Robotisation of bank statement posting

Until recently, all activities related to accounting were handled by specialized employees. Nowadays, companies more and more often decide to automate accounting processes that include the use of computer programs (the so-called software robots), which take over the most repetitive and time-consuming activities from accounting department employees.

What is the robotization of accounting processes?

In simple terms, it is the replacement of certain accounting operations with the operation of a computer program. A robot in this sense is a software that allows you to perform tasks - within existing IT systems - without human intervention. A robot imitates an accountant's actions (e.g. logging into the system, searching for a bank statement, opening a file, copying selected data, pasting and saving data in the system, closing a file) performing repetitive tasks without the need to make any decisions. And what is important - implementation of robotization does not require any changes in the IT systems used in the company.

Virtual accountant

The posting of bank statements is a repetitive, rule-based activity with a small number of exceptions, which makes it particularly suitable for automation. Assuming that bank statements have a digitalized form (which is the technical basis of robotization) and their volume is large (which is a factor of economic efficiency) - this process may be the beginning of a comprehensive automation of the department. Robotization is also a necessary condition for handling the increasing amount of handled data and processes. It also allows - while maintaining the same level of employment - to handle a few times more processed operations (contracts, invoices).

It is worth noting that the same robot can perform many tasks in different areas of company's operations. The only limitation of the robot is its 24-hour work mode.

Automatic posting of bank statements - case study

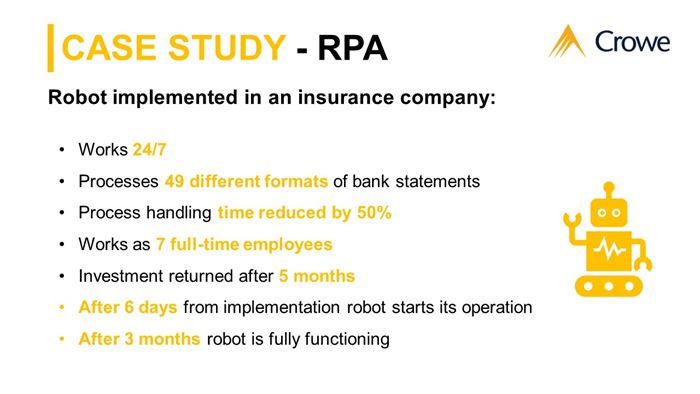

The implementation of the robot presented below took place in the accounting department of an insurance company and was carried out on the basis of a licensed technology of one of the world's leaders in developing software dedicated to process automation. The first task of the robot was downloading and posting bank statements. Initially, the robot booked about 220 bank statements daily. This number, after a one-week trial period, increased to 380.

This increase in efficiency resulted from the inclusion of other financial entities into the process of automation of bank statements. At first, it was the 5 largest banks, to reach the level of 16 different financial institutions. It is worth noting that the robot was able to handle the processing of different formats of bank statements efficiently. Clearly, each of the statements of a given institution differed in data layout. This required the robot to learn how to recognize each of them and copy the correct information.

Currently, the robot processes 49 different formats of bank statements. The number of financial transactions on the bank statements varies from 1 to 72. The robot starts its work as early as 7:00 a.m., under the supervision of an experienced employee, whose task is to solve emerging exceptions and possibly improve its operation. The robot is planned to operate around the clock.

Effects of robotization

The efficiency of the robot has exceeded expectations. Process handling time has been reduced by half. This is a huge saving for the accounting department. Previously, these processes were handled by 7 full-time employees. Despite the large staff, these people had difficulties with the timely handling of processes, resulting from their absences or lack of staff. Due to the development, the number of documents was growing, and in the longer perspective, employment had to be increased.

Automation is a seemingly expensive process (the cost of the robot's annual license alone is about PLN 25 thousand), but the return on investment is very fast. In this case, it only took 5 months to achieve return on the investment. The implementation did not cause any troubles for the organization. The tests of the robot and its start-up in the working environment took only 6 days. It took 3 months from the initial concept of robotization to the beginning of the full functioning of the project.

Paperless accounting

Automated posting of bank statements not only relieves employees of repetitive tasks, but is also a step towards paperless accounting and digital transformation. Robotization allows to create an innovative organizational culture by digitalizing data, using process optimization methodology, managing knowledge of modern technology, as well as developing future-oriented competences.

Contact our expert