The CERS is a rent subsidy program which provides a base subsidy based on the revenue decline of a qualifying renter, as well as a 25 per cent top-up subsidy if the renter is forced to close or reduce operations due to a public health restriction.

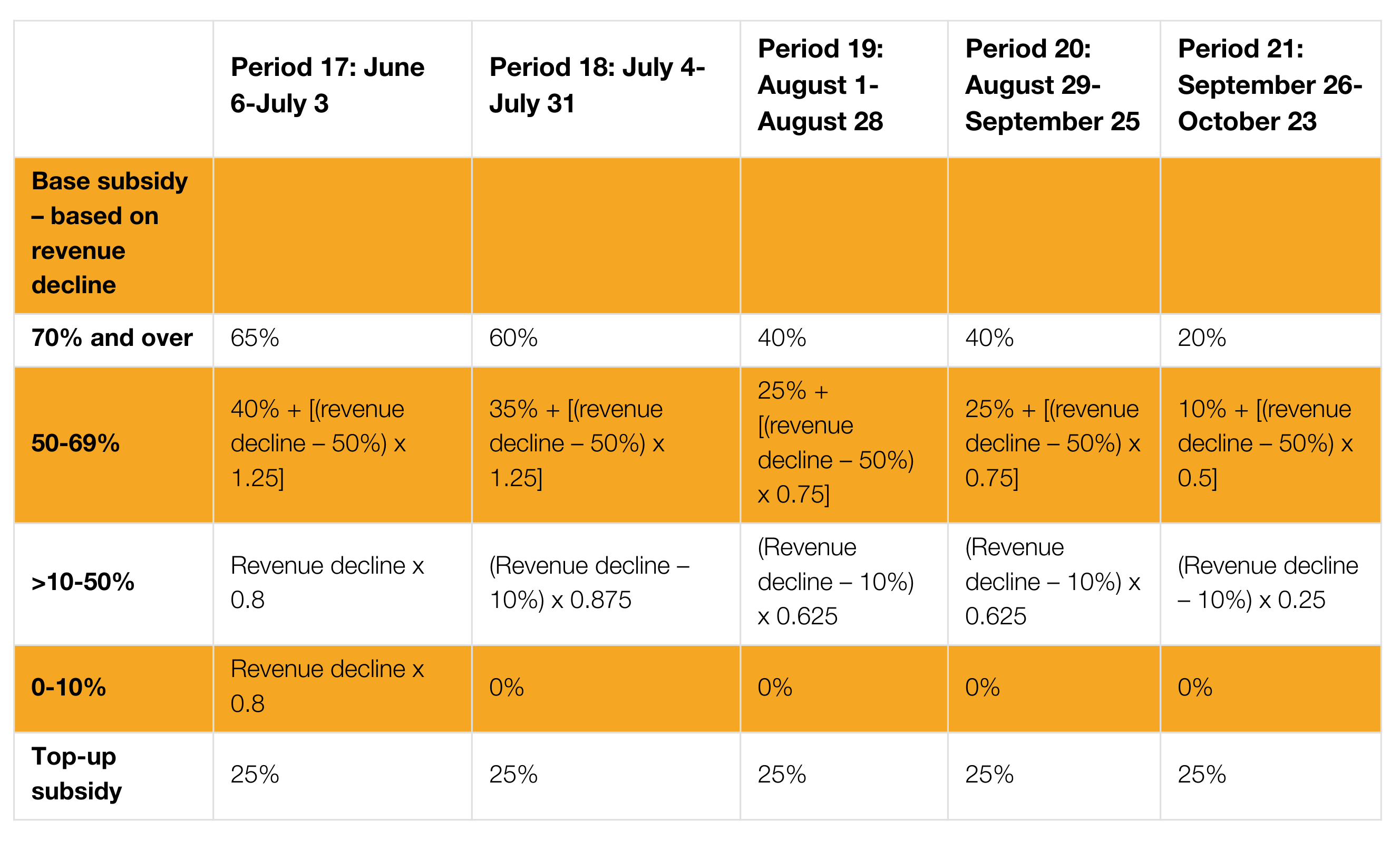

New legislation has been introduced as part of the 2021 Federal Budget to extend the CERS program to September 25, 2021, with support gradually being phased out beginning July 4, 2021. Please see Table 1 below for details on the calculation of the CERS for Periods 17 to 20.

Similar to the new changes to the Canada Emergency Wage Subsidy (CEWS), a business must demonstrate a revenue decline of over 10 per cent to be eligible for the CERS in the last three periods of the program, Periods 18 to 20, which start on July 4, 2021. This is a minimum requirement that, if not met, will preclude the business from being eligible for both the base subsidy and the top-up subsidy.

The new CERS legislation includes the extension of the top-up subsidy to September 25, 2021 for qualifying renters that are required to close due to a public health restriction. As a reminder, a public health restriction is:

- Made under the laws of Canada or a province in response to COVID-19;

- Limited in scope, such as a geographical boundary or type of business activity;

- One that requires some or all of the activities of the entity, in connection with the qualifying property, to cease for at least one week (“restricted activities”); and

- It is reasonable to conclude that at least 25 per cent of the qualifying revenues of the entity are derived from the restricted activities.

Finally, for Periods 17 to 20, the total amount of qualifying rent expenses eligible for the CERS remains capped at $75,000 per property and $300,000 for an affiliated group. As in prior periods, the $300,000 cap does not apply to the top-up portion of the subsidy.

Please feel free to reach out to the Crowe Soberman Tax Group with any questions related to the 2021 federal budget changes.

Table 1: CERS Base Subsidy for Periods 17 to 21

Subsequent to the publishing of this article on May 21, 2021, the federal government announced an extension to the CERS on July 30, 2021 and a change to the CERS rate for Period 20. The CERS was extended to Period 21, ending October 23, 2021. Furthermore, the CERS rates for Period 20 remain the same as Period 19 and the decline in the CERS rates now occurs in Period 21. The table above reflects these changes.

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.