Simplified VAT Registeration

VAT registration begins today under the Executive Decision No. 3/2021. As per the VAT law, any person who resides in the Sultanate and carries out any commercial, industrial, professional or other activity in the country and has annual supplies that exceeds the mandatory threshold of RO 38,500 will have to register for VAT. It is noteworthy that any person whether natural or legal, who carries such taxable activities will have to register, regardless of whether they possess a commercial registration number or not.

The Executive Decision has provided a staggered approach for the taxable person to register for VAT. This is to ease the process of registration and give sufficient time to businesses to prepare for VAT. It becomes very important for the entities to understand the methodology to calculate the value of taxable supplies and ascertain their registration timeline (table A).

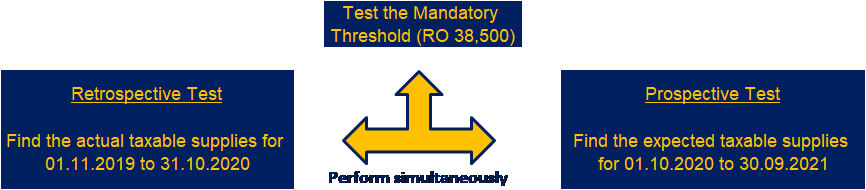

As per the VAT law, there are two approaches or test to determine if the taxable person has exceeded the Mandatory Registration Threshold and the approach has to be extended to ascertain the timeline for registrations as per the above executive decision.

Let us try to simply the registrations process before the effective date of Law with the help of the below chart:

Eligibility to register before the effective date of Law

Entities will have to carry out above two tests simultaneously. The retrospective test is to determine if the actual taxable supplies exceed the mandatory threshold or not for the given period. Simultaneously, entities need to check the prospective test to determine if the expected taxable supplies exceed the mandatory threshold or not for the given period. In either case, if the entity touches or exceeds the mandatory threshold of RO 38,500, it will have to register for VAT.

The next step is to determine under which category the total value of supplies fall and the same will guide the entity to register accordingly as per the Executive Decision No. 3/2021 as mentioned in Table below.

|

Category |

Persons having annual taxable supplies in Oman (RO) |

Persons having Annual taxable supplies in Oman up-to (RO) |

Mandatory Registration timeline |

|

A |

1,000,000 |

No limit |

1st February to 15th March 2021 |

|

B |

500,000 |

999,999 |

1st April to 31st May 2021 |

|

C |

250,000 |

499,999 |

1st July to 31st August 2021 |

|

D |

38,500 |

249,999 |

1st December to 28th February 2022 |

Executive Decision No. 3/2021

For instance, as per the retrospective test, if the actual taxable supplies are less than RO 1 million and as per the prospective test, the expected taxable supplies are more than RO 1 million, the entity will have to mandatory register within the registration timeline of 1st February to 15th March 2021.

Once the Law is effective, the above two tests needs to be performed on rolling monthly basis to ascertain the mandatory threshold. It is important to note that the person will have to register immediately once the actual or expected value of supplies exceeds the mandatory threshold limit.

There is another important clarification given by the Tax Authority that the person who wish voluntarily register for VAT may apply for registration with the Tax Authority at any time starting from February 1, 2021.

For the purpose of registration, the value of supplies shall include the following:

1. Value of Taxable Supplies –except supplies of capital assets.

2. Value of the Goods and Services supplied to the Taxable Person and subject to the Reverse Charge Mechanism.

3. Value of Intra GCC supplies of Goods and Services.

It is advisable to entities, corporates and any person carrying out taxable economic activities, to start evaluating their taxable supplies to ascertain the threshold and timelines to register for VAT.