Challenges Ahead for Corporate Housing and Extended Stay

With relaxation of full lockdown measures now finally in sight, the hospitality industry is waking up to a new set of opportunities and challenges. What underlying concerns do we foresee, that need to be addressed going forward for the extended stay market and the corporate housing model?

While the extended stay sector has generally out-performed hotels in terms of occupancy and utilisation during the pandemic, there are several core factors that will impact the corporate housing model in the future, which to date have been obscured by the impact of COVID-19.

Together with generally high operating leases, a more limited demand profile and competition from newer concepts such as aparthotels and co-living, we believe that the corporate housing model may be heading into choppy waters.

There will always be a need in parts of the UK for this style of lodging accommodation, but as a sector, it will need to diversify its offering and upgrade its operating infrastructure to remain competitive in key primary and secondary cities where newer concepts are more efficient and adaptable to changing demand patterns.

Given the vague nature of the terminology surrounding corporate housing and aparthotels, we set out a brief overview of some of the key characteristics of each in figure 1:

Figure 1: Typical characteristics of corporate housing versus a full-service hotel

| Corporate Housing | Aparthotels | Hotels | |

| Number of keys | 5 to 80+ | 50 to 250+ | 80 to 300+ |

| Unit sizes (sqm) | 24 to 100+ | 24 to 80+ | 24 to 60+ |

| Planning | C3 | C1/C3 | C1 |

| Demand profile | 80% Corporate | 25% Corporate (short stay) | 30% Corporate |

| 10% Transient | 30% Corporate (long stay) | 25% Leisure | |

| 10% Bar/Other | 20% Leisure | 10% Tour Group | |

| 15% Transient | 10% Conference | ||

| 10% Bar/Other | 25% Bar/Other | ||

| Short stay | 20% | 70% | 100% |

| Long stay (30 nights +) | 80% | 30% | - |

| Facilities/services | |||

|

In-room kitchen/dining |

Private | Private | None |

|

Food & beverage |

None | Limited | Yes |

|

Fitness/wellbeing |

Limited | Yes | Yes |

| Av. length of stay | 30+ days | 4 to 30+ days | 1 to 4 days |

| Staff ratio/key | 0.2 to 0.6 | 0.2 to 0.6 | 08. to 1.8 |

| GOP margin | 45 to 70% | 45 to 65% | 24 to 45% |

| Contract types | Lease/Management Cost+ | Lease/Management | Lease/Management/Franchise |

| Lease type | FRI | FRI/ Double Net / Fixed and variable | FRI/ Double Net/ Fixed and variable |

| Lease length | 5+ years | 15 to 25 years | 15 to 25 years |

Source: Horwath HTL – Strictly indicative and illustrative estimates

Tourism picks-up, but business demand is still lagging

On the surface, the outlook appears relatively positive with strong economic recovery and online searches for staycations or domestic holidays increasing significantly on the back of continued disruption to overseas travel. Domestic tourism is at the forefront of this current upswing. Even the government weighed in as part of their own tourism recovery plan to incentivise consumers to travel, with the hope that domestic tourism levels will bounce back to pre-pandemic levels by 2022 and international tourism by 2023 - both a year earlier than many analysts anticipate.

An upturn in business demand is, however, far more difficult to predict, given so much has changed in terms of working habits through either government intervention or changes to companies’ own working practices. As part of a Business Travel Association (BTA) report, Amadeus recently reported that only 37% of business executives believe that business growth will start to rebound in 2022 with 46% looking to 2023. This view was also shared by International Air Transport Association (IATA), who anticipate that prepandemic travel levels will not be reached until at least 2024.

The impact of a change on working models

The impact of the work from home (WFH) directive has not only altered the way we interact with our fellow colleagues but also shown companies that business can survive without the need for fixed office space that can cost as much as 20% of each employees’ salary in office space alone.

Recent evidence suggests many organisations are continuing to evaluate hybrid working models on the back of numerous surveys that have identified an increased appetite for flexibility over working locations. By renting out or relinquishing some of their office space, companies are in a better position to save costs as well as help meet some of their Net Zero Carbon commitments.

JLL, a commercial property advisor, anticipates that around 30% of all office space will be consumed flexibly by 2030, as the need for a fixed office space decline. Notable companies like Deloitte have already announced the permanent closures of four UK offices in Gatwick, Liverpool, Nottingham and Southampton, with some 500 staff now able to work remotely in the future. Similarly, Salesforce announced that around 65% of its employees are anticipated to adopt an agile working strategy. Other major companies that have recently made headlines include BP who are planning to dispose of their London HQ, which would impact around 6,500 office staff and Linklaters, a large legal firm that anticipates that all staff will in the future spend between 20 and 50% of their time working from home.

While the coming of age of Microsoft Teams, Zoom and GoToMeeting won’t completely replace in-person meetings or international conferences, the extremes of 2020 have served as a reset for many companies. This has forced them to reassess how and why they travel, and what their business trips will look like in the future. It is more than likely that more meetings and training will be undertaken remotely, reducing the need for overnight stays, conferences and business entertainment. There will also likely be a knock-on impact on serviced apartments and extended stay accommodation requirements, with potentially less demand requirements for short, medium and long-stay business, if more of their project team members will be eventually working away from the office.

This concern has been backed up by our own discussions with a number of travel and relocation management companies who are putting on a brave face, but are still concerned that a number of previously high-volume clients are yet to show significant activity in terms of relocation requests, especially for locations within the UK.

The impact of Brexit

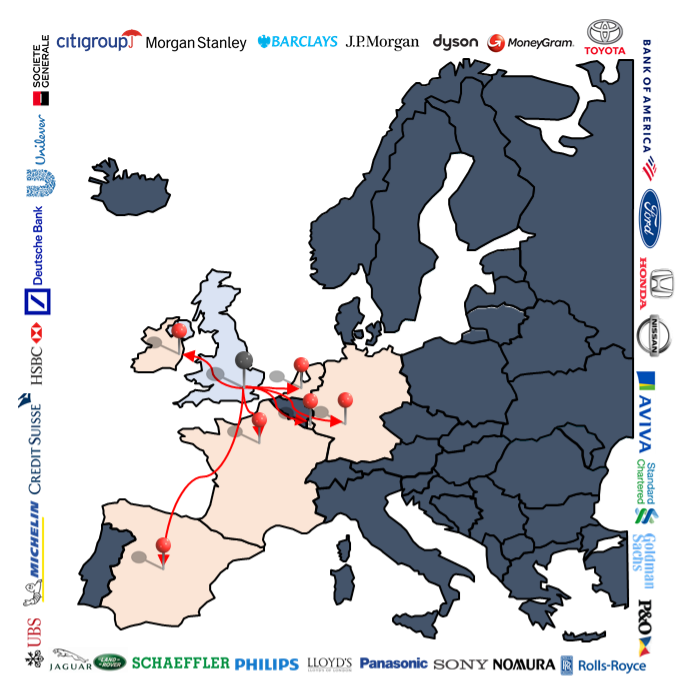

Where there is activity, the growth in requests has been far greater for locations in Europe. London which was previously at the top of the list in terms of relocation has largely fallen away to the likes of Dublin, Frankfurt, Paris and Amsterdam where many companies are now relocating key staff as well as back-office functions, as part of their ongoing Brexit moves. To date, around 7,400 job relocations and some GBP 900bn of assets have moved out of the UK.

In the following chart, we set out a map of companies that have indicated that they are downsizing their UK operations and relocating parts thereof to other European Union countries:

This trend was already happening prior to the COVID-19 outbreak which placed many of these moves temporarily on hold, but the pandemic also gave perspective to expatriates who were living overseas to re-evaluate their situation – and this has led also to some repatriating back home to be closer to their families.

Carbon Zero commitments impact on business travel

A growing number of governments are signing on to setting targets to end their contribution to global warming as part of the 2015 Paris Agreement. To date, more than a hundred countries have joined an alliance aiming for net zero emissions by 2050 as well some 21% of the world’s 2,000 largest public companies according to Forbes Magazine. The rise in pledges comes as corporates face increasing pressure from conscious investors keen to take on portfolios with good Environmental Social and Governance (ESG) ratings.

Research from O2 Business, in partnership with ICM, YouGov and Cenex, reported that over a third of UK workers actively want to scale back non-essential business trips, forcing businesses to reconsider the future of work-related travel in a post-lockdown world. Some 30% of the UK’s FTSE100 companies have already signed up to the United Nation’s Race to Zero campaign, aligning themselves with the UK government’s own ambitions and eliminate their contribution to climate change by 2050. In some cases, they have pledged to reduce business travel between 30 and 35% by 2025 to achieve their carbon zero goals.

Further companies will surely be evaluating the benefits of reducing business travel in terms of cost savings as well as on their own carbon footprint and ESG ratings. While we have yet to see the impact, we do foresee this as a growing threat to the lodging industry at large, including the corporate housing model that relies so heavily on business demand.

Brexit and Covid restrictions on travel, leisure and work permits

Business travel has been highly depressed during the pandemic and any new regulations for work permits and travel to and from the UK and EU were not at the forefront of everybody’s attention. With travel restrictions now being gradually eased, companies are struggling to grapple with all this new legislation on immigration and visa arrangements, as well as any new COVID-19 travel restrictions being imposed, including quarantine periods. This will certainly have a knock-on effect on the hospitality industry as a whole, including the ‘bleisure market’ which previously was growing exponentially on the back of business travel.

There isn’t any publicly available statistical evidence to see yet the impact on relocation demand into the UK, but there will surely in the months ahead be further disruption, with companies being reluctant to move employees either on a shorter or longer-term basis, until all the implications are fully understood. That said, our own experts who advise organisations on Global Mobility related matters are definitely seeing more relocation planning and relocations taking place than at any time since the pandemic began. The reduction in people mobility and relocations are not across the board, some industries such as infrastructure, engineering etc. never really did stop.

The changes in regulations are also having a huge impact on the hospitality workforce too. In one article for the Independent, Michael Kill, CEO of the Night Time Industries Association commented on both Brexit and the loss of staff during the long pandemic having left many firms struggling with their reopening plans due to severe staffing shortages. Together with the furlough hangover, a lot of workers in hospitality are from Europe, so Brexit has had an impact where either they have returned home permanently or have found other employment to keep themselves going. The industry’s reputation for low pay, unsocial hours, poor employment conditions and precarious contracts are also driving hospitality staff, including mid and senior management, to change careers.

Rates and pricing

Pricing in long-stay accommodation has been under pressure for several years, generally failing to match the inflation in lease rental costs, as long-term corporate clients have pushed back on rate increases or sought discounts. This rate squeeze has inevitably diminished profit margins and led to several companies, such as Oakwood, spinning off or reducing their reliance on chain/corporate housing business to concentrate more on short stay demand and aparthotels, which are more adaptable in this ever-changing market.

We expect the Corporate Housing to become ever more competitive as larger volume clients - such as those in tech, finance and, and energy – look to reduce their costs. Unless corporate housing providers change and diversify their own channel distribution and expand their core demand base, they will potentially struggle financially in the future.

Lease agreements

Major Corporate housing operators have typically leased the properties they manage at significantly higher rates than equivalent hotel leases. Whereas hotel leases pre-pandemic may have been the equivalent of 20 to 30% of turnover, serviced apartment and corporate housing leases reached 45%, or more, of turnover. This high level of fixed cost forced operations into the red as occupancies and revenues slumped.

Many serviced apartment companies secured short-term rent reductions and holidays from landlords during COVID-19. While this has helped preserve cashflow during the pandemic, a major concern is what will happen once such concessions end. In the absence of a significant increase in long stay demand the current business model of many operators, which depends on consistent high occupancy levels, appears to be unsustainable. By illustration, BridgeStreet, which was one of the biggest operators in the sector, went into administration in November 2020. Their UK administrators reported that their existing leases made it difficult to sufficiently reduce costs to match ongoing and anticipated revenues. In its filing, it stated that the group had less than US$10 million in assets but more than US$50 million in liabilities.

Looking ahead

Serviced apartments have in the past been considered a good investment opportunity because of their high profit margins, stable cashflow, high space efficiency and conversion flexibility and potentially lower development costs. Whether this holds true in the future remains to be seen. The competitive landscape is changing with the move to more standardised aparthotels which offer greater flexibility and diversity in terms of demand segmentation.

This together with changes to the legislation and use of C3 assets, and less long-stay corporate demand, could trigger a downturn in interest in this alternative asset class going forward. Some landlords may likely consider bringing their stock back into the private rented sector.

In the short term, we believe that the main challenge many operators will face is cashflow. It is extremely likely that a few more well-known brands and portfolios will go either into administration or be swallowed up by competitive firms as they struggle with a mountain of debt and/or pay down the high cost of their lease commitments.

For corporate housing operators and landlords, we believe that the focus will need to be short term on attracting private residential and student demand to meet the shortfall left by less corporate demand, while refocusing again the services and pricing packages to fit in with new, more leaner operating models.

There may also be opportunities to renegotiate lease agreements, convert these to fixed and variable structures or even convert them into management agreements. The typical staffing model, which previously had staff outsourced or paid by the operator, will likely evolve too, with cost plus models becoming increasingly commonplace in the future.

The adoption of technology to streamline operations and accelerate contactless tech to enhance the guest experience is also key to the future success of the industry, which in many cases has dragged it’s heels compared to their counterparts in the hotel and co-living space. This includes gearing up connectivity to other booking platforms.

In this volatile environment, it is important for the industry to also stand and work together with local government and the wider hospitality industry. There will surely be further changes coming and, in all likelihood, further consolidation of the sector, as hotels and co-living companies also move into this space to diversify and compete head on for a share of this long-stay demand. While we don’t see the end of the corporate housing model, we do see much change afoot. Sometimes, if you want to move forward, you have to stop looking at the past and find these new opportunities.

Insights

Contact us