Despite Headwinds the Economy is Looking Up

As we wave goodbye to two downbeat years of COVID, Oman SAOGs are now in positive territory, with a general improvement in Y-o-Y profitability, despite a few worrying sectors that are more directly impacted by the outbreak of war between Russia and the Ukraine, which is putting huge pressure on the supply side. With localized disasters/events now having such huge impacts throughout the world, we really do seem to be witnessing Edward Lorenz’s chaos theory metaphorical argument that a butterfly flapping its wings can cause a hurricane.

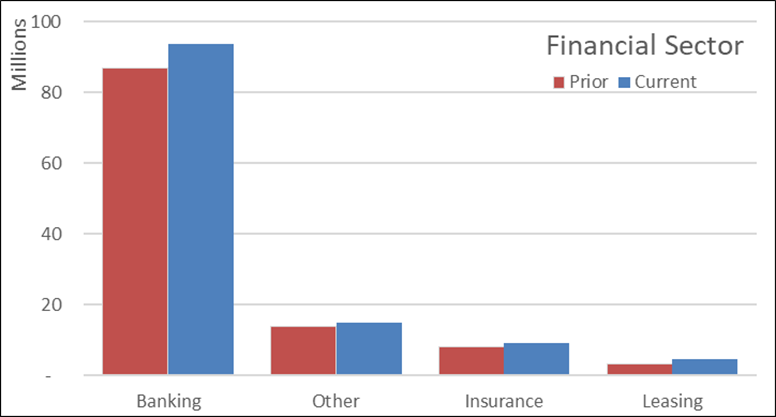

In the financial sector, we see the banks and leasing companies have shrugged off the high ECL impairment charges of 2021 and, with asset portfolios that have remained high due to the lack of repayments (due in a big part to the CBO mandated loan deferrals arrangements), have been able to post increased profits this year. However, the remainder of 2022 will be a very critical year for the banks, as many customers are now exiting from the deferral programs and further loan restructures/deferrals will be made on more commercial grounds with their bankers. It is unlikely that they will all be successful. However, the banks have a canny way of making their good customers pay for their bad customers. Whilst the insurance companies are struggling to return to pre-Covid levels of profitability (as premium pricing in a smaller market is challenging), they have benefitted from increased values of their asset portfolios.

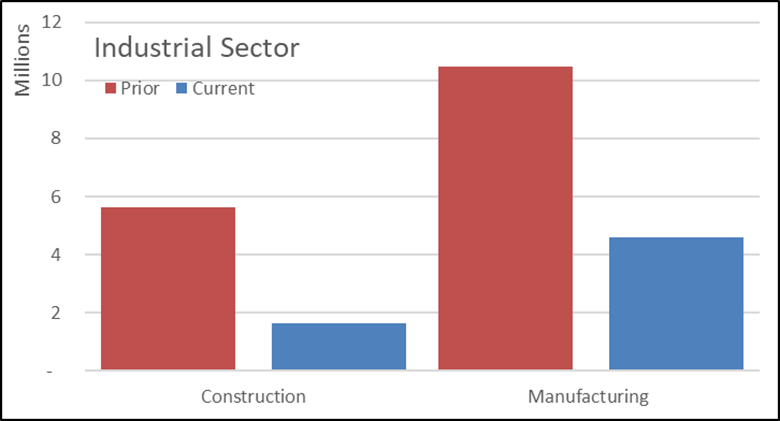

The Industrial sector, comprising of construction and manufacturing companies tells two separate stories. Activities in the construction sector are still at very low levels and two major companies (Galfar and Raysut Cement) have provided a drag on the sector with a combined RO 4.5m reduction in profitability. The story within the manufacturing sector, is primarily an external one. Many of the companies are struggling as they are unable to pass on the higher cost of imported raw materials and shipping to customers, either within Oman or in the overseas markets they export to. A situation that is only going to get worse, the longer the conflict between Russia and the Ukraine continues.

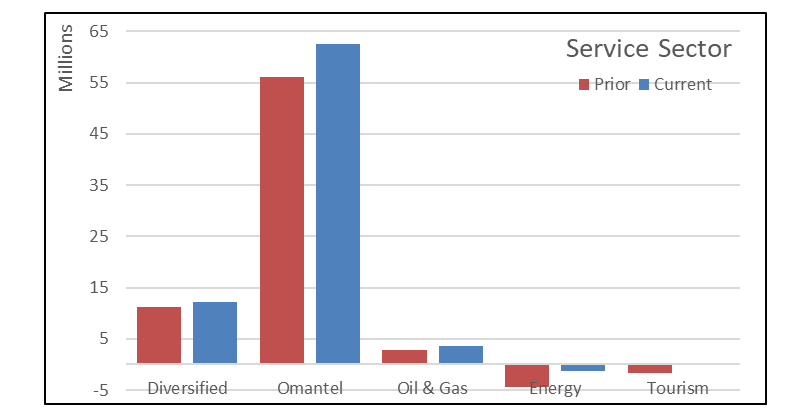

Finally, as we look at the Service sector, we can definitely observe the early shoots of recovery. Despite the entry of Vodafone to the local market, Omantel continues its dominance and Renaissance Services has led the way in the diversified sector. Within the oil and gas sector, we see the 3 petrol station owners showing improvements as lockdowns and working from home become just memories. Although not a major sector for listed companies, the six hotels within the tourism sector have definitely turned the corner as tourists return and physical conventions start taking place, as we try and say goodbye to webinars. The energy sector is the most interesting. Overall, the companies reporting in both years have reduced their losses but missing from the list are ACWA Power, Al Kamel Power and United Power that have ceased operations following the introduction of the spot market for electricity.

This article was written by Karl Jackson, an Audit and Assurance Partner with Crowe Oman [email protected] and is based on financial data published by the Muscat Stock Exchange.