Tax microaccount – change for taxpayers from 1 January 2020

Tax microaccount number - where to find out?

The individual tax account number will be assigned to each person holding a Tax Identification Number (NIP) or Personal Identification Number (PESEL), so it applies both to entrepreneurs and natural persons not conducting business activity. You can check it by using the free and available 24-hour MICROACCOUNT GENERATOR or by visiting any tax office.

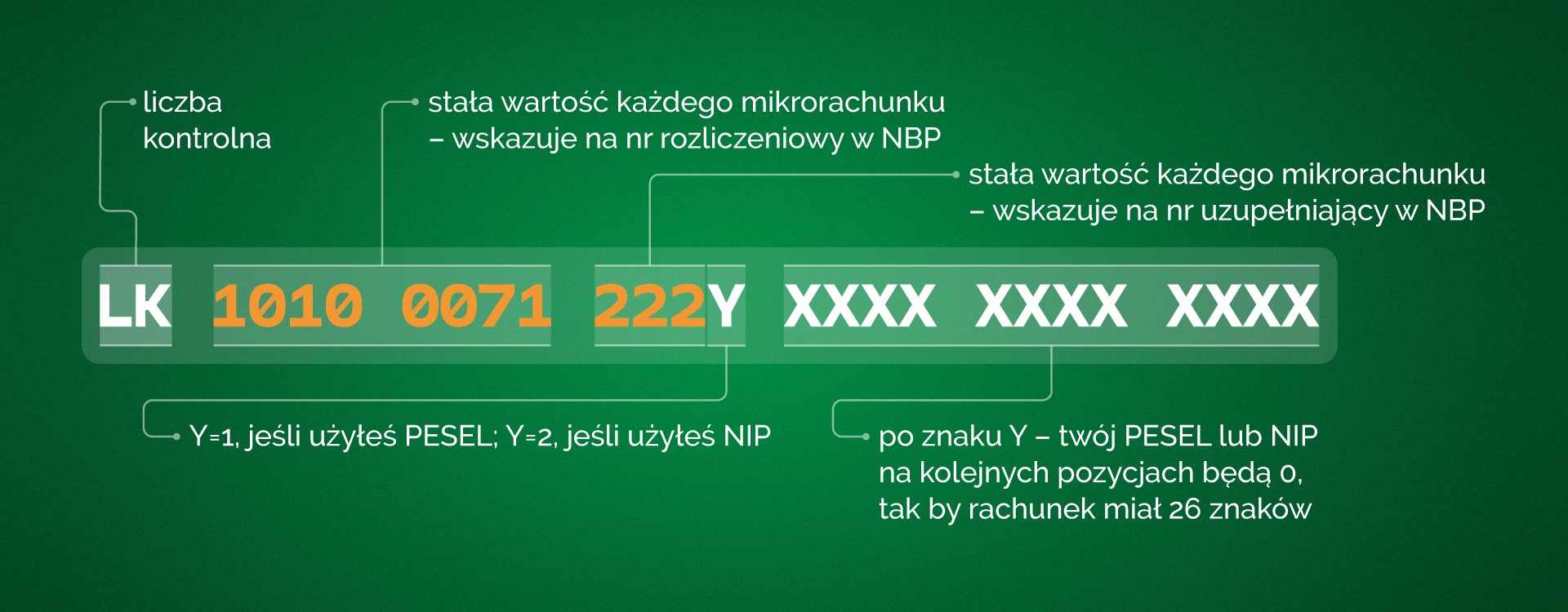

The individual account number will consist of 26 characters, including digits indicating, among others, the correct PESEL or NIP of a given taxpayer.

Source: podatki.gov.pl

Tax microaccount – what should you be aware of?

Before using your tax microaccount number, you should check whether it contains the digits included in your NIP or PESEL number. Entities conducting business activity (including natural persons) should use the NIP number for this purpose, if they are VAT payers. It is worth paying attention to phishing attempts and not to use any other generators than the one available at www.podatki.gov.pl and any account numbers sent by e-mail or text message.

The existing numbers of tax office accounts for PIT, CIT and VAT payments will remain active only until the end of 2019. However, all refunds of overpayments and taxes as well as all payments of taxes other than PIT, CIT and VAT will continue to be made in accordance with the existing rules.

Persons who do not possess a NIP or PESEL number and are awaiting their granting after 1 January 2020 will be able to pay the required amount to the indicated tax microaccount of their tax office. In order to correctly settle the payment to one of such accounts, it is necessary to remember that the transfer title should include the number of passport or ID card.

Employers who, as payers, make PIT advances for employees, will make transfers to their microaccounts. They do not have to collect information about the numbers of microaccounts of employees.

A new list of bank accounts of tax offices with explanations on which account the taxpayers should pay particular taxes will be published in December.

Benefits of introducing a tax microaccount

The aim of introducing tax microaccounts is to simplify and speed up settlements with the tax office:

- quick and easy processing of PIT, CIT and VAT payments made to only one account,

- ·no need to use the existing several separate accounts,

- limiting the number of transfers sent by mistake to improper accounts,

- faster issuing of necessary certificates, e.g. on the lack of tax arrears,

- ·verifying the microaccount number anytime and anywhere,

- keeping the same account number when moving or relocating.