Business opportunities with the Commonwealth

According to the Institute of Export and International trade, in 2020 British exports to the Commonwealth were worth £56.3bn. With post-Brexit trade agreements in place or being negotiated with several Commonwealth markets, the importance of the association to UK exporters is only likely to grow. So what are the opportunities for UK businesses and how will hosting the Commonwealth Games in Birmingham later this year help them?

The Commonwealth is a voluntary association of 54 countries and home to 2.5 billion people. It’s roots go back to the British Empire, but today any country can join the modern Commonwealth, the last country to join was Rwanda in 2009. The combined GDP of Commonwealth countries in 2021 was US$13.1 trillion and is estimated to reach $19.5 trillion in 2027, almost doubling in ten years from $10.4 trillion in 2017. Source commonwealth website.

According to information from the Houses or Parliament the key statistics for the Commonwealth and UK trade are:

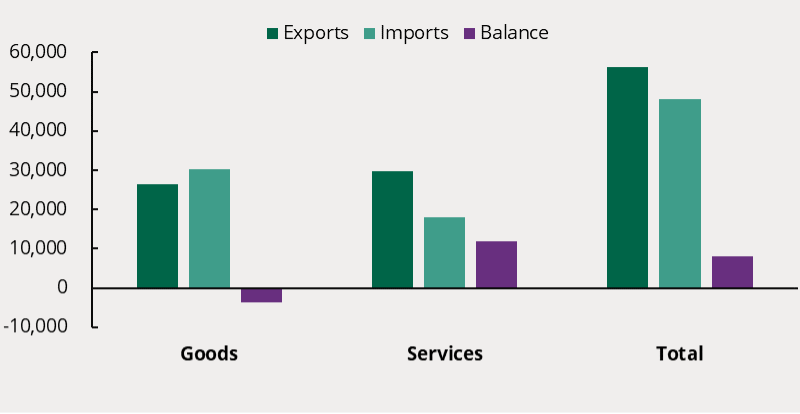

- UK exports to the Commonwealth were worth £56.3 billion; British imports from the Commonwealth were £48.2 billion.

- The UK had a trade surplus with the Commonwealth of £8.2 billion – a deficit in goods was offset by a surplus in services.

- The Commonwealth accounted for 8.7% of the UK’s total trade – around the same as the UK’s total trade with Germany.

- UK trade with the Commonwealth was heavily focused on five countries – Australia, Canada, India, Singapore and South Africa; combined these countries accounted for 74% of UK exports to the Commonwealth and 74% of UK imports from the Commonwealth.

Even without any formal arrangements, trading between Commonwealth countries is 19% cheaper than with non-members. Massive costs cuts come from shared history, cultural links, common legal systems, business practices, and a common language between many countries. This is also known as ‘the Commonwealth advantage’. Britain’s membership of the Commonwealth provides a “unique opportunity” to expand its trade with a series of “vast and growing” markets now that it has left the EU, Boris Johnson has said only this week. He went on to say that so far the UK had completed agreements with 33 Commonwealth members – including Australia and New Zealand – and was aiming for India, the biggest of them all, by Diwali in October.

The Birmingham 2022 Commonwealth Games are badged as being an opportunity to demonstrate the very best of Global Britain to the world with the opening on Thursday 28th July 2022.

I asked our head of manufacturing, Johnathan Dudley, what types of products the UK exports to the commonwealth and was surprised by the diversity of products which include:

- motor vehicles and bicycles

- electronics such as lighting drivers

- fashion items including clothing, jewellery, watches, bags, briefcases, footwear

- equine supplies such as saddlery, bridles, fancy leather goods

- components for the mining, oil and gas and nuclear power industries

- defence products including propulsion systems, marine engineering, nuclear submarine technology and military vehicles

- aerospace products such as wings and undercarriages

- garden and agricultural products such as hand tools and wheel barrows

- construction products and materials including bricks, architectural steel and other components including roofing and cladding systems

I really should have asked for a list of what we do not export to the commonwealth. It really does highlight the importance of the commonwealth to trade and the opportunities which exist.

Therefore, there seems to be a real opportunity for UK exporters to capitalise on the games and highlight the products that the UK can export to the commonwealth, along with highlighting other products which may be less well known to those countries or perhaps which were more difficult/expensive to export to those countries pre-Brexit and the signing of new free trade deals with commonwealth countries. Equally there are lots of products from the commonwealth which could feed into and help grow the UK economy via its manufacturing base which is strong in the Midlands.

In addition, and very important in the current climate, the games can showcase what Britain has to offer for people in the commonwealth who want to relocate to the UK, this was touted as a key benefit of leaving the UK. Our global mobility team can help advise those interested in moving to the UK or wanting to access the talent in commonwealth countries by providing advice, and support for employers and employees, including cross-border tax, social security, immigration and work permit issues.

Our international trade team at Crowe can advise on the implications, practicalities and costs of trading with the commonwealth whilst our tax teams can advise on setting up the best structures to use to trade with the commonwealth whilst our business solutions and corporate finance teams can advise on setting up new businesses, raising finance, business plans and outsourcing.

Further information for those wishing to capitalise on the games can be found in this recent article which provides details of a number of considerations to help both those organisations involved with the running of the Games, or those that are simply attending to entertain their clients and staff.

Insights

Contact us