Coronavirus: Government financial support for organisations

On 6 April 2021, the government launched the Recovery Loan Scheme to replace the CBILS/CLBILS and BBL Scheme that ceased as of 31 March 2021.

The support measures include:

Financial support for workers

- Coronavirus Job Retention Scheme (CJRS)

Under the scheme, any employer will be eligible to contact HMRC for apply for a grant to cover the majority of the wages of people who are part of a PAYE scheme and who not working but furloughed and kept on payroll. The grant will be 80% of salary up to £2,500 a month (just above median income) plus employers' NIC and minimum auto enrolment pension contributions. Employers can top up this amount if they wish. The grant can be backdated to 1 March and will apply for three months; it will be extended if necessary. The Chancellor confirmed that there would be no limit on funding as the government wishes to support as many jobs as necessary. On 3 March 2021, the Chancellor announced changes to the CJRS with the intention of phasing it out by September 2021. Read more on the CJRS.

- Job Support Scheme (JSS)

The JSS will start when the CJRS ends, and has two variants: the ‘JSS Open’ and the ‘JSS Closed’. The JSS Open is available to support many organisations that are operating, but facing decreased demand. Whereas organisations that are legally required to close their premises as a direct result of coronavirus restrictions (set by one or more of the four governments of the UK) can claim through the JSS Closed.

|

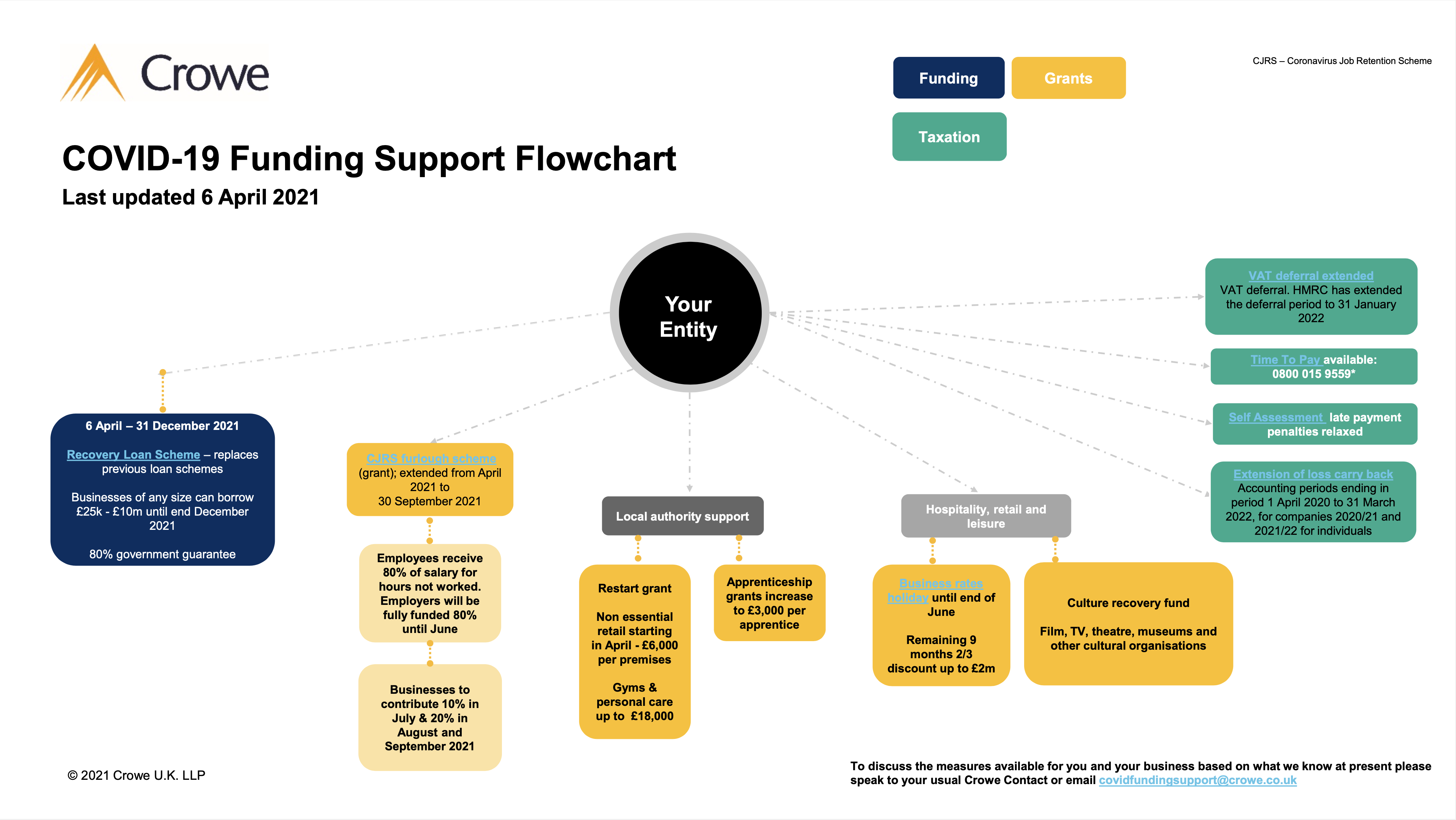

This flowchart is designed to point you in the right direction of what measures might be available for you and your business based on what we know at present. |

Further deferral to the due date for paying deferred VAT

In March 2020 the government announced an immediate deferral of VAT payments falling due between 20 March 2020 and 30 June 2020. Many organisations took advantage of the payment deferral scheme, and were able to automatically defer the VAT payments due to be made between these dates until 31 March 2021. However, just before the March 2021 Budget, it was confirmed that organisations could stagger these payments through to January 2022.

The New Payment Scheme was introduced in September 2020, whereby deferred VAT payment amounts can be made in instalments, rather than as a single lump sum falling due on 31 March 2021. The details released so far by HMRC say that the amount owing can be split across 11 months, and no interest will be charged on the deferral.

It was announced by the Chancellor on 3 March 2021 that a penalty, totalling 5% of any outstanding VAT due after 31 March 2021, will be implemented if that organisation had not opted into the New Payment Scheme or made an alternative arrangement to pay by 30 June 2021. This penalty will apply instead of the normal default surcharge regime. Organisations need to ensure they have decided how to manage VAT that was deferred. An application has to be made to access the New Payment Scheme – it is not an automatic enrolment system. As such, doing nothing is not an option and will probably result in a 5% penalty.

You can find full details in our recent update When to pay VAT which was deferred due to COVID-19.

It should be noted that the measures do not apply to VAT payments falling due from 1 July 2020 onwards. If organisations have difficulties in making these VAT payments, they should be able to agree a 'time to pay' arrangement with HMRC and Crowe can support you in applying for this.

Deferral to the payment of UK taxes

Details of the HMRC helpline for organisations that are struggling to pay their UK taxes on time is available on the GOV.UK website.

It is recommended that businesses contact HMRC at the earliest opportunity to agree tax deferrals if they are not automatic.

We understand that it can take time to get through on the line so you should have as much detail to support your grant or tax deferral discussion.

HMRC will discuss your specific circumstances to explore:

- agreeing an instalment arrangement

- suspending debt collection proceedings

- cancelling penalties and interest where you have administrative difficulties contacting or paying HMRC immediately.

We understand that HMRC has not been issuing either written confirmation of payment deferral agreements or even a tax reference. We therefore suggest that you keep detailed records of the conversation including the name of the person you spoke to, the date and time so that you have a record of the agreement to a payment deferral and that no interest will be charged by HMRC.

What funding support could you be eligible for?As more measures are introduced and more detail becomes available, this tool will be updated on a real time basis.

|

|

Recovery Loan Scheme

With effect from 6 April 2021, the government has replaced the CBILS, CLBILS and Bounce Back Loans with the new Recovery Loan Scheme.

We have substantial experience in dealing with the majority of the lenders on the scheme.

Facilities of up to £10 million are available per business and a list of accredited lenders is available to view via the British Business Bank website. There are fewer lenders on the Recovery Loan Scheme than the previous CBILS.

There are similarities to the facilities previously provided under CBILS, namely:

- no personal guarantees will be taken on facilities up to £250,000 and no private residence will be taken as security

- the facilities are 80% backed by the government

- the borrower has to meet the same criteria in that they are UK based, not in collective insolvency proceedings, and would be viable where it not for the impact of COVID

The points of difference are :

- unlike CBILS and Bounce Back loans there is no support to cover the interest in the first 12 months

- the terms are a maximum of three years for overdrafts and invoice finance and six years for term loans and asset finance (rather than up to 10 years).

If you need assistance in accessing the scheme or wish to have a conversation before you apply please get in touch with your usual Crowe contact or Dave Riley.

Business Rates Relief

Business Rates Relief include:

- the 12 months business rates relief applies to all hospitality, retail and leisure businesses in England

- an expanded retail discount.

The reliefs will be given automatically and will be administered by Local Authorities. Details of the reliefs can be found on GOV.UK website.

Grant funding for small business

It was announced that funding grants of the following would be provided:

- the £25,000 grant for retail, hospitality and leisure businesses with a rateable value of between £15,000 and £51,000

- the £10,000 grant is for any business that qualifies for Small Business Rates Relief.

There may be other funding solutions for businesses available through your current or an alternative provider. Crowe’s debt advisory team have strong relationships with a wide range of potential funders, for more details on how we can support you please contact your usual Crowe contact.

Insights

Contact us

Designed to point you in the right direction of what measures might be available for you and your business based on what we know at present.

Designed to point you in the right direction of what measures might be available for you and your business based on what we know at present.