Climate-Related Financial Disclosures

One of the most significant and perhaps most understated risks that an organisation face today is the risk relating to climate change. Large-scale and catastrophic nature of climate risk affects almost all businesses. The risk-return profile of an organisation exposed to climate risk requires clear understanding, management and disclosure of the financial impact of such risk. A recent study estimated the value at risk, as a result of climate change, to the global stock of manageable assets as ranging from $4 trillion to $40 trillion. The study highlights that “much of the impact on future assets will come through weaker growth and lower asset returns across the board”.

Currently, however, investors, lenders, and insurers do not have a clear understanding of how companies will survive or endure or even flourish as the environment changes, regulations evolve, new technologies emerge, and customer behaviour shifts. Without reliable climate-related financial information, the markets cannot price climate-related risks and opportunities correctly and may potentially face a rocky transition to a low-carbon economy, with sudden value shifts and destabilizing costs if industries must rapidly adjust to the new reality. Given such concerns and the potential impact, the G20 Finance Ministers and Central Bank Governors asked the Financial Stability Board (FSB) to review how the financial can take account of climate-related issues.

Task Force on Climate-related Financial Disclosures

In response, the FSB established an industry-led task force: Task Force on Climate-related Financial Disclosures. Drawing from the experience and expertise of its members, the Task Force developed four widely adoptable recommendations on climate-related financial disclosures that are applicable to organisations across sectors and jurisdictions. The Task Force recommends that preparers of climate-related financial disclosures provide such information in their mainstream annual financial filings which have become a mandatory obligation in some G20 jurisdictions.

Core Elements of Climate-related Financial Disclosures

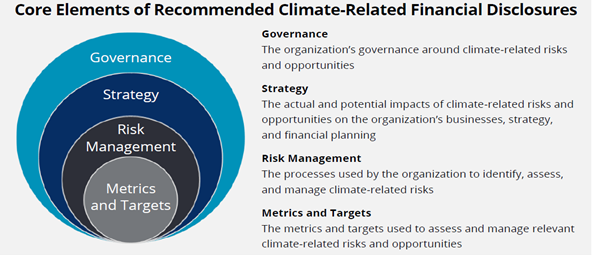

Recommendation of the Task Force is structured around four core elements of how organisations operate: governance, strategy, risk management and metrics and targets.

The four overarching recommendations are supported by disclosures that build out the framework with information that will help investors and others understand how reporting organisations assess climate-related risks and opportunities. In addition, sector-wise guidance to support all organisations in developing climate-related financial disclosures consistent with the recommendations are also available. An organisation’s disclosure of how its strategies might change to address potential climate-related risks and opportunities is a key step to better understanding the potential implications of climate change on the organisation.

One of the key recommendations of the Task Force focuses on the resilience of an organisation’s strategy, taking into consideration different climate-related scenarios, including a 20 Celsius or lower scenario. (A 20 C scenario lays out an energy system deployment pathway and an emission system trajectory consistent with limiting the global average temperature increase 20 C above the pre-industrial average). An organisation’s disclosure of how its strategies might change to address potential climate-related risks and opportunities is a key step to better understanding the potential implications of climate change on the organisation.

Climate-Related Opportunities

Efforts to mitigate and adopt to climate change also produce opportunities for organisations, like resource efficiency, cost-savings, adoption of low-emission energy sources, development of new products and services, access to new markets, and building resilience along the supply chain. Climate-related opportunities may vary depending on the region, market, and industry in which an organisation operates. Many governments also provide grants and tax credits to organisations adopting such practices.

Government initiatives in Oman

Oman is a signatory to the Paris Agreement on climate action plan that took place in 2020. Oman’s action plan for combating the effects of climate change is set out in the National Strategy for Adaptation and Mitigation of Climate Change, which aims to determine the impact of climate change on sustainable development, encompassing agriculture, livestock, fisheries, water resources, coastal areas, infrastructure, industries, bio-diversity, human health and welfare. In the Sultanate of Oman, as various sectors of the national economy align themselves with the strategic objectives of Oman’s Vision 2040, a stronger commitment to a greener economy based on sustainable practices is now becoming evident.

Conclusion

Recognising that climate-related financial reporting is still evolving, the Task Force’s recommendations provide a foundation to improve investors and other’s ability to appropriately assess and price climate-related risks and opportunities. These recommendations aim to be ambitious, but also practical for near-term adoption. The Task Force expects to advance the quality of mainstream financial disclosures related to the potential effects of climate change on organisations today and in the future and to increase investor engagement with boards and senior management on climate-related issues.