FRS 102

Financial reporting changes

The Financial Reporting Council (FRC) made comprehensive changes to Financial Reporting Standards 102. These changes are effective for accounting periods which begin on or after 1 January 2026, with early adoption permitted.

In developing the revised standards, the FRC has considered:

- Changes to revenue recognition, based on the five-step model for revenue recognition from IFRS 15 ‘Revenue from Contracts with Customers’, with appropriate simplifications.

- Changes to lease accounting requirements, based on the ‘on-balance sheet’ model from IFRS 16 Leases, with some simplifications.

- Changes to fair value measurement definitions to reflect the principles of IFRS 13 ‘Fair Value Measurement’.

- Stakeholder feedback in response to the FRC’s 2021 request for views and other developments in Corporate Reporting.

The main sections revised

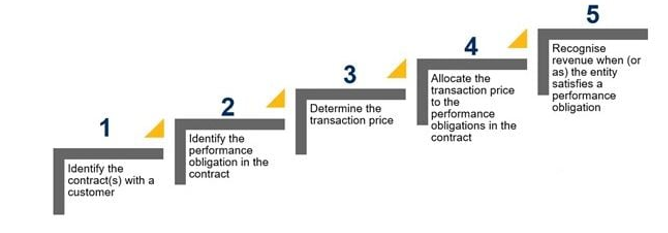

Section 23 of FRS102 has been replaced to introduce the five-step revenue recognition model. Previously under UK GAAP, revenue recognition fell into two areas – revenue from the sale of goods, and revenue from the rendering of services with additional guidance around construction contracts.

This new model will require businesses to consider the individual terms of revenue-generating contracts to appropriately recognise revenue. To apply the model, an entity shall take the following steps:

- Performance obligations are goods or services a business has promised to deliver under the contract, such as cleaning services or product sales through a shop or website. When identifying the performance obligation, the business should determine whether it will be settled over time or at a point in time. Typically, services would be recognised over time, and goods supplied at a point in time.

- Having identified the performance obligations, the transaction price must be allocated to them. If a contract has a single performance obligation this will be straightforward. If there are multiple performance obligations then allocating the price may involve judgement, especially where 'bundling' is used.

- Revenue is recognised as, or when, a performance obligation is satisfied. This typically occurs when the customer either receives the service or when the risks and rewards associated with ownership of the good have transferred to the customer.

The amendments result in a 'more robust' approach to revenue accounting. The standard now includes guidance on matters not previously dealt with. These include:

- variable consideration

- the treatment of discounts

- accounting for returns

- certain costs arising from revenue transactions (e.g. sales commission).

What should businesses do?

Review their revenue arrangements and understand the performance obligations and the transaction price.

Identify when a performance obligation is satisfied and the revenue recognised. Where this leads to a different recognition pattern to the previous requirements the effect on reported performance should be understood together with possible consequences. (e.g. the need to amend systems to capture the required information, and impact on reported amounts for covenant compliance.)

In addition to a change in the approach to revenue recognition, the amendments introduce additional disclosure requirements, which apply to all entities who apply FRS 102.

Transition

Businesses do not need to restate comparatives. Where the amendments lead to a change in the previously reported amount, this will be applied as an opening balance adjustment in the first period for the cumulative impact. There are several transitional provisions to simplify the initial implementation.

Leases

The biggest change is the removal of the distinction between a finance lease and an operating lease. All leases, subject to certain limited exceptions, will be brought onto the balance sheet in a manner consistent with the current treatment for a finance lease.

Where an entity has, for example, property leases, these will need to be recognised on the balance sheet as a ‘right of use asset’ (ROUA) with a corresponding lease liability.

Previously, such leases would have been an operating lease accounted for on a ‘pay as you go’ basis, with future liability only a disclosure within the financial statements.

The effect on reported profit will be to remove the rental charge and replace it with depreciation of the ROUA, and an interest expense on the lease liability. Although the total effect on profit for the duration of the lease is the same, the accounting will change the timing of the expense. It becomes front end loaded with a higher total expense recognised in earlier years of the lease arrangement which is illustrated in the example below.

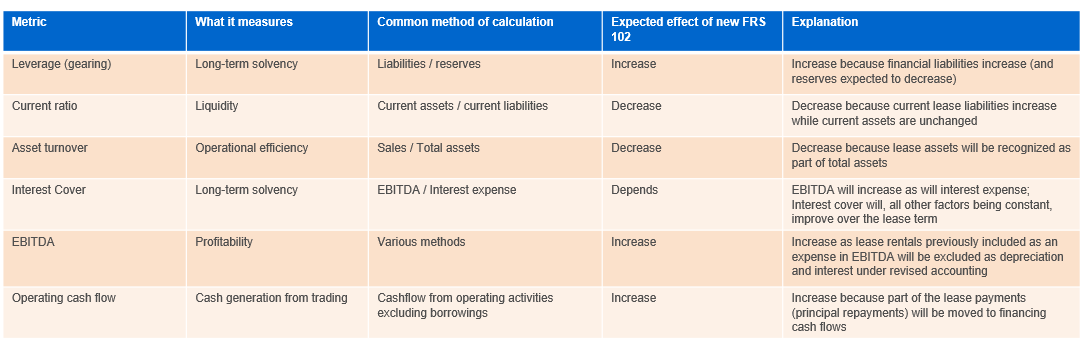

As the expense is accounted for as depreciation and interest rather than rent. This will change key performance measures such as earnings before interest, depreciation and amortisation (EBITDA) and the interest expense. Reported EBITDA will increase under the proposals, as the rental will move out of operating expenditure and into interest and depreciation but with an increase in the interest expense which may impact on loan covenants.

Considerations for metrics are outlined in the table below:

In the cashflow statement, the rentals, previously treated as part of operating cashflows, will be replaced with an interest cashflow and liability repayments, the latter being classified as financing cashflows. The net effect is that a business will report higher cash generated from operations, but with an increase in financing cashflows. The overall net cashflow will be the same.

Making the changes

Implementing the changes will also present management with additional challenges in preparing accounts. Management will need to gather lease documentation to determine, for example, whether you have a lease, what is the lease term, what future payments to include and what discount rate to apply to the future payments.

What is a lease?

This is quite complex, but broadly, where the arrangement provides the lessee with the ability to control the use of a defined asset for a period of time it will be a lease.

How are the ROUA and lease liability measured?

The ROUA is set as the amount of the lease liability, together with any payments made before commencement of the lease and less any incentives received. The lease liability is the present value of the lease payments due to be made over the lease term. Where there are options to extend a lease, these will be included but only where it is reasonably certain that the extension will be taken, reasonably certain is a high threshold.

Present value discount rate

The lease liability should be discounted using the interest rate implicit in the lease – this is the rate of interest that causes the present value of:

- the lease payment

- the unguaranteed residual value.

To equal the sum of:

- the fair value of the underlying asset

- any initial direct costs of the lessor.

If that rate cannot be readily determined:

- Lessee’s incremental borrowing rate - The rate of interest a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment.

- Lessee’s obtainable borrowing rate - The rate of interest a lessee would have to pay to borrow, over a similar term, an amount similar to the total undiscounted value of lease payments to be included in the measurement of the lease liability.

If none of these can be determined, Public Benefit Entities are able to fall back on the interest rate obtainable on deposits held with financial institutions.

What exemptions are available?

There are two main exemptions for lessees. If the lease term is no more than 12 months, it may be accounted for as an operating lease. This is on a straight line basis over the lease term, and without recognition of a lease liability on the balance sheet. Similarly, if the underlying asset is of low value, it may also adopt this treatment. A low value asset is not defined by monetary amounts, but typically would include items such as laptops, mobile phones and items of furniture.

Lessors

The accounting for lessors remains broadly the same as existing requirements, with the distinction, and different accounting applying, depending upon whether the lease is an operating lease or a finance lease. Most leases with tenants will be classed as operating leases.

The changes to lessee accounting will have consequences for lessors where they enter into back-to-back arrangements, or sale and leasebacks.

Transition

Entities do not need to restate comparatives. The amendments will be applied as an opening balance adjustment for the cumulative impact. However, as a practical expedient an entity can measure the ROUA at the lease liability adjusted, where you have prepaid or accrued lease payments in the reporting period immediately before the date of initial application. The lease liability may be measured initially at the discounted amount of remaining lease payments over the remaining lease term at the date of initial application.

The amendments introduce additional disclosures for leases, with both qualitative and quantitative information to be given. Materiality may be applied to the disclosures.

Practical implications

- Decisions made today on leases could result in significant changes in accounting.

- Almost all leases come on Balance Sheet.

- Lease Accounting inherently more complex likely requiring system changes.

- Be wary of so called ‘off Balance Sheet’ structures.

- Scenario plan for impact.

- ‘Higher costs’ earlier on in the lease period – potential impact on Loan covenants to consider.

- Interest cover – impacted by higher financing costs.

- Gearing – impacted by net liability brought on Balance Sheet.

Fair value

The amendments introduce a new appendix on Fair Value Measurement which provides more details on measurement and valuation techniques. We do not consider that this will make significant changes to accounting treatment.

Other changes

For small entities applying the reduced disclosures of Section1A, the amendments introduce a significant number of additional disclosures. These include disclosures in respect of:

- current and deferred tax

- leases

- share based payments

- revenue performance obligations

- dividends.

Governance of transition

- Identify who in your organisation is responsible for implementing changes.

- Are relevant individuals in the organisation fully trained and updated on the changes?

- Develop an impact assessment and project plan.

- Understand impact on loan covenants and any need to discuss with lenders.

- Are there any new systems or changes needed to manage the accounting going forwards?

Timing

FRS102 amendments are effective for periods commencing on or after 1 January 2026.

This will mean entities will prepare first period financial statements for the year end 31 December 2026 or 31 March 2027.

For further information, please get in touch with your usual Crowe contact.

Contact us

Insights