TNFD - how to integrate nature into sustainability strategies

Nature is being added to the long list of sustainability expectations and organisations need to respond. Tackling this in an incremental manner and building on the existing climate change frameworks where companies have already invested makes sense, but the addition is also an opportunity to take a step back and think about the most effective way to be organised to address nature and other requirements.

The forthcoming publication of the final Taskforce on Nature-related Financial Disclosures (TNFD) provides both challenges and opportunities for organisations who have previously put in place a climate risk management strategy and have been reporting against the pre-existing Taskforce for Climate-related Financial Disclosures (TCFD) guidelines or other equivalent frameworks.

Should we adopt TNFD?

Clearly, since it is a voluntary initiative, the first question most organisations will face is: whether and why we should adopt this new framework. In trying to weigh up the pros and cons of this decision, several factors come into play:

- most organisations’ sustainability reporting has in-fact been quite narrowly drawn around climate change impacts and so TNFD enables a more holistic approach to environmental exposures to be taken

- TNFD has specifically been designed for ease of adoption by those who have already embraced TCFD as outlined in Figure 1. It incorporates with slight modifications the same four building blocks: governance, strategy, risk management and, metrics and targets

- the cost of ownership is therefore relatively low, especially if an incremental stance is taken, building out from a strong TCFD base

- the key factor is probably whether there is the capability to maintain this additional reporting requirement, given other emerging sustainability initiatives, such as ISSB, CSRD and U.S. SEC reporting.

Rather than a decision purely on reporting, the extent to which companies are transparent about sustainability is a risk appetite decision balancing high transparency (and associated risks of over commitment or “greenwashing” accusations) against low transparency (and associated risks of being called out for falling behind peers).

Figure 1 – Overview of TNFD guidance

Figure 1 – Overview of TNFD guidance

How to engage with TNFD?

The opportunity is to adapt the existing climate-related infrastructure to include biodiversity, which has until now been the ‘poor relation’ to climate change. The TNFD initiative provides an opportunity to adopt a joined-up perspective to environmental exposures, with clear links between issues such as air pollution, freshwater abstraction and droughts, nature resource extraction, soil pollution and land use change. There is also a clear link to the UN Sustainable Development Goals associated with clean water (SDG #6) and marine life (SDG #14) as well as land (SDG #15), which many insurance organisations are using to prioritise their wider sustainability strategies.

In practice, organisations have focused on the challenges related to the definition of biodiversity and the setting of boundaries around scoping their nature-related impacts and dependencies. Despite the language of measurement still evolving and hence making metrics challenging, we believe it is possible to make incremental progress, building on an existing TCFD framework. Examples include:

- Governance – incorporate biodiversity by revisiting governance elements, including committee charters, key performance indicators (KPIs), reporting requirements and risk assessment and appetite taxonomies

- Strategy – incorporate biodiversity by revisiting the organisation’s sustainability materiality assessment and ensuring nature-related factors have been appropriately articulated and tested

- Risk and impact management – identify and assess threats and opportunities within the organisation’s underwriting and investment portfolios. Start to evaluate existing data sources and consider the sector-specific ‘hot spots’ within these overall portfolios. Consider what information would be required to inform subsequent decision making.

Ultimately, the value comes from considering insurance-based solutions. How can insurers work with brokers to provide novel funding and risk transfer solutions that assist their clients to adapt to the pressures their operations create on biodiversity?

The wider implications of TNFD

We observe that many sustainability teams are struggling to deliver what they are currently being asked to do, with twin challenges:

- complexity: insurance organisations are often faced with multiple reporting expectations, an international re/insurer might be regulated by over ten supervisors with varying reporting requirements. Being listed on a major stock exchange brings additional requirements, as do any voluntary commitments the organisation has chosen to make

- speed of change: the rapid evolution of requirements places significant burden on climate teams, forced to focus on short-term deadlines. Teams have in some cases being moving from reporting deadline to deadline, without any time to step back and think about how best to be organised.

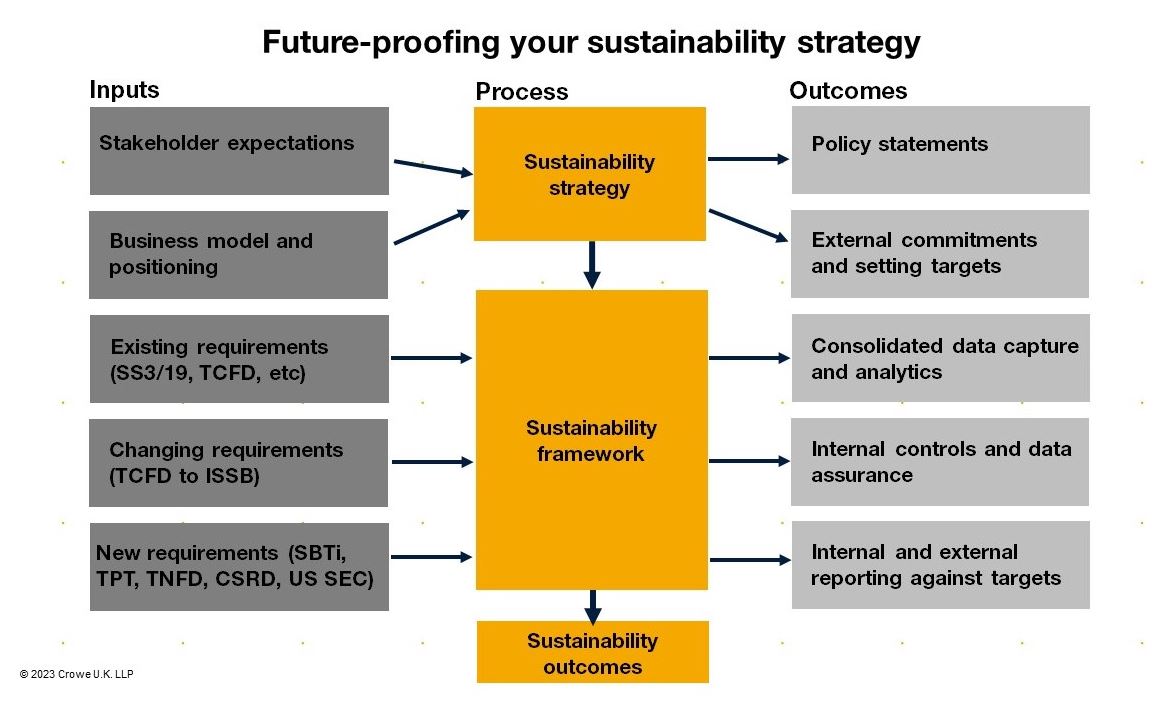

So, as well as thinking about what TNFD means for the technical aspects of integrating nature considerations into existing climate-focused frameworks and reporting structures, there is an opportunity to think more broadly. Figure 2 outlines an example whereby an organisation firstly puts in place its own sustainability strategy, driven by its strategic context, related to stakeholder and business model. This defines what external commitments and targets are felt to be appropriate. The sustainability framework and associated governance is established and scaled to these strategic considerations, and used to report against a varied and changing set of requirements. As requirements are modified or added to, the framework is simply adapted and expanded to cope.

Figure 2 – Crowe’s approach to addressing rapidly changing sustainability reporting expectations

Given the complexity and change we discussed previously, it makes sense for organisations to step back and think about how best to be organised to manage these requirements. Although meeting external reporting requirements is helpful, the aim of all this activity remains to change sustainability outcomes. In other words, make a difference by reducing the impact organisations have on their environment.

The launch of TNFD is an opportunity for many organisations to take stock and think about how they are currently organised to implement their sustainability strategy and support external reporting. TNFD has been specifically designed to make it easy to integrate into pre-existing climate risk frameworks, but this does not help unless the organisation has taken the opportunity to consider whether it has the right capabilities in place and efficient processes to deliver on its commitments.

Please contact Alex Hindson or your usual Crowe contact for more information.

Insights

Contact us