From One Global Financial Catastrophe To The Next

Traditional economic wisdom typically predicted a big financial event every 10-20 years but as the world has become global and thus inter-connected, we are now seeing such huge catastrophic events occurring every couple of years. Just as we were all beginning to hope that the demand side impact of the COViD pandemic was eventually receding, we have the outbreak of war between Russia and the Ukraine, which is putting huge pressure on the supply side. Whether this will be a net benefit (due to high prices of oil) or cost (due to increasing prices of many imported items) to Oman will be evident only in the coming year ahead.

Looking back, over what we hope to be the last fully affected financial year due to the COViD pandemic, we can see which Oman listed entities have started to reap the benefits of the recovery and which are still struggling to see their business models kick back into gear.

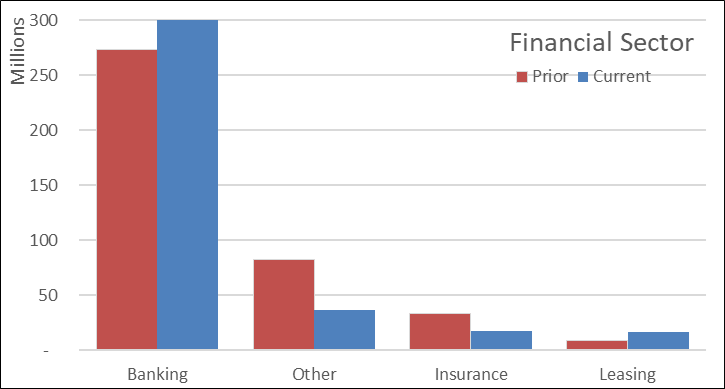

In the financial sector, we see the banks and leasing companies have shrugged off the high impairment charges of 2020 and have been able to post increased profits this year. However, 2022 will be a very critical year for the banks, as many customers are exiting from the CBO mandated COViD deferral programs and now have to fend for themselves when arranging loan restructures with their bankers. It is unlikely that they will all be successful. The insurance companies are struggling to return to pre-COViD levels of profitability, as premium pricing in a smaller market is challenging and the cost of the pandemic in terms of medical and life insurance payouts has bitten. Excluding the one-off “accounting impact” as DIDIC changed is status from an investment entity to a holding company, the remaining companies in the other category have showed flat performance.

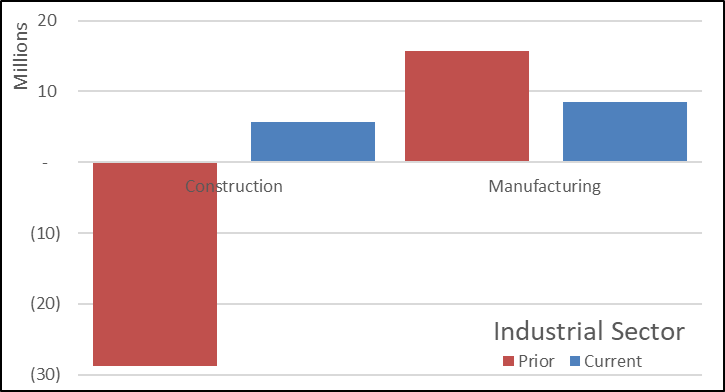

Within the Industrial sector, even after removing the impact of the successful restructuring at Galfar in which the group booked RO 28m of losses in 2020, the other construction companies have recorded a modest net recovery, helped considerably by the strong performance of Al Jazeera Steel Products (RO 9m profit) but hampered by the ongoing difficulties at Raysut Cement who recorded a RO 15m loss for the second year running. Within the manufacturing sector, we see many of the companies involved in the food industry continuing to struggle as they are unable to pass on the higher cost of imported raw materials to customers. A situation that is only going to become much more acute as the conflict between Russia and the Ukraine continues, due to the high export of agricultural commodities from the region.

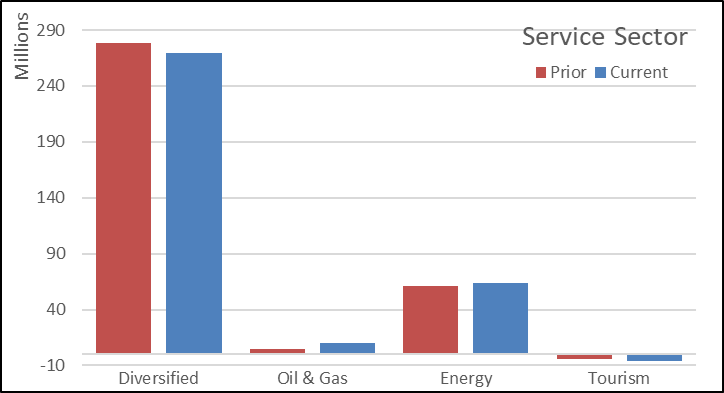

Finally, as we look at the Service sector, which in terms of listed companies in Oman is dominated by Omantel with profits of RO 233m, we observe relatively flat year-on-year performance. In the energy sector we see both winners and losers. With a RO 19m favorable profit swing at ACWA Power being offset by RO 10m profit reductions at both Al Kamel Power and Sohar Power, as they booked asset write downs following the introduction of the spot market for electricity. Although not a major sector for listed companies, the six hotels within the tourism sector continue to record losses as inward bound tourism is yet to witness any meaningful shoots of recovery.

This article was written by Karl Jackson, an Audit and Assurance Partner with Crowe Oman [email protected] and is based on financial data published by the Muscat Stock Exchange.