller’s financial position. I envisage the high volumes of potentially rushed M&A transactions in October 2024 will heighten this dispute climate further, whether it be the buyer realising all is not well when they get their feet under the table and pursuing a warranty claim, or stemming from an inability to agree a set of completion or earn-out accounts.”