Claiming Gift Aid as a charity or CASC

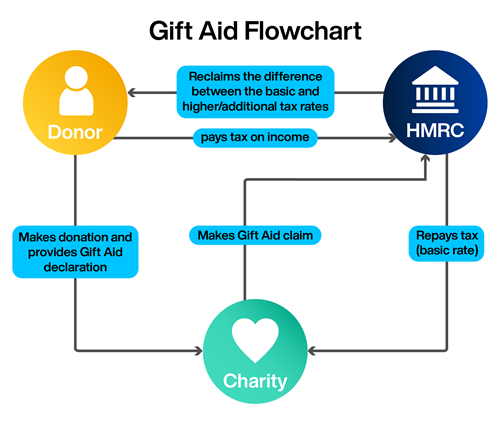

Claiming Gift Aid can substantially increase income for eligible charities and Community Amateur Sports Clubs (CASCs), allowing them to reclaim 25p for every £1 donated by an individual. However, navigating the rules requires careful attention to detail and robust record-keeping to ensure you remain compliant.

Key requirements for Gift Aid

In order for a donation to qualify for Gift Aid, it must be a payment of money from an individual donor. In addition, the donor must be a UK taxpayer and have paid at least as much income tax or capital gains tax during the tax year, as the amount being reclaimed. It is also essential that the donor provides the charity with permission to claim Gift Aid.

A Gift Aid declaration is an essential requirement, and it must include the following details:

- donor’s full name and address

- the name of the charity or CASC

- a description of the gift

- a statement confirming the donor would like the charity to claim Gift Aid on the donation

- confirmation that the donor understands that if they pay less Income Tax and/or Capital Gains Tax in that tax year than the Gift Aid claimed on all their donations it is the donor’s responsibility to pay any difference.

Declarations must be kept for six years after the most recent donation Gift Aid was claimed on. HMRC is increasingly scrutinising claims, so maintaining a complete audit trail linking each donor and donation to a valid declaration is important.

Benefits for taxpayers

Gift Aid not only benefits charities, it also offers tax relief for individual donors. Higher and additional rate taxpayers can claim tax relief, proportionate to the amount they donate to the charity. High income taxpayers pay income tax at 40% or 45%, depending on their income bracket and therefore they can claim back the difference between the basic rate of tax (20%) and the higher rate (40%) or the additional rate (45%) on the total gross amount of the donation.

For example, if an individual donates £100, the charity can reclaim an additional 25p in Gift Aid for every £1, making the gross donation £125. A donor paying tax at 40% can reclaim £25 (£125 x 20%) in their personal tax return, reducing the net cost to £75. For a 45% taxpayer, the reclaimable amount would be £31.25 (£125 x 25%), making the net cost £68.75.

Eligible and ineligible donations

Gift Aid can be claimed on donations from individuals with a valid declaration. Special rules apply to various donations, including funds from sponsored challenges, charity membership fees, selling goods on behalf of individuals, such as charity shops, and volunteer expenses that are donated back. Gift Aid may also be claimed on waived refunds for cancelled ticketed events and loan repayments waived by individual donors, provided a valid declaration is held.

However, Gift Aid cannot be claimed on donations from limited companies, through payroll giving schemes, or on donations of shares, charity cards or vouchers. Additionally, donations where the donor receives a benefit in exchange for the donation, such as goods or services (ranging from a badge to membership benefits) may be ineligible if the value exceeds certain limits.

There are two tests used to assess these limits:

- The ‘relevant value’ test.

This test sets the maximum value of a benefit for a particular donation.- For donations up to £100, the maximum benefit value is 25% of the donation.

- For donations of £101 and above, the maximum benefit value is 25% of £100 (being £25), plus 5% of the donation amount exceeding £100, up to a total benefit value of £2,500. These limits apply to each donation separately. Special annualising rules may apply for benefits received at intervals or for membership schemes. If the value of the benefit exceeds this limit, the donation will not qualify for Gift Aid.

-

The ‘aggregate value’ test.

For donations made on or after 6 April 2011, the aggregate value of benefits received by the same donor in one tax year from multiple donations to the same charity must not exceed £2,500. The actual value of benefits, not an annualised value, counts for this test. If this limit is exceeded, the donation will not qualify for Gift Aid.

Gift Aid Small Donations Scheme (GASDS)

The GASDS allows charities and CASCs to claim an additional 25% on small cash donations (£30 or less) and contactless card donations (£30 or less) without needing a Gift Aid declaration. This can be particularly useful for fundraising events or street collections. More information on GASDS is available here.

Making a claim

Gift Aid claims can be submitted online via Charities Online, using the charity’s online HMRC account (software must be used for claims exceeding 1,000 donations). Alternatively, claims can be submitted by post using form ChR1. Online claims are typically paid via BACS within four weeks, while postal claims take about five weeks.

There are strict deadlines for submitting claims.

- For Gift Aid: Claims must be made four years after the end of the relevant period. The relevant period will be from the tax year date (5 April) for charitable trusts, and the accounting period end date for CASCs, CIOs and limited charitable companies.

- For GASDS: Claims must be submitted within two years of the end of the tax year in which donations were collected.

For further information and specific guidance on the areas discussed, please get in touch with your usual Crowe contact.

Contact us

Insights